Working capital and capital budgeting. Farbuck's Tea Shops is thinking about opening another tea shop. The incremental cash flow (not including the working capital investment) for the first five years is as follows: Click on the icon o in order to copy its content into a spreadsheet Initial capital cost = $3,500,000 Operating cash flow for each year =$1,000,000 Recovery of capital assets after five years = $280,000 The hurdle rate for this project is 13%. If the initial cost of working capital is $520,000 for items such as teapots, teacups, saucers, and napkins, should Farbuck's open this new shop if it will be in business for only five years? What is the most it can invest in working capital and still have a positive net present value? Should Farbuck's open this new shop if it will be in business for only five years? (Select the best response.) O A. Yes. Farbuck's should open the new shop because the project's NPV is $68,561. O B. Yes. Farbuck's should open the new shop because the project's NPV is $61,705. O C. No. Farbuck's should not open the new shop because the project's NPV is - $68,561. O D. No. Farbuck's should not open the new shop because the project's NPV is - $61,705.

Working capital and capital budgeting. Farbuck's Tea Shops is thinking about opening another tea shop. The incremental cash flow (not including the working capital investment) for the first five years is as follows: Click on the icon o in order to copy its content into a spreadsheet Initial capital cost = $3,500,000 Operating cash flow for each year =$1,000,000 Recovery of capital assets after five years = $280,000 The hurdle rate for this project is 13%. If the initial cost of working capital is $520,000 for items such as teapots, teacups, saucers, and napkins, should Farbuck's open this new shop if it will be in business for only five years? What is the most it can invest in working capital and still have a positive net present value? Should Farbuck's open this new shop if it will be in business for only five years? (Select the best response.) O A. Yes. Farbuck's should open the new shop because the project's NPV is $68,561. O B. Yes. Farbuck's should open the new shop because the project's NPV is $61,705. O C. No. Farbuck's should not open the new shop because the project's NPV is - $68,561. O D. No. Farbuck's should not open the new shop because the project's NPV is - $61,705.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 5E: Cash payback period for a service company Janes Clothing Inc. is evaluating two capital investment...

Related questions

Question

Chapter 13, Question 9. Attached is a similar question with answers. Please answer the same two parts for the new question

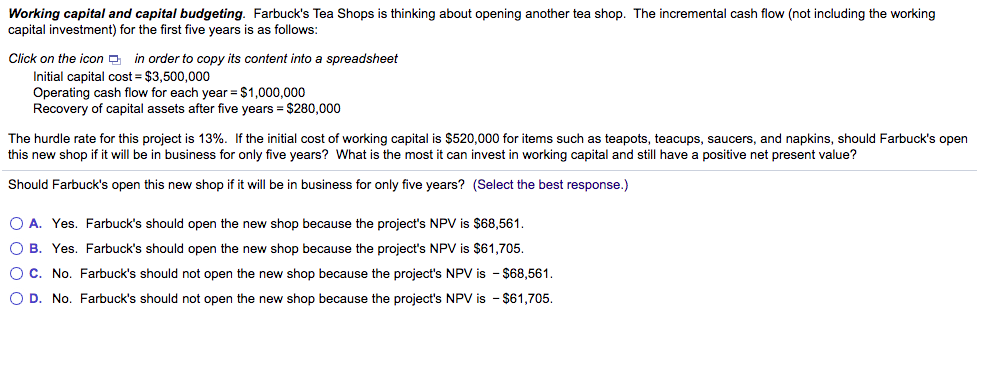

Transcribed Image Text:Working capital and capital budgeting. Farbuck's Tea Shops is thinking about opening another tea shop. The incremental cash flow (not including the working

capital investment) for the first five years is as follows:

Click on the icon a in order to copy its content into a spreadsheet

Initial capital cost = $3,500,000

Operating cash flow for each year = $1,000,000

Recovery of capital assets after five years = $280,000

The hurdle rate for this project is 13%. If the initial cost of working capital is $520,000 for items such as teapots, teacups, saucers, and napkins, should Farbuck's open

this new shop if it will be in business for only five years? What is the most it can invest in working capital and still have a positive net present value?

Should Farbuck's open this new shop if it will be in business for only five years? (Select the best response.)

O A. Yes. Farbuck's should open the new shop because the project's NPV is $68,561.

O B. Yes. Farbuck's should open the new shop because the project's NPV is $61,705.

O C. No. Farbuck's should not open the new shop because the project's NPV is - $68,561.

O D. No. Farbuck's should not open the new shop because the project's NPV is - $61,705.

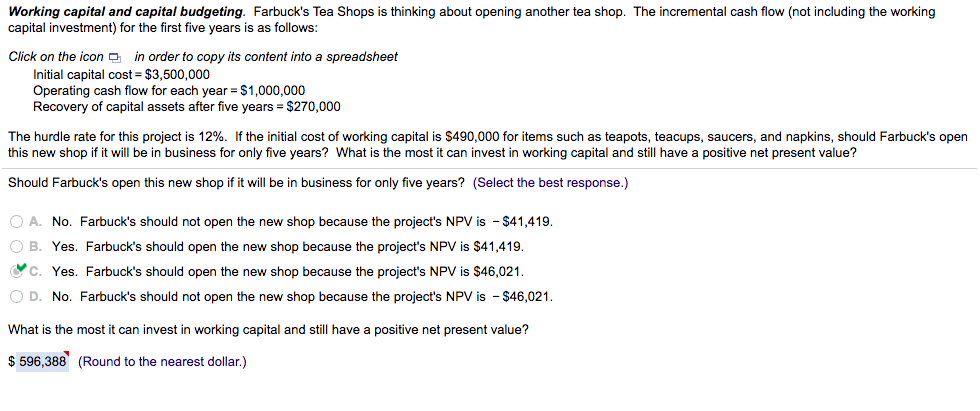

Transcribed Image Text:Working capital and capital budgeting. Farbuck's Tea Shops is thinking about opening another tea shop. The incremental cash flow (not including the working

capital investment) for the first five years is as follows:

Click on the icon a in order to copy its content into a spreadsheet

Initial capital cost = $3,500,000

Operating cash flow for each year =$1,000,000

Recovery of capital assets after five years = $270,000

The hurdle rate for this project is 12%. If the initial cost of working capital is $490,000 for items such as teapots, teacups, saucers, and napkins, should Farbuck's open

this new shop if it will be in business for only five years? What is the most

can invest in working capital and still have a positive net present value?

Should Farbuck's open this new shop if it will be in business for only five years? (Select the best response.)

O A. No. Farbuck's should not open the new shop because the project's NPV is - $41,419.

O B. Yes. Farbuck's should open the new shop because the project's NPV is $41,419.

Oc. Yes. Farbuck's should open the new shop because the project's NPV is $46,021.

O D. No. Farbuck's should not open the new shop because the project's NPV is - $46,021.

What is the most it can invest in working capital and still have a positive net present value?

$ 596,388 (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning