XSport Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $10,540,000 Sales—Summer Sports Division 13,650,000 Cost of Goods Sold—Winter Sports Division 6,265,000 Cost of Goods Sold—Summer Sports Division 7,884,000 Sales expense—Winter Sports Division 1,665,000 Sales expense—Summer Sports Division 1,884,000 Administrative Expense—Winter Sports Division 1,020,000 Administrative Expense—Summer Sports Division 1,202,800 Advertising Expense 480,300 Transportation Expense 205,100 Accounts Receivable Collection Expense 120,150 Warehouse Expense 1,146,000 The bases to be used in allocating expenses, together with other essential information, are as follows: A. Advertising expense—incurred at headquarters, charged back to divisions on the basis of usage: Winter Sports Division, $217,900; Summer Sports Division, $262,400. B. Transportation expense—charged back to divisions at a charge rate of $7 per bill of lading: Winter Sports Division, 14,300 bills of lading; Summer Sports Division, 15,000 bills of lading. C. Accounts receivable collection expense—incurred at headquarters, charged back to divisions at a charge rate of $5 per invoice: Winter Sports Division, 9,600 sales invoices; Summer Sports Division, 14,430 sales invoices. D. Warehouse expense—charged back to divisions on the basis of floor space used in storing division products: Winter Sports Division, 90,000 square feet; Summer Sports Division, 101,000 square feet. Required: 1. Prepare a divisional income statement with two column headings: Winter Sports Division and Summer Sports Division. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. (Complete the Supporting Calculations tab first.) A colon (:) will fill in where needed. 2. Provide supporting calculations for service department charges.

XSport Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: Sales—Winter Sports Division $10,540,000 Sales—Summer Sports Division 13,650,000 Cost of Goods Sold—Winter Sports Division 6,265,000 Cost of Goods Sold—Summer Sports Division 7,884,000 Sales expense—Winter Sports Division 1,665,000 Sales expense—Summer Sports Division 1,884,000 Administrative Expense—Winter Sports Division 1,020,000 Administrative Expense—Summer Sports Division 1,202,800 Advertising Expense 480,300 Transportation Expense 205,100 Accounts Receivable Collection Expense 120,150 Warehouse Expense 1,146,000 The bases to be used in allocating expenses, together with other essential information, are as follows: A. Advertising expense—incurred at headquarters, charged back to divisions on the basis of usage: Winter Sports Division, $217,900; Summer Sports Division, $262,400. B. Transportation expense—charged back to divisions at a charge rate of $7 per bill of lading: Winter Sports Division, 14,300 bills of lading; Summer Sports Division, 15,000 bills of lading. C. Accounts receivable collection expense—incurred at headquarters, charged back to divisions at a charge rate of $5 per invoice: Winter Sports Division, 9,600 sales invoices; Summer Sports Division, 14,430 sales invoices. D. Warehouse expense—charged back to divisions on the basis of floor space used in storing division products: Winter Sports Division, 90,000 square feet; Summer Sports Division, 101,000 square feet. Required: 1. Prepare a divisional income statement with two column headings: Winter Sports Division and Summer Sports Division. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. (Complete the Supporting Calculations tab first.) A colon (:) will fill in where needed. 2. Provide supporting calculations for service department charges.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter25: Departmental Accounting

Section: Chapter Questions

Problem 6SEB

Related questions

Question

XSport Sporting Goods Co. operates two divisions—the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted:

| Sales—Winter Sports Division | $10,540,000 |

| Sales—Summer Sports Division | 13,650,000 |

| Cost of Goods Sold—Winter Sports Division | 6,265,000 |

| Cost of Goods Sold—Summer Sports Division | 7,884,000 |

| Sales expense—Winter Sports Division | 1,665,000 |

| Sales expense—Summer Sports Division | 1,884,000 |

| Administrative Expense—Winter Sports Division | 1,020,000 |

| Administrative Expense—Summer Sports Division | 1,202,800 |

| Advertising Expense | 480,300 |

| Transportation Expense | 205,100 |

| Accounts Receivable Collection Expense | 120,150 |

| Warehouse Expense | 1,146,000 |

The bases to be used in allocating expenses, together with other essential information, are as follows:

| A. | Advertising expense—incurred at headquarters, charged back to divisions on the basis of usage: Winter Sports Division, $217,900; Summer Sports Division, $262,400. |

| B. | Transportation expense—charged back to divisions at a charge rate of $7 per bill of lading: Winter Sports Division, 14,300 bills of lading; Summer Sports Division, 15,000 bills of lading. |

| C. | Accounts receivable collection expense—incurred at headquarters, charged back to divisions at a charge rate of $5 per invoice: Winter Sports Division, 9,600 sales invoices; Summer Sports Division, 14,430 sales invoices. |

| D. | Warehouse expense—charged back to divisions on the basis of floor space used in storing division products: Winter Sports Division, 90,000 square feet; Summer Sports Division, 101,000 square feet. |

| Required: | |

| 1. | Prepare a divisional income statement with two column headings: Winter Sports Division and Summer Sports Division. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. (Complete the Supporting Calculations tab first.) A colon (:) will fill in where needed. |

| 2. | Provide supporting calculations for service department charges. |

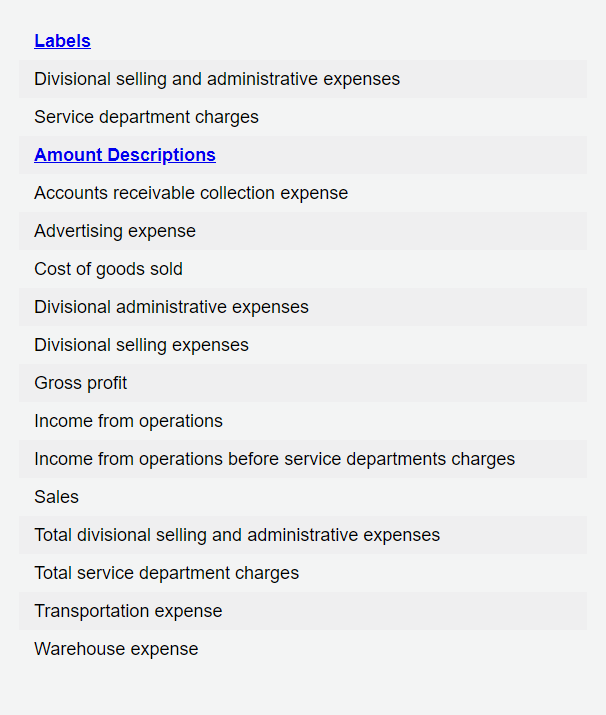

Transcribed Image Text:Labels

Divisional selling and administrative expenses

Service department charges

Amount Descriptions

Accounts receivable collection expense

Advertising expense

Cost of goods sold

Divisional administrative expenses

Divisional selling expenses

Gross profit

Income from operations

Income from operations before service departments charges

Sales

Total divisional selling and administrative expenses

Total service department charges

Transportation expense

Warehouse expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College