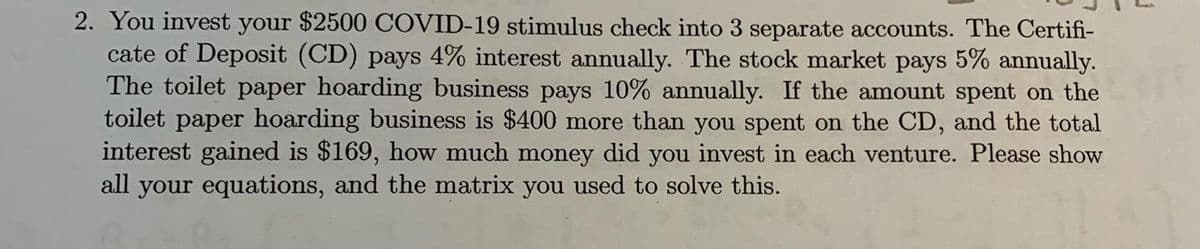

You invest your $2500 COVID-19 stimulus check into 3 separate accounts. The Certifi- cate of Deposit (CD) pays 4% interest annually. The stock market pays 5% annually. The toilet paper hoarding business pays 10% annually. If the amount spent on the toilet paper hoarding business is $400 more than you spent on the CD, and the total interest gained is $169, how much money did you invest in each venture. Please show all your equations, and the matrix you used to solve this.

You invest your $2500 COVID-19 stimulus check into 3 separate accounts. The Certifi- cate of Deposit (CD) pays 4% interest annually. The stock market pays 5% annually. The toilet paper hoarding business pays 10% annually. If the amount spent on the toilet paper hoarding business is $400 more than you spent on the CD, and the total interest gained is $169, how much money did you invest in each venture. Please show all your equations, and the matrix you used to solve this.

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:2. You invest your $2500 COVID-19 stimulus check into 3 separate accounts. The Certifi-

cate of Deposit (CD) pays 4% interest annually. The stock market pays 5% annually.

The toilet paper hoarding business pays 10% annually. If the amount spent on the

toilet paper hoarding business is $400 more than you spent on the CD, and the total

interest gained is $169, how much money did you invest in each venture. Please show

all your equations, and the matrix you used to solve this.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning