You are a portfolio manager who uses options positions to customize the risk profile of your clients. In each case, what strategy is best given your client's objective? a. • Performance to date: Up 16%. Client objective: Earn at least 15%. Your scenario: Good chance of large stock price gains or large losses between now and end of year. Buy a call option Write a call option Long straddle Long bullish spread Short straddle Short bullish spread Performance to date: Up 16%. b. . Client objective: Earn at least 15% with limited losses Your scenario: Good chance of large stock price losses between now and end of year. Short put options Long put options Short call options Long call options

You are a portfolio manager who uses options positions to customize the risk profile of your clients. In each case, what strategy is best given your client's objective? a. • Performance to date: Up 16%. Client objective: Earn at least 15%. Your scenario: Good chance of large stock price gains or large losses between now and end of year. Buy a call option Write a call option Long straddle Long bullish spread Short straddle Short bullish spread Performance to date: Up 16%. b. . Client objective: Earn at least 15% with limited losses Your scenario: Good chance of large stock price losses between now and end of year. Short put options Long put options Short call options Long call options

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter6: Risk And Return

Section: Chapter Questions

Problem 5MC: Your client has decided that the risk of the bond portfolio is acceptable and wishes to leave it as...

Related questions

Question

Need help on all

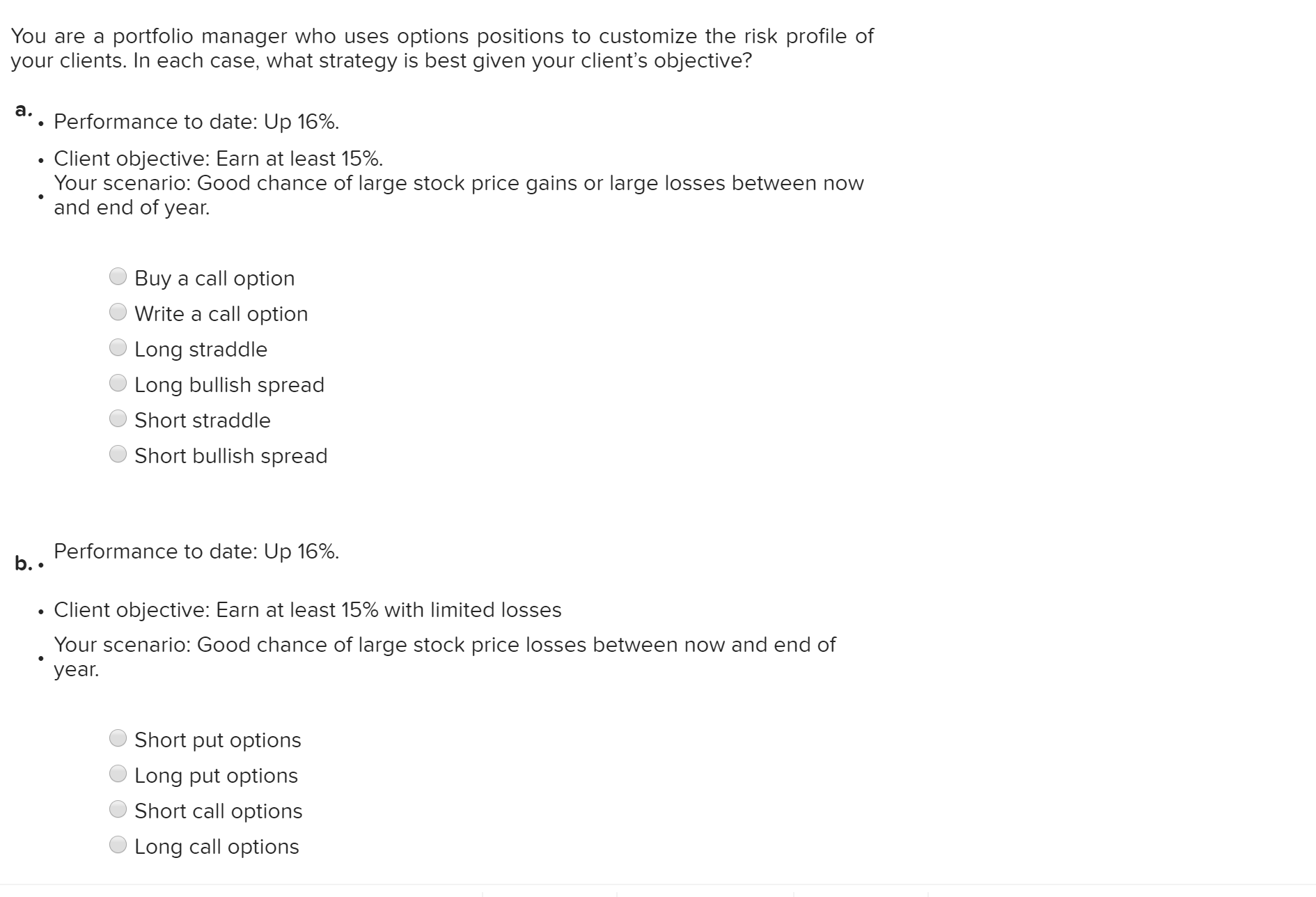

Transcribed Image Text:You are a portfolio manager who uses options positions to customize the risk profile of

your clients. In each case, what strategy is best given your client's objective?

a.

• Performance to date: Up 16%.

Client objective: Earn at least 15%.

Your scenario: Good chance of large stock price gains or large losses between now

and end of year.

Buy a call option

Write a call option

Long straddle

Long bullish spread

Short straddle

Short bullish spread

Performance to date: Up 16%.

b. .

Client objective: Earn at least 15% with limited losses

Your scenario: Good chance of large stock price losses between now and end of

year.

Short put options

Long put options

Short call options

Long call options

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT