You plan to retire in 20 years. You would like to maintain your current level of consumption which is $55,937 per year. You will need to have 38 years of consumption during your retirement. You can earn 5.52% per year (nominal terms) on your investments. In addition, you expect inflation to be 2.09% inflation per year, from now and through your retirement. How much do you have to invest each year, starting next year, for 13 years, in nominal terms to just cover your retirement needs?

You plan to retire in 20 years. You would like to maintain your current level of consumption which is $55,937 per year. You will need to have 38 years of consumption during your retirement. You can earn 5.52% per year (nominal terms) on your investments. In addition, you expect inflation to be 2.09% inflation per year, from now and through your retirement. How much do you have to invest each year, starting next year, for 13 years, in nominal terms to just cover your retirement needs?

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 39P

Related questions

Question

You plan to retire in 20 years. You would like to maintain your current level of consumption which is $55,937 per year. You will need to have 38 years of consumption during your retirement. You can earn 5.52% per year (nominal terms) on your investments. In addition, you expect inflation to be 2.09% inflation per year, from now and through your retirement.

How much do you have to invest each year, starting next year, for 13 years, in nominal terms to just cover your retirement needs?

Expert Solution

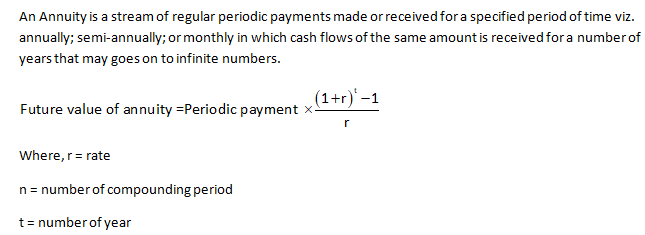

Introduction

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College