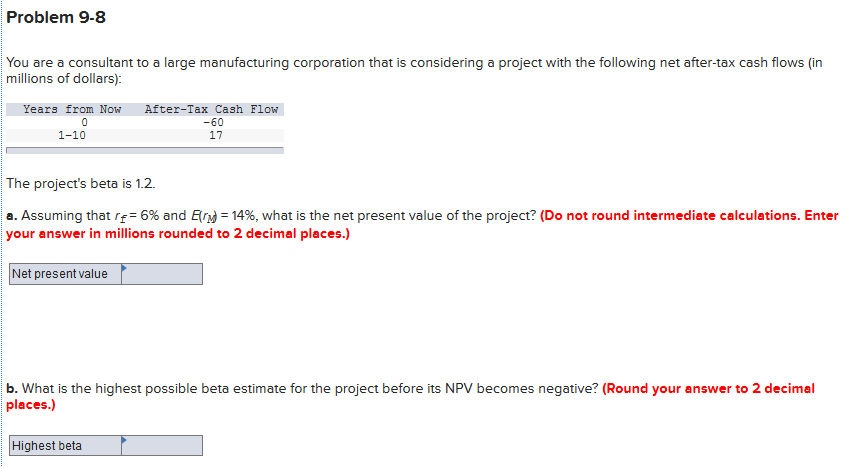

You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax Cash Flow -60 17 1-10 The project's beta is 1.2. a. Assuming that re= 6% and Er) = 14%, what is the net present value of the project? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Net present value b. What is the highest possible beta estimate for the project before its NPV becomes negative? (Round your answer to 2 decimal places.) Highest beta

You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax Cash Flow -60 17 1-10 The project's beta is 1.2. a. Assuming that re= 6% and Er) = 14%, what is the net present value of the project? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Net present value b. What is the highest possible beta estimate for the project before its NPV becomes negative? (Round your answer to 2 decimal places.) Highest beta

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 8PROB

Related questions

Question

Transcribed Image Text:Problem 9-8

You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in

millions of dollars):

Years from Now

After-Tax Cash Flow

-60

1-10

17

The project's beta is 1.2.

a. Assuming that r = 6% and Er = 14%, what is the net present value of the project? (Do not round intermediate calculations. Enter

your answer in millions rounded to 2 decimal places.)

Net present value

b. What is the highest possible beta estimate for the project before its NPV becomes negative? (Round your answer to 2 decimal

places.)

Highest beta

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you