Chapter28: Income Taxati On Of Trusts And Estates

Section: Chapter Questions

Problem 13CE

Related questions

Question

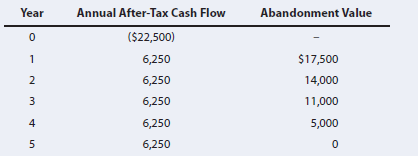

The Scampini Supplies Company recently purchased a new

delivery truck. The new truck costs $22,500, and it is expected to generate after-tax cash

flows, including

expected year-end abandonment values (salvage values after tax adjustments) for the truck

are given here. The company’s WACC is 10%.

a. Should the firm operate the truck until the end of its 5-year physical life; if not, what is

the truck’s optimal economic life?

b. Would the introduction of abandonment values, in addition to operating cash flows,

ever reduce the expected

Transcribed Image Text:Year

Annual After-Tax Cash Flow

Abandonment Value

($22,500)

6,250

$17,500

14,000

11,000

2

6,250

3

6,250

6,250

5,000

6,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you