You are ready to buy a house and you have $15,000 for a down payment and closing costs. Closing costs are estimated to be 4% of the loan value. You have an annual salary of $48,000, The bank is willing to allow your monthly mortgage payment to be equal to 30% of your monthly income. The interest rate on the loan is 4.0% per year with monthly compounding for a 30-year fixed rate loan. Provide answers in whole dollars, no decimals, no dollar sign, eg., 120514. A) How much money will the bank loan you? B) How much can you offer for the house?

You are ready to buy a house and you have $15,000 for a down payment and closing costs. Closing costs are estimated to be 4% of the loan value. You have an annual salary of $48,000, The bank is willing to allow your monthly mortgage payment to be equal to 30% of your monthly income. The interest rate on the loan is 4.0% per year with monthly compounding for a 30-year fixed rate loan. Provide answers in whole dollars, no decimals, no dollar sign, eg., 120514. A) How much money will the bank loan you? B) How much can you offer for the house?

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter7: Using Consumer Loans

Section: Chapter Questions

Problem 9FPE

Related questions

Question

Ñ3

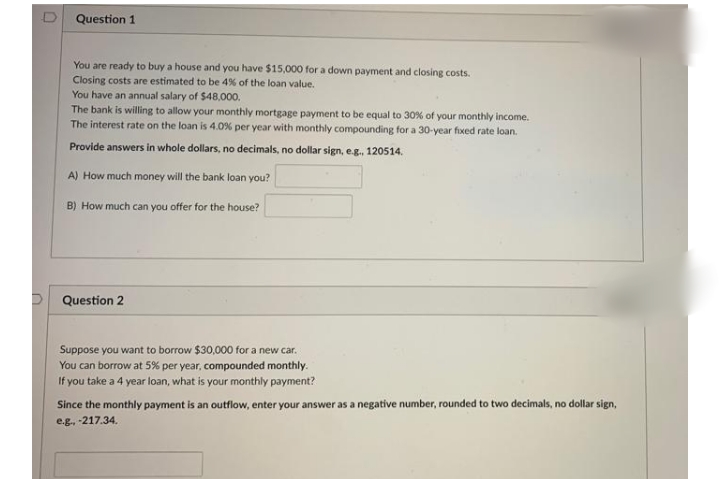

Transcribed Image Text:Question 1

You are ready to buy a house and you have $15,000 for a down payment and closing costs.

Closing costs are estimated to be 4% of the loan value.

You have an annual salary of $48,000.

The bank is willing to allow your monthly mortgage payment to be equal to 30% of your monthly income.

The interest rate on the loan is 4.0% per year with monthly compounding for a 30-year fixed rate loan.

Provide answers in whole dollars, no decimals, no dollar sign, e.g., 120514.

A) How much money will the bank loan you?

B) How much can you offer for the house?

Question 2

Suppose you want to borrow $30,000 for a new car.

You can borrow at 5% per year, compounded monthly.

If you take a 4 year loan, what is your monthly payment?

Since the monthly payment is an outflow, enter your answer as a negative number, rounded to two decimals, no dollar sign,

e.g. 217.34.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT