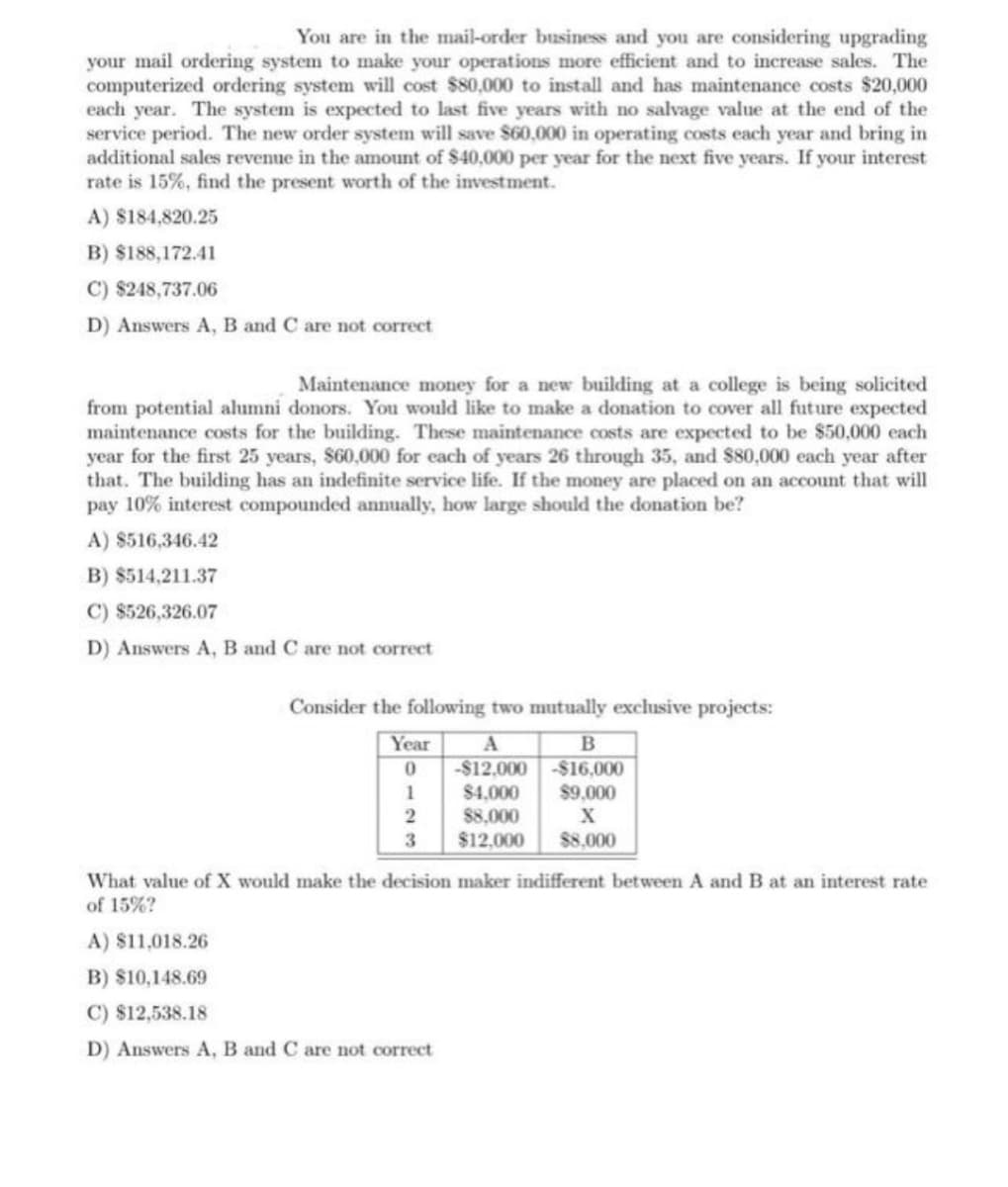

You are in the mail-order business and you are considering upgrading your mail ordering system to make your operations more efficient and to increase sales. The computerized ordering system will cost $80,000 to install and has maintenance costs $20,000 each year. The system is expected to last five years with no salvage value at the end of the service period. The new order system will save $60,000 in operating costs each year and bring in additional sales revenue in the amount of $40,000 per year for the next five years. If your interest rate is 15%, find the present worth of the investment. A) $184,820.25 B) $188,172.41 C) $248,737.06 D) Answers A, B and C are not correct

You are in the mail-order business and you are considering upgrading your mail ordering system to make your operations more efficient and to increase sales. The computerized ordering system will cost $80,000 to install and has maintenance costs $20,000 each year. The system is expected to last five years with no salvage value at the end of the service period. The new order system will save $60,000 in operating costs each year and bring in additional sales revenue in the amount of $40,000 per year for the next five years. If your interest rate is 15%, find the present worth of the investment. A) $184,820.25 B) $188,172.41 C) $248,737.06 D) Answers A, B and C are not correct

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 15E: Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided...

Related questions

Question

Transcribed Image Text:You are in the mail-order business and you are considering upgrading

your mail ordering system to make your operations more efficient and to increase sales. The

computerized ordering system will cost $80,000 to install and has maintenance costs $20,000

each year. The system is expected to last five years with no salvage value at the end of the

service period. The new order system will save $60,000 in operating costs each year and bring in

additional sales revenue in the amount of $40,000 per year for the next five years. If your interest

rate is 15%, find the present worth of the investment.

A) $184,820.25

B) $188,172.41

C) $248,737.06

D) Answers A, B and C are not correct

Maintenance money for a new building at a college is being solicited

from potential alumni donors. You would like to make a donation to cover all future expected

maintenance costs for the building. These maintenance costs are expected to be $50,000 each

year for the first 25 years, $60,000 for each of years 26 through 35, and $80,000 each year after

that. The building has an indefinite service life. If the money are placed on an account that will

pay 10% interest compounded annually, how large should the donation be?

A) 8516,346.42

B) $514,211.37

C) $526,326.07

D) Answers A, B and C are not correct

Consider the following two mutually exchusive projects:

Year

-$12,000

$4,000

88,000

$12,000

-$16,000

$9,000

1

$8,000

What value of X would make the decision maker indifferent between A and B at an interest rate

of 15%?

A) $11,018.26

B) $10,148.69

C) $12,538.18

D) Answers A, B and C are not correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning