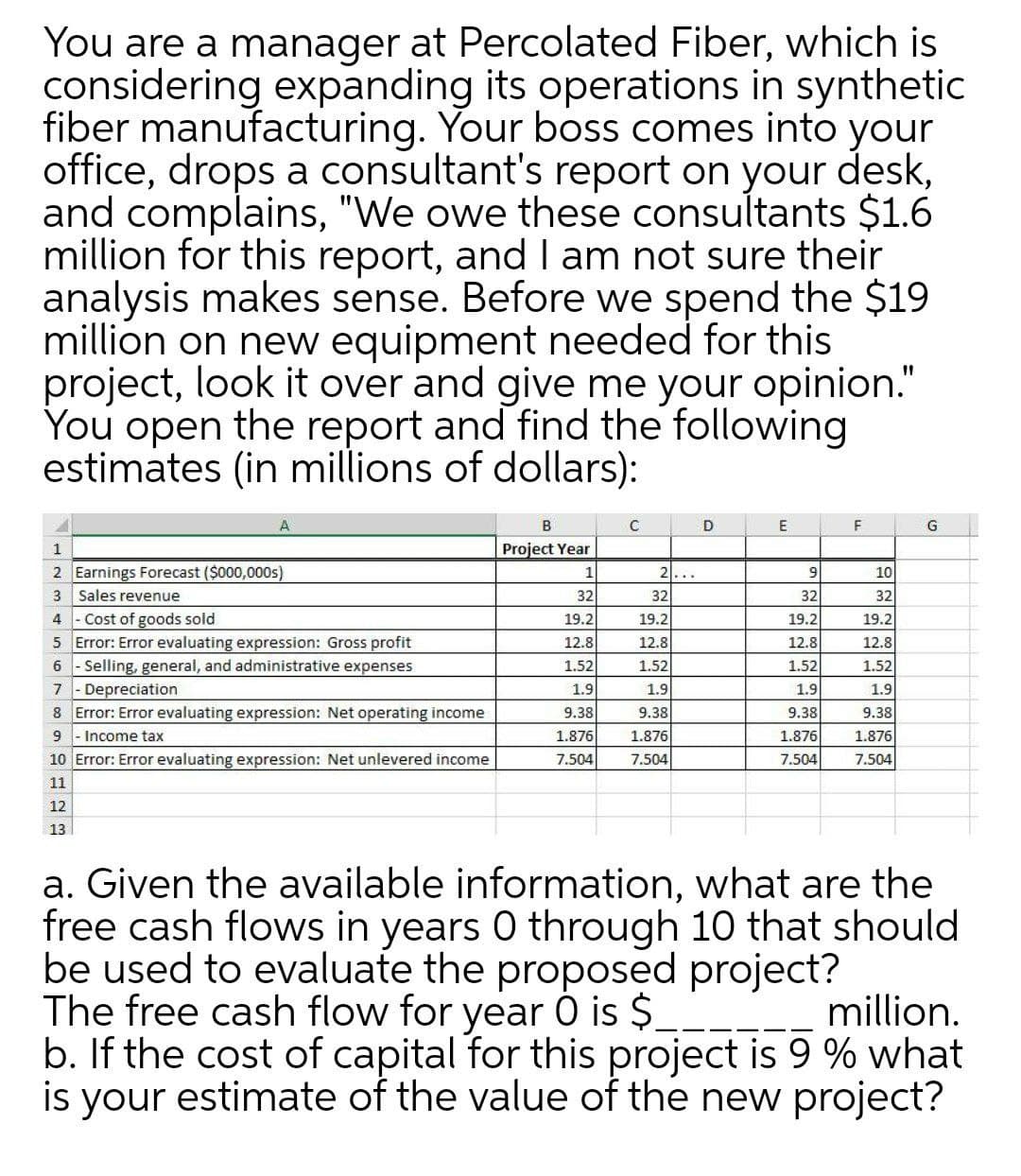

You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and I am not sure their analysis makes sense. Before we spend the $19 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): A C D E F G 1 Project Year 10 32 2... 2 Earnings Forecast ($000,000s) 3 Sales revenue 4 - Cost of goods sold 5 Error: Error evaluating expression: Gross profit 6 - Selling, general, and administrative expenses 7- Depreciation 8 Error: Error evaluating expression: Net operating income 1 32 32 32 19.2 19.2 19.2 19.2 12.8 1.52 1.9 12.8 12.8 12.8 1.52 1.52 1.52 1.9 9.38 1.9 9.38 1.9 9.38 9.38 9 |- Income tax 1.876 1.876 1.876 1.876 10 Error: Error evaluating expression: Net unlevered income 7.504 7.504 7.504 7.504 11 12 13 a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? The free cash flow for year 0 is $. b. If the cost of capital for this project is 9 % what is your estimate of the value of the new project? million.

You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and I am not sure their analysis makes sense. Before we spend the $19 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): A C D E F G 1 Project Year 10 32 2... 2 Earnings Forecast ($000,000s) 3 Sales revenue 4 - Cost of goods sold 5 Error: Error evaluating expression: Gross profit 6 - Selling, general, and administrative expenses 7- Depreciation 8 Error: Error evaluating expression: Net operating income 1 32 32 32 19.2 19.2 19.2 19.2 12.8 1.52 1.9 12.8 12.8 12.8 1.52 1.52 1.52 1.9 9.38 1.9 9.38 1.9 9.38 9.38 9 |- Income tax 1.876 1.876 1.876 1.876 10 Error: Error evaluating expression: Net unlevered income 7.504 7.504 7.504 7.504 11 12 13 a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? The free cash flow for year 0 is $. b. If the cost of capital for this project is 9 % what is your estimate of the value of the new project? million.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter14: Quality And Environmental Cost Management

Section: Chapter Questions

Problem 35P: Recently, Ulrich Company received a report from an external consulting group on its quality costs....

Related questions

Concept explainers

Question

Urgent please

Transcribed Image Text:You are a manager at Percolated Fiber, which is

considering expanding its operations in synthetic

fiber manufacturing. Your boss comes into your

office, drops a consultant's report on your desk,

and complains, "We owe these consultants $1.6

million for this report, and I am not sure their

analysis makes sense. Before we spend the $19

million on new equipment needed for this

project, look it over and give me your opinion."

You open the report and find the following

estimates (in millions of dollars):

D

E

F

Project Year

10

32

19.2

2 Earnings Forecast ($000,000s)

3 Sales revenue

4 - Cost of goods sold

5 Error: Error evaluating expression: Gross profit

6 - Selling, general, and administrative expenses

- Depreciation

8 Error: Error evaluating expression: Net operating income

1

21...

9

32

19.2

32

32

19.2

19.2

12.8

12.8

12.8

12.8

1.52

1.52

1.52

1.52

7

1.9

1.9

1.9

1.9

9.38

9.38

9.38

9.38

9

Income tax

1.876

1.876

1.876

1.876

10 Error: Error evaluating expression: Net unlevered income

7.504

7.504

7.504

7.504

11

12

13

a. Given the available information, what are the

free cash flows in years 0 through 10 that should

be used to evaluate the proposed project?

The free cash flow for year 0 is $__

b. If the cost of capital for this project is 9 % what

is your estimate of the value of the new project?

million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub