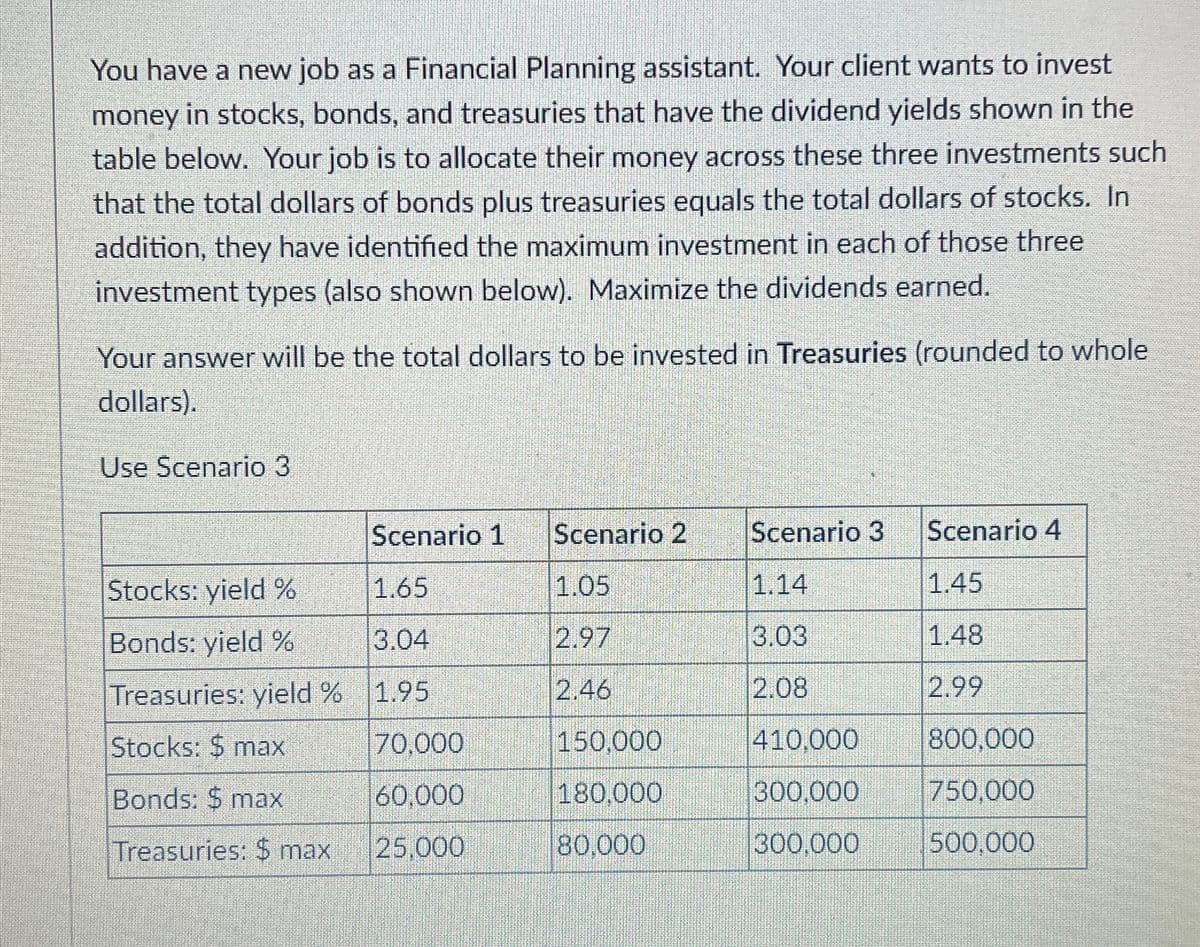

You have a new job as a Financial Planning assistant. Your client wants to invest money in stocks, bonds, and treasuries that have the dividend yields shown in the table below. Your job is to allocate their money across these three investments such that the total dollars of bonds plus treasuries equals the total dollars of stocks. In addition, they have identified the maximum investment each of those three investment types (also shown below). Maximize the dividends earned. Your answer will be the total dollars to be invested in Treasuries (rounded to whole dollars). Use Scenario 3 Scenario 1 Scenario 2 Scenario 3 Scenario 4 Stocks: yield % 1.65 1.05 1.14 1.45 Bonds: yield % 3.04 2.97 3.03 1.48 Treasuries: yield % 1.95 2.46 2.08 2.99 Stocks: $ max 70,000 150,000 410,000 800,000 Bonds: $ max 60,000 180,000 300,000 750,000 Treasuries: $ max 25,000 80,000 300,000 500,000

You have a new job as a Financial Planning assistant. Your client wants to invest money in stocks, bonds, and treasuries that have the dividend yields shown in the table below. Your job is to allocate their money across these three investments such that the total dollars of bonds plus treasuries equals the total dollars of stocks. In addition, they have identified the maximum investment each of those three investment types (also shown below). Maximize the dividends earned. Your answer will be the total dollars to be invested in Treasuries (rounded to whole dollars). Use Scenario 3 Scenario 1 Scenario 2 Scenario 3 Scenario 4 Stocks: yield % 1.65 1.05 1.14 1.45 Bonds: yield % 3.04 2.97 3.03 1.48 Treasuries: yield % 1.95 2.46 2.08 2.99 Stocks: $ max 70,000 150,000 410,000 800,000 Bonds: $ max 60,000 180,000 300,000 750,000 Treasuries: $ max 25,000 80,000 300,000 500,000

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:You have a new job as a Financial Planning assistant. Your client wants to invest

money in stocks, bonds, and treasuries that have the dividend yields shown in the

table below. Your job is to allocate their money across these three investments such

that the total dollars of bonds plus treasuries equals the total dollars of stocks. In

addition, they have identified the maximum investment in each of those three

investment types (also shown below). Maximize the dividends earned.

Your answer will be the total dollars to be invested in Treasuries (rounded to whole

dollars).

Use Scenario 3

Scenario 1

Scenario 2

Scenario 3

Scenario 4

Stocks: yield %

1.65

1.05

1.14

1.45

Bonds: yield %

3.04

2.97

3.03

1.48

Treasuries: yield %

1.95

2.46

2.08

2.99

Stocks: $ max

70,000

150,000

410,000

800,000

Bonds: $ max

60,000

180,000

300,000

750,000

Treasuries: $ max

25,000

80,000

300,000

500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,