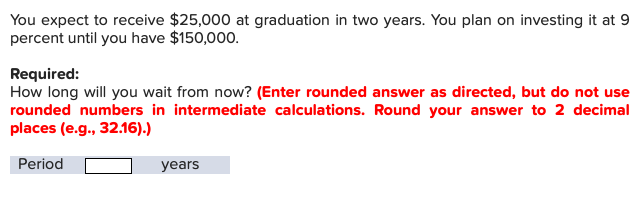

You expect to receive $25,000 at graduation in two years. You plan on investing it at 9 percent until you have $150,000 Required: How long will you wait from now? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Period years

You expect to receive $25,000 at graduation in two years. You plan on investing it at 9 percent until you have $150,000 Required: How long will you wait from now? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Period years

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 3CE

Related questions

Question

Transcribed Image Text:You expect to receive $25,000 at graduation in two years. You plan on investing it at 9

percent until you have $150,000

Required:

How long will you wait from now? (Enter rounded answer as directed, but do not use

rounded numbers in intermediate calculations. Round your answer to 2 decimal

places (e.g., 32.16).)

Period

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT