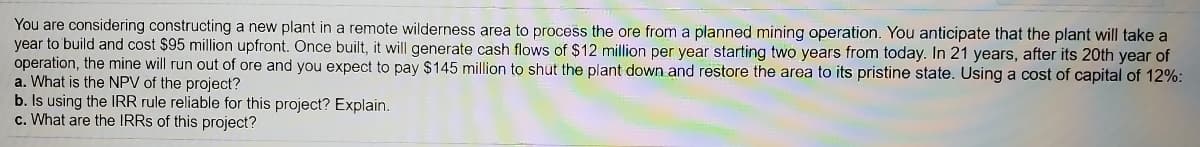

You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a year to build and cost $95 million upfront. Once built, it will generate cash flows of $12 million per year starting two years from today. In 21 years, after its 20th year of operation, the mine will run out of ore and you expect to pay $145 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 12%: a. What is the NPV of the project? b. Is using the IRR rule reliable for this project? Explain. c. What are the IRRS of this project?

You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a year to build and cost $95 million upfront. Once built, it will generate cash flows of $12 million per year starting two years from today. In 21 years, after its 20th year of operation, the mine will run out of ore and you expect to pay $145 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 12%: a. What is the NPV of the project? b. Is using the IRR rule reliable for this project? Explain. c. What are the IRRS of this project?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a

year to build and cost $95 million upfront. Once built, it will generate cash flows of $12 million per year starting two years from today. In 21 years, after its 20th year of

operation, the mine will run out of ore and you expect to pay $145 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 12%:

a. What is the NPV of the project?

b. Is using the IRR rule reliable for this project? Explain.

c. What are the IRRS of this project?

Expert Solution

Cash Flows:

| Year | Cash Flow |

| 0 | -95,000,000 |

| 1 | 0 |

| 2 | 12,000,000 |

| 3 | 12,000,000 |

| 4 | 12,000,000 |

| 5 | 12,000,000 |

| 6 | 12,000,000 |

| 7 | 12,000,000 |

| 8 | 12,000,000 |

| 9 | 12,000,000 |

| 10 | 12,000,000 |

| 11 | 12,000,000 |

| 12 | 12,000,000 |

| 13 | 12,000,000 |

| 14 | 12,000,000 |

| 15 | 12,000,000 |

| 16 | 12,000,000 |

| 17 | 12,000,000 |

| 18 | 12,000,000 |

| 19 | 12,000,000 |

| 20 | 12,000,000 |

| 21 | -145,000,000 |

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning