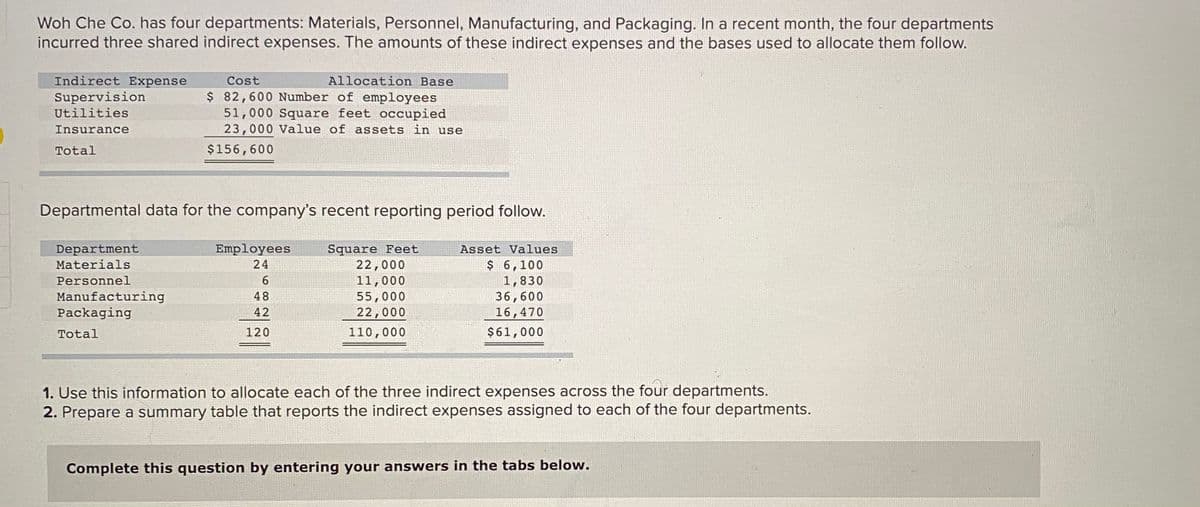

Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. Indirect Expense Supervision Utilities Cost $ 82,600 Number of employees 51,000 Square feet occupied 23,000 Value of assets in use Allocation Base Insurance Total $156,600 Departmental data for the company's recent reporting period follow. Square Feet 22,000 11,000 55,000 22,000 Asset Values $ 6,100 1,830 36,600 16,470 Employees Department Materials 24 Personnel Manufacturing Packaging 48 42 Total 120 110,000 $61,000 1. Use this information to allocate each of the three indirect expenses across the four departments. 2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments. Complete this question by entering your answers in the tabs below.

Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. Indirect Expense Supervision Utilities Cost $ 82,600 Number of employees 51,000 Square feet occupied 23,000 Value of assets in use Allocation Base Insurance Total $156,600 Departmental data for the company's recent reporting period follow. Square Feet 22,000 11,000 55,000 22,000 Asset Values $ 6,100 1,830 36,600 16,470 Employees Department Materials 24 Personnel Manufacturing Packaging 48 42 Total 120 110,000 $61,000 1. Use this information to allocate each of the three indirect expenses across the four departments. 2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments. Complete this question by entering your answers in the tabs below.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 7E: Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments,...

Related questions

Question

Transcribed Image Text:Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four departments

incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow.

Indirect Expense

Supervision

Utilities

Cost

Allocation Base

$ 82,600 Number of employees

51,000 Square feet occupied

23,000 Value of assets in use

Insurance

Total

$156,600

Departmental data for the company's recent reporting period follow.

ETII

Employees

Square Feet

22,000

11,000

55,000

22,000

Department

Materials

Asset Values

$ 6,100

1,830

36,600

16,470

24

Personnel

Manufacturing

Packaging

48

42

Total

120

110,000

$61,000

1. Use this information to allocate each of the three indirect expenses across the four departments.

2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

Complete this question by entering your answers in the tabs below.

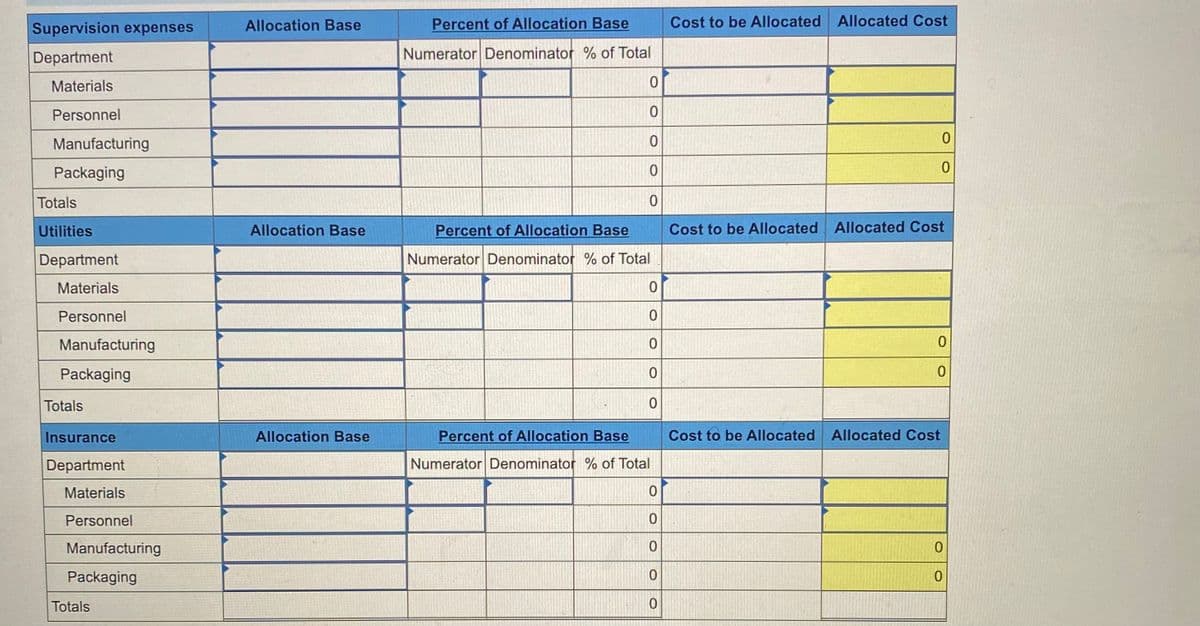

Transcribed Image Text:Supervision expenses

Allocation Base

Percent of Allocation Base

Cost to be Allocated Allocated Cost

Department

Numerator Denominator % of Total

Materials

Personnel

Manufacturing

Packaging

Totals

Utilities

Allocation Base

Percent of Allocation Base

Cost to be Allocated Allocated Cost

Department

Numerator Denominator % of Total

Materials

Personnel

Manufacturing

Packaging

Totals

Insurance

Allocation Base

Percent of Allocation Base

Cost to be Allocated Allocated Cost

Department

Numerator Denominator % of Total

Materials

Personnel

0.

Manufacturing

Packaging

Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,