You are trying to decide between four machines for your firm. These machines only differ in their lifespan, initial cost, and annual maintenance costs... they are identical in every other way. This investment is vital to the operations of your firm, so you will need one of these machines in order to stay in business; that means, when the machine quits working, you will need to immediately reinvest in the same machine. You are looking for the cheapest machine. And you will reinvest in the same machine as switching between machines would create switching costs that would be significant. 2. Annual costs each Initial cost today Machine Lifespan year $2.5 milliona $50 milliona 5 years 8 years 4 years 10 years AC $57 milliona $47 million $75 milliona $3.5 million Cа $2.0 million $2.0million The cost of capital for the new machine is 10%. Use the same common end-year approach to rank the machines in order from best to worst. (Using Excel will help with this.) a. b. Use the equivalent annual annuity approach to Tank the machines in order from best to worst.

You are trying to decide between four machines for your firm. These machines only differ in their lifespan, initial cost, and annual maintenance costs... they are identical in every other way. This investment is vital to the operations of your firm, so you will need one of these machines in order to stay in business; that means, when the machine quits working, you will need to immediately reinvest in the same machine. You are looking for the cheapest machine. And you will reinvest in the same machine as switching between machines would create switching costs that would be significant. 2. Annual costs each Initial cost today Machine Lifespan year $2.5 milliona $50 milliona 5 years 8 years 4 years 10 years AC $57 milliona $47 million $75 milliona $3.5 million Cа $2.0 million $2.0million The cost of capital for the new machine is 10%. Use the same common end-year approach to rank the machines in order from best to worst. (Using Excel will help with this.) a. b. Use the equivalent annual annuity approach to Tank the machines in order from best to worst.

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 3TP: As a manager, you have to choose between two options for new production equipment. Machine A will...

Related questions

Question

Need help to figure this problem and put into excel format with formulas.

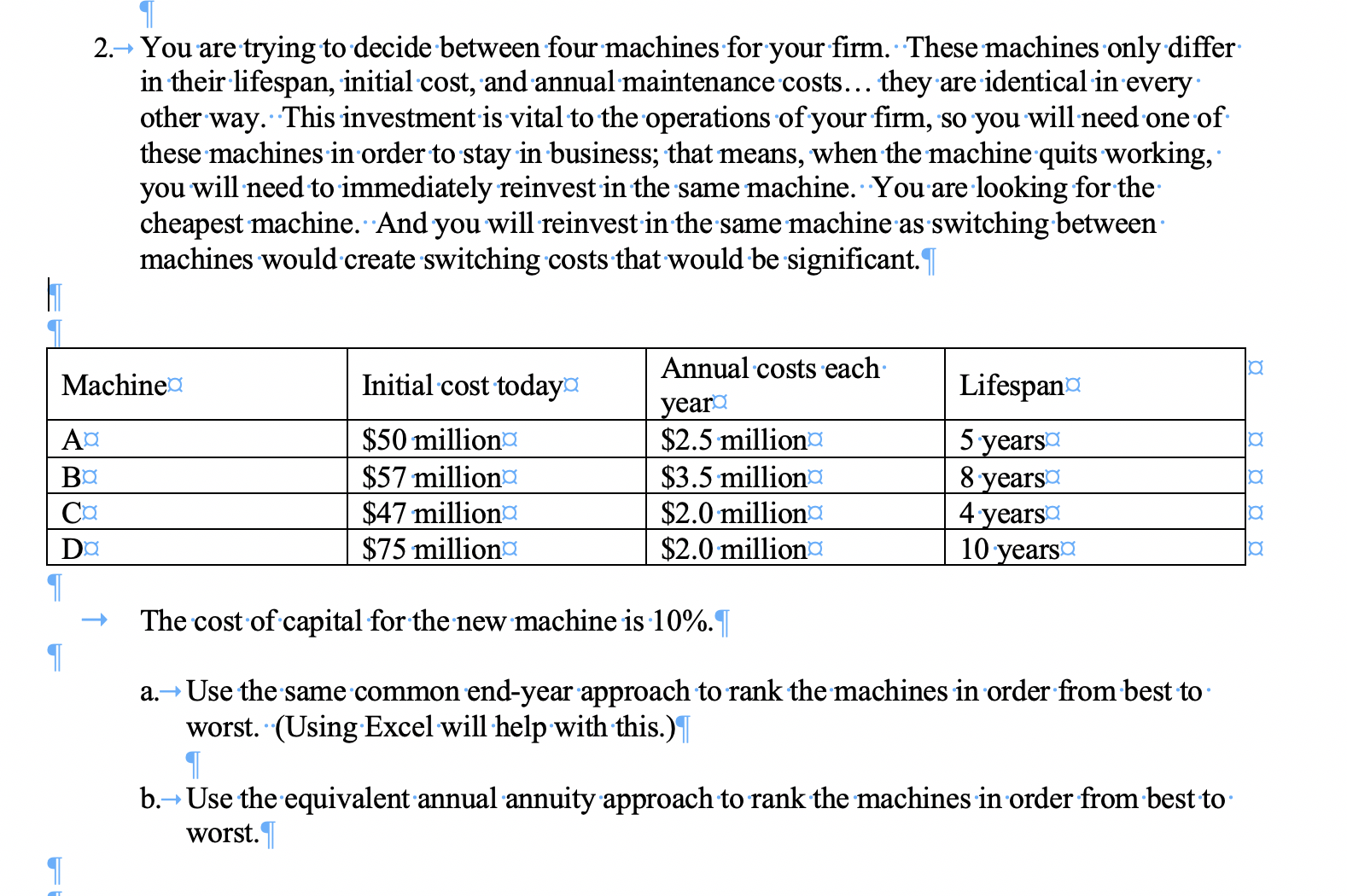

Transcribed Image Text:You are trying to decide between four machines for your firm. These machines only differ

in their lifespan, initial cost, and annual maintenance costs... they are identical in every

other way. This investment is vital to the operations of your firm, so you will need one of

these machines in order to stay in business; that means, when the machine quits working,

you will need to immediately reinvest in the same machine. You are looking for the

cheapest machine. And you will reinvest in the same machine as switching between

machines would create switching costs that would be significant.

2.

Annual costs each

Initial cost today

Machine

Lifespan

year

$2.5 milliona

$50 milliona

5 years

8 years

4 years

10 years

AC

$57 milliona

$47 million

$75 milliona

$3.5 million

Cа

$2.0 million

$2.0million

The cost of capital for the new machine is 10%.

Use the same common end-year approach to rank the machines in order from best to

worst. (Using Excel will help with this.)

a.

b.

Use the equivalent annual annuity approach to Tank the machines in order from best to

worst.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub