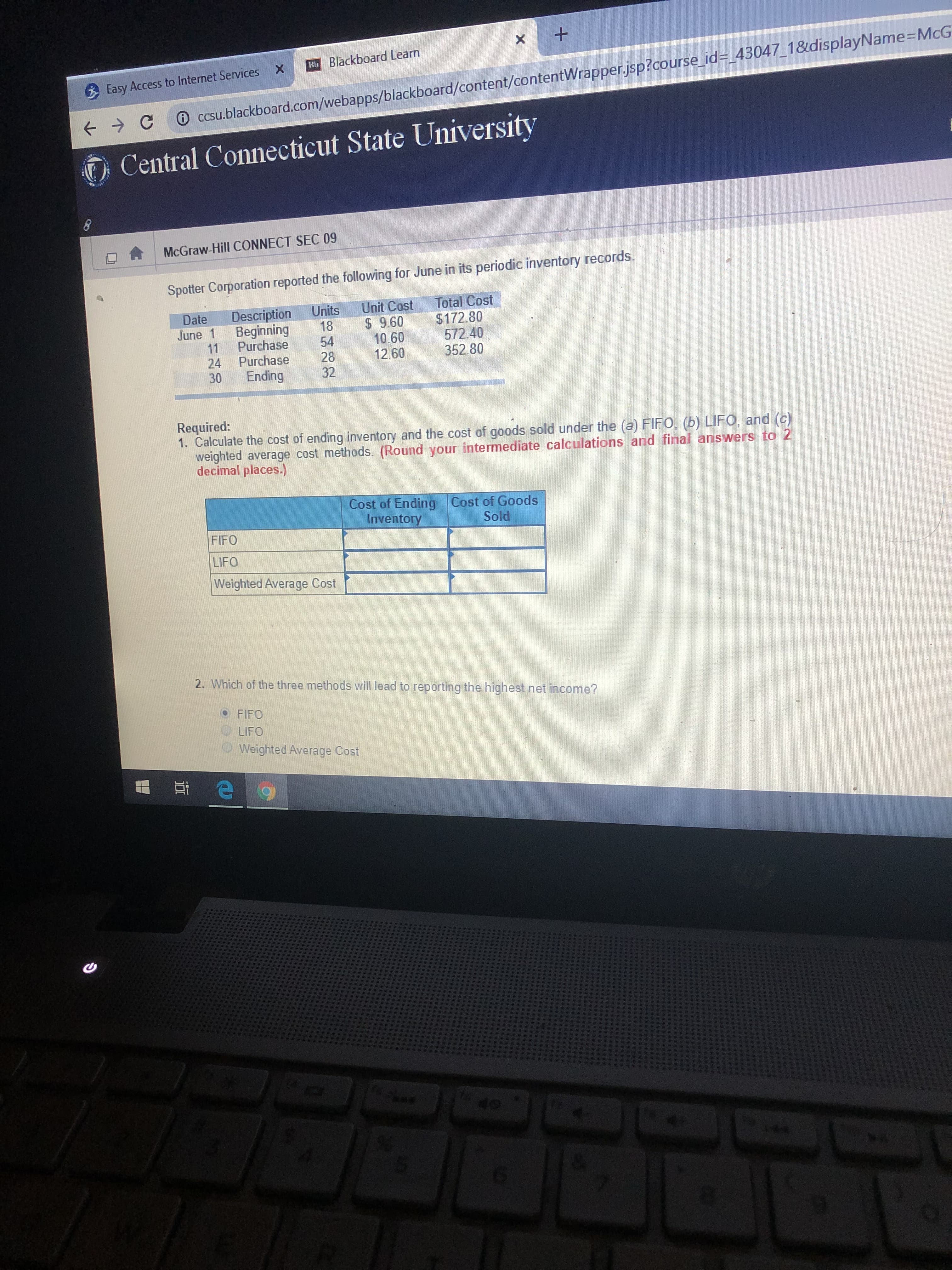

+ X HBlackboard Learn X Easy Access to Internet Services CCsu.blackboard.com/webapps/blackboard/content/contentWrapper.jsp?course_id- 43047_1&displayName-McG C Central Connecticut State University McGraw-Hill CONNECT SEC 09 Spotter Corporation reported the following for June in its periodic inventory records Total Cost $172.80 572.40 352.80 Unit Cost $ 9.60 10.60 12.60 Units 18 54 28 32 Description Beginning Date June 1 Purchase 11 Purchase 24 Ending 30 Required: 1. Calculate the cost of ending inventory and the cost of goods sold under the (a) FIFO, (b) LIFO, and (c) weighted average cost methods. (Round your intermediate calculations and final answers to 2 decimal places.) Cost of Ending Inventory Cost of Goods Sold FIFO LIFO Weighted Average Cost 2. Which of the three methods will lead to reporting the highest net income? FIFO DLIFO Weighted Average Cost

+ X HBlackboard Learn X Easy Access to Internet Services CCsu.blackboard.com/webapps/blackboard/content/contentWrapper.jsp?course_id- 43047_1&displayName-McG C Central Connecticut State University McGraw-Hill CONNECT SEC 09 Spotter Corporation reported the following for June in its periodic inventory records Total Cost $172.80 572.40 352.80 Unit Cost $ 9.60 10.60 12.60 Units 18 54 28 32 Description Beginning Date June 1 Purchase 11 Purchase 24 Ending 30 Required: 1. Calculate the cost of ending inventory and the cost of goods sold under the (a) FIFO, (b) LIFO, and (c) weighted average cost methods. (Round your intermediate calculations and final answers to 2 decimal places.) Cost of Ending Inventory Cost of Goods Sold FIFO LIFO Weighted Average Cost 2. Which of the three methods will lead to reporting the highest net income? FIFO DLIFO Weighted Average Cost

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 3.4C

Related questions

Question

Part 1

Transcribed Image Text:+

X

HBlackboard Learn

X

Easy Access to Internet Services

CCsu.blackboard.com/webapps/blackboard/content/contentWrapper.jsp?course_id- 43047_1&displayName-McG

C

Central Connecticut State University

McGraw-Hill CONNECT SEC 09

Spotter Corporation reported the following for June in its periodic inventory records

Total Cost

$172.80

572.40

352.80

Unit Cost

$ 9.60

10.60

12.60

Units

18

54

28

32

Description

Beginning

Date

June 1

Purchase

11

Purchase

24

Ending

30

Required:

1. Calculate the cost of ending inventory and the cost of goods sold under the (a) FIFO, (b) LIFO, and (c)

weighted average cost methods. (Round your intermediate calculations and final answers to 2

decimal places.)

Cost of Ending

Inventory

Cost of Goods

Sold

FIFO

LIFO

Weighted Average Cost

2. Which of the three methods will lead to reporting the highest net income?

FIFO

DLIFO

Weighted Average Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning