Yogajothi is thinking of investing in a rental house. The total cost to purchase the house, including legal fees and taxes, is $240,000. All but $30,000 of this amount will be mortgaged. He will pay $1700 per month in mortgage payments. At the end of two years, he will sell the house and at that time expects to clear $50,000 after paying off the remaining mortgage principal (in other words, he will pay off all his debts for the house and still have $50,000 left). Rents will earn him $2500 per month for the first year and $2900 per month for the second year. The house is in fairly good condition now, so he doesn't expect to have any maintenance costs for the first six months. For the seventh month, Yogajothi has budgeted $500. This figure will be increased by $50 per month thereafter (e.g., the expected month 7 expense will be $500, month 8, $550, month 9, $600, etc.). If interest is 6 percent compounded monthly, what is the present worth of this investment? Given that Yogajothi's estimates of revenue and expenses are correct, should he buy the house? Click the icon to view the table. compound interest factors for discrete compounding periods when i = 0.5%. Yogajothi The present value of buying the house is $. Since the present value is (Round to the nearest cent as needed.) buy the house.

Yogajothi is thinking of investing in a rental house. The total cost to purchase the house, including legal fees and taxes, is $240,000. All but $30,000 of this amount will be mortgaged. He will pay $1700 per month in mortgage payments. At the end of two years, he will sell the house and at that time expects to clear $50,000 after paying off the remaining mortgage principal (in other words, he will pay off all his debts for the house and still have $50,000 left). Rents will earn him $2500 per month for the first year and $2900 per month for the second year. The house is in fairly good condition now, so he doesn't expect to have any maintenance costs for the first six months. For the seventh month, Yogajothi has budgeted $500. This figure will be increased by $50 per month thereafter (e.g., the expected month 7 expense will be $500, month 8, $550, month 9, $600, etc.). If interest is 6 percent compounded monthly, what is the present worth of this investment? Given that Yogajothi's estimates of revenue and expenses are correct, should he buy the house? Click the icon to view the table. compound interest factors for discrete compounding periods when i = 0.5%. Yogajothi The present value of buying the house is $. Since the present value is (Round to the nearest cent as needed.) buy the house.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 13CQ

Related questions

Question

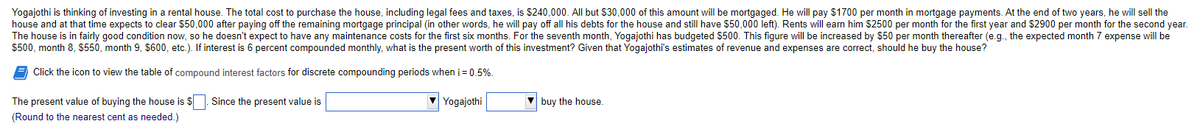

Transcribed Image Text:Yogajothi is thinking of investing in a rental house. The total cost to purchase the house, including legal fees and taxes, is $240,000. All but $30,000 of this amount will be mortgaged. He will pay $1700 per month in mortgage payments. At the end of two years, he will sell the

house and at that time expects to clear $50,000 after paying off the remaining mortgage principal (in other words, he will pay off all his debts for the house and still have $50,000 left). Rents will earn him $2500 per month for the first year and $2900 per month for the second year.

The house is in fairly good condition now, so he doesn't expect to have any maintenance costs for the first six months. For the seventh month, Yogajothi has budgeted $500. This figure will be increased by $50 per month thereafter (e.g., the expected month 7 expense will be

$500, month 8, $550, month 9, $600, etc.). If interest is 6 percent compounded monthly, what is the present worth of this investment? Given that Yogajothi's estimates of revenue and expenses are correct, should he buy the house?

Click the icon to view the table of compound interest factors for discrete compounding periods when i = 0.5%.

Yogajothi

The present value of buying the house is $. Since the present value is

(Round to the nearest cent as needed.)

buy the house.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning