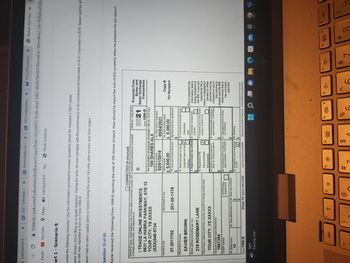

Xavier Brown (32) is filing as a single taxpayer. During the year, he was unhappy with the performance of an investment he had made in ALX Corporation in 2018. Xavier sold his shares on May 4, 2020, for fear the stock would continue its downward trend. Information relating to the sale was reported to him on Form 1099-B. Xavier had no other capital gains or losses during the year. His only other income was from wages. Xavier received the following Form 1099-B reporting the sale of 100 shares of stock. How should he report the sale of this property when he prepares his tax return?

Xavier Brown (32) is filing as a single taxpayer. During the year, he was unhappy with the performance of an investment he had made in ALX Corporation in 2018. Xavier sold his shares on May 4, 2020, for fear the stock would continue its downward trend. Information relating to the sale was reported to him on Form 1099-B. Xavier had no other capital gains or losses during the year. His only other income was from wages. Xavier received the following Form 1099-B reporting the sale of 100 shares of stock. How should he report the sale of this property when he prepares his tax return?

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 15DQ

Related questions

Question

100%

Xavier Brown (32) is filing as a single taxpayer. During the year, he was unhappy with the performance of an investment he had made in ALX Corporation in 2018. Xavier sold his shares on May 4, 2020, for fear the stock would continue its downward trend. Information relating to the sale was reported to him on Form 1099-B.

Xavier had no other

Xavier received the following Form 1099-B reporting the sale of 100 shares of stock. How should he report the sale of this property when he prepares his tax return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:FreeTaxUSAⓇ -- X2021 Schedule C x

Gmail

art 1 - Scenario 8

с

• hrblock.csod.com/Evaluations/EvalLaunch.aspx?loid-47a30875-9c0b-4ea2-bf63-40a9c98c0b29&evalLvl=5&redirect_url=%2fphnx%2fd

YouTube Maps FreeTaxUSAⓇ

LE - Sig...

I TRADE ONLINE INVESTMENTS

5631 LA HABRA PARKWAY, STE 13

YOUR CITY, YS XXXXX

(XXX)548-5734

CORRECTED (if checked)

PAYER'S name, street address, city or town, state or province, country. ZIP Applicable checkbox on Form 8949

or foreign postal code, and telephone no.

D

PAYER'S TIN

eview the following scenario. Use the information provided to answer questions about the taxpayer's 2021 return.

he sale was reported to him on Form 1099-B.

avier Brown (32) is filing as a single taxpayer. During the year, he was unhappy with the performance of an investment he had made in ALX Corporation in 2019. Xavier sold his sha

Cavier had no other capital gains or losses during the year. His only other income was from wages.

07-2011702

Question 15 of 50.

Xavier received the following Form 1099-B reporting the sale of 100 shares of stock. How should he report the sale of this property when he prepares his tax return?

RECIPIENT'S name

XAVIER BROWN

Street address (including apt. no.)

218 ROSEMARY LANE

Account number (see instructions)

1861354

CUSIP number

City or town, state or province, country, and ZIP or foreign postal code

YOUR CITY, YS XXXXX

14 State name

YS

Form 1099-B

RECIPIENT'S TIN

34°F

Raining now

201-00-1178

esc

Instructions for FX

FATCA fing

requirement

15 State identification no. 16 State tax withhold

$

(Keep for your records)

?

f2

Block Academy

1d Procoods

$ 6,640.00

OMB No. 1545-0715

2021

Form 1099-B

1a Description of property (Example: 100 sh. XYZ Co.)

100 SHARES ALX

1b Date acquired

02/01/2019

Gross proceeds

Net proceeds

8 Profit or loss) realized in

2021 on closed contracts

1g Wash sale loss disallowed

11 Accrued market discount

$

$

2 Short-term gain or loss

Long-term gain or loss

Ordinary

3 If checked. proceeds from:

Collectibles

QOF

4 Federal income tax withheld 5 If checked, noncovered

security

$

6 Reported to IRS:

$

10 Unrealized profit or loss) on

open contracts-12/31/2021

✓✔

f3

www.irs.gov/Form10998

#

2021 Instructions X

N

$

$

12 if checked, basis reported 13 Bartering

to IRS

✔$

f4

1c Date sold or disposed

05/04/2021

$

10 Cost or other basis

$ 8,300.00

7 checked, loss is not allowed

based on amount in 1d.

9 Unrealized profit or (oss) on

open contracts-12/31/2020

$

11 Aggregate profit or (loss)

on contracts

f5

Proceeds From

Broker and

Barter Exchange

Transactions

10

%

Department of the Treasury - Internal Revenue Service

Copy B

For Recipient

This is important tax

information and is

being furnished to

the IRS. If you are

required to file a

return, a negligence

penalty or other

sanction may be

imposed on you if

this income is

taxable and the IRS

determines that it

has not been

reported.

0

f6

(133,379 unread) X

■

4-

A

(C

f7

liji

Realize Your Pote X 1

4+

&

f8

8

LO

9

144

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT