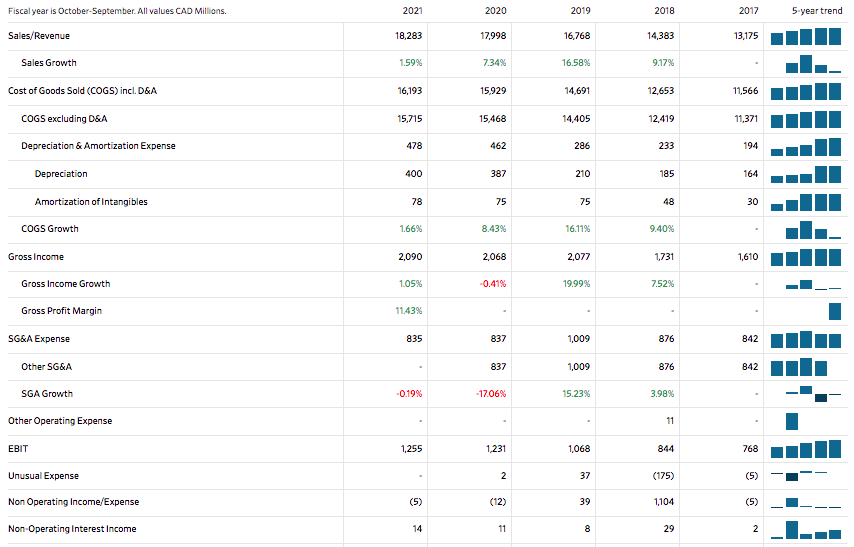

year is October-September. All välues CAD Millions. 2021 2020 2019 2018 201 5-year trer Sales/Revenue 18,283 17,998 16,768 14,383 13,175 Sales Growth 1.59% 7.34% 16.58% 9.17% Cost of Goods Sold (COGS) incl. D&A 16,193 15,929 14,691 12,653 11,566 COGS excluding D&A 15,715 15,468 14,405 12,419 11,371 Depreciation & Amortization Expense 478 462 286 233 194 Depreciation 400 387 210 185 164 Amortization of Intangibles 78 5ל 75 48 30 COGS Growth 1.66% 8.43% 16.11% 9.40% Gross Income 2,090 2,068 2,077 1,731 1,610 Gross Income Growth 1.05% -0.41% 19.99% 7.52% Gross Profit Margin 11.43% SG&A Expense 835 837 1,009 876 842 Other SG&A 837 1,009 876 842 SGA Growth -0.19% 17.06% 15.23% 3.98% Other Operating Expense 11 EBIT 1,255 1,231 1,068 844 768 Unusual Expense 37 (175) (5) 2.

year is October-September. All välues CAD Millions. 2021 2020 2019 2018 201 5-year trer Sales/Revenue 18,283 17,998 16,768 14,383 13,175 Sales Growth 1.59% 7.34% 16.58% 9.17% Cost of Goods Sold (COGS) incl. D&A 16,193 15,929 14,691 12,653 11,566 COGS excluding D&A 15,715 15,468 14,405 12,419 11,371 Depreciation & Amortization Expense 478 462 286 233 194 Depreciation 400 387 210 185 164 Amortization of Intangibles 78 5ל 75 48 30 COGS Growth 1.66% 8.43% 16.11% 9.40% Gross Income 2,090 2,068 2,077 1,731 1,610 Gross Income Growth 1.05% -0.41% 19.99% 7.52% Gross Profit Margin 11.43% SG&A Expense 835 837 1,009 876 842 Other SG&A 837 1,009 876 842 SGA Growth -0.19% 17.06% 15.23% 3.98% Other Operating Expense 11 EBIT 1,255 1,231 1,068 844 768 Unusual Expense 37 (175) (5) 2.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.6P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

100%

Perform a horizontal analysis of the company

Transcribed Image Text:Fiscal year is October-September. All values CAD Millions.

2021

2020

2019

2018

2017

5-year trend

Sales/Revenue

18,283

17,998

16,768

14,383

13,175

Sales Growth

1.59%

7.34%

16.58%

9.17%

Cost of Goods Sold (COGS) incl. D&A

16,193

15,929

14,691

12,653

11,566

COGS excluding D&A

15,715

15,468

14,405

12,419

11,371

Depreciation & Amortization Expense

478

462

286

233

194

Depreciation

400

387

210

185

164

Amortization of Intangibles

78

75

75

48

30

COGS Growth

1.66%

8.43%

16.11%

9.40%

Gross Income

2,090

2,068

2,077

1,731

1,610

Gross Income Growth

1.05%

-0.41%

19.99%

7.52%

Gross Profit Margin

11.43%

SG&A Expense

835

837

1,009

876

842

Other SG&A

837

1,009

876

842

SGA Growth

-0.19%

-17.06%

15.23%

3.98%

Other Operating Expense

11

EBIT

1,255

1,231

1,068

844

768

Unusual Expense

2

37

(175)

(5)

Non Operating Income/Expense

(5)

(12)

39

1,104

(5)

Non-Operating Interest Income

14

11

8

29

2

co

Transcribed Image Text:Interest Expense

143

144

109

106

61

Interest Expense Growth

-0.42%

31.56%

3.60%

72.10%

Gross Interest Expense

143

144

109

106

61

Pretax Income

1,121

1,084

969

2,046

708

Pretax Income Growth

3.36%

11.88%

-52.63%

188.85%

Pretax Margin

6.13%

Income Tax

295

288

255

358

193

Income Tax - Current Domestic

255

271

232

422

151

Income Tax - Deferred Domestic

40

17

23

(63)

42

Equity in Affiliates

31

94

Consolidated Net Income

826

796

714

1,719

608

Minority Interest Expense

3

1

3

2

17

Net Income

823

795

712

1,717

592

Net Income Growth

3.50%

11.75%

-58.54%

190.10%

Net Margin

4.50%

Net Income After Extraordinaries

823

795

712

1,717

592

Net Income Available to Common

823

795

712

1,717

592

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,