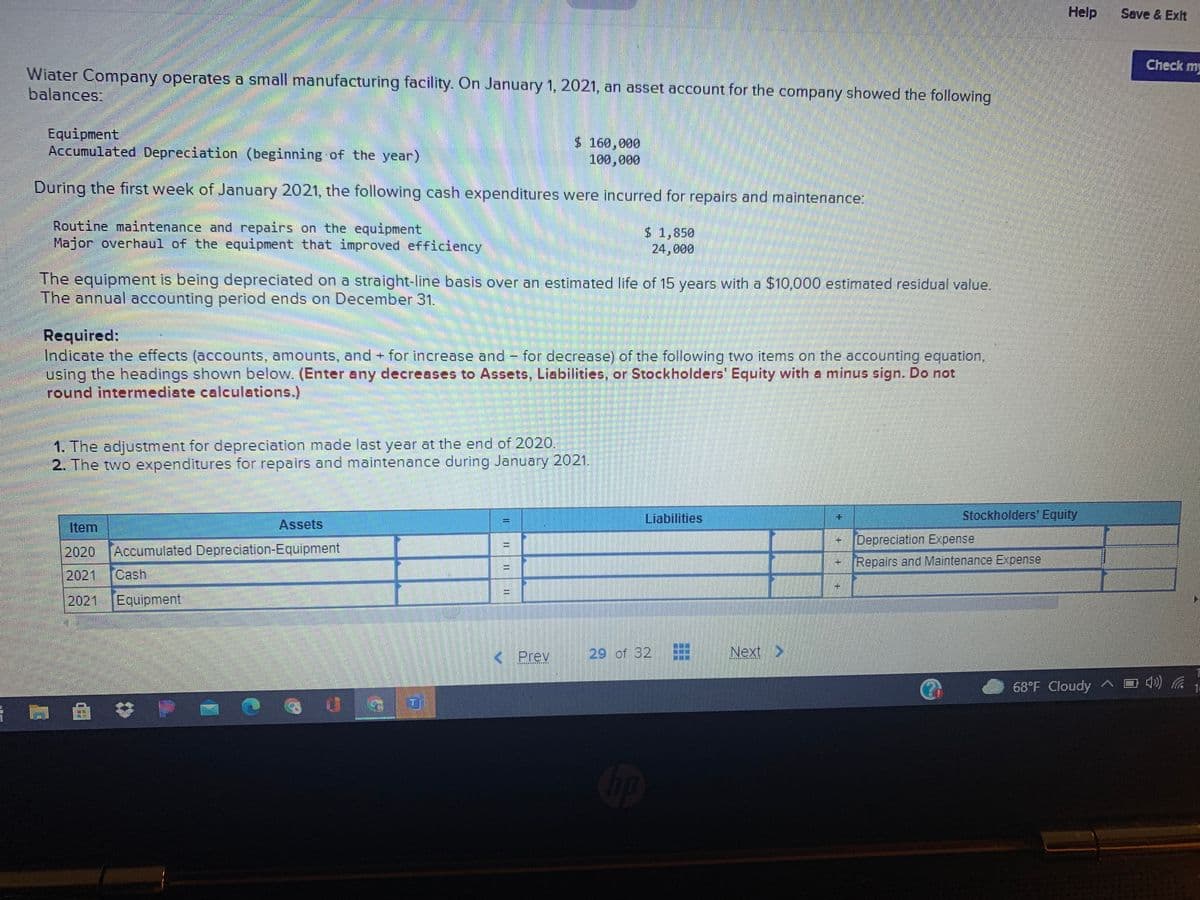

Wiater Company operates a small manufacturing facility. On January 1, 2021, an asset account for the company showed the following balances: Equipment Accumulated Depreciation (beginning of the year) $ 160,000 100,000 During the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance: Routine maintenance and repairs on the equipment Major overhaul of the equipment that improved efficiency $ 1,850 24, 000 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $10,000 estimated residual value. The annual accounting period ends on December 31. Required: Indicate the effects (accounts, amounts, and + for increase and - for decrease) of the following two items on the accounting equation, using the headings shown below. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign. Do not round intermediate calculations.)

Wiater Company operates a small manufacturing facility. On January 1, 2021, an asset account for the company showed the following balances: Equipment Accumulated Depreciation (beginning of the year) $ 160,000 100,000 During the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance: Routine maintenance and repairs on the equipment Major overhaul of the equipment that improved efficiency $ 1,850 24, 000 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $10,000 estimated residual value. The annual accounting period ends on December 31. Required: Indicate the effects (accounts, amounts, and + for increase and - for decrease) of the following two items on the accounting equation, using the headings shown below. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign. Do not round intermediate calculations.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 10E: Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual...

Related questions

Question

I can't find the numbers to the

Transcribed Image Text:Help

Save & Exit

Check my

Wiater Company operates a small manufacturing facility. On January 1, 2021, an asset account for the company showed the following

balances:

Equipment

Accumulated Depreciation (beginning of the year)

$ 160,000

100,000

During the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance:

Routine maintenance and repairs on the equipment

Major overhaul of the equipment that improved efficiency

$ 1,850

24,000

The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $10,000 estimated residual value.

The annual accounting period ends on December 31.

Required:

Indicate the effects (accounts, amounts, and for increase and - for decrease) of the following two items on the accounting equation,

the headings shown below. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign. Do not

using

round intermediate calculations.)

1. The adjustment for depreciation made last year at the end of 2020.

2. The two expenditures for repairs and maintenance during January 2021.

Liabilities

Stockholders' Equity

Item

Assets

Depreciation Expense

2020

Accumulated Depreciation-Equipment

Repairs and Maintenance Expense

%3D

2021

Cash

%3D

2021,

Equipment,

< Prev

29 of 32

Next>

68°F Cloudy ^ O 4)) G

op

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College