Your answer is incorrect. Try again. Bramble Company's ledger shows the following balances on December 31, 2020. $ 216,000 3,230,000 6% Preferred Stock-S10 par value, outstanding 21,500 shares Common Stock-$100 par value, outstanding 32,300 shares Retained Eamings 618,000 Assuming that the directors decide to declare total dividends in the amount of $353,000, determine how much each dass of stock should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock. (a) The preferred stock is cumulative and fully participating. (Round the rate of participation to 4 decimal places, eg.1.4278. Round answers to o decimal places, e.g. S38,487.) Common 196.896 Preferred 156.104 (b) The preferred stock is noncumulative and nonparticipating. (Round answers to 0 decimal places, eg. $38,487.) Preferred Common 12,420 340,580 () The preferred stock is noncumulative and is participating in distributions in excess of a 8% dividend rate on the common stock. (Round the rate of participation to 4 decimal places, eg.1.4278. Round answers to o decimal places, eg. S38,487.) Preferred Common 45.292 307,708

Your answer is incorrect. Try again. Bramble Company's ledger shows the following balances on December 31, 2020. $ 216,000 3,230,000 6% Preferred Stock-S10 par value, outstanding 21,500 shares Common Stock-$100 par value, outstanding 32,300 shares Retained Eamings 618,000 Assuming that the directors decide to declare total dividends in the amount of $353,000, determine how much each dass of stock should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock. (a) The preferred stock is cumulative and fully participating. (Round the rate of participation to 4 decimal places, eg.1.4278. Round answers to o decimal places, e.g. S38,487.) Common 196.896 Preferred 156.104 (b) The preferred stock is noncumulative and nonparticipating. (Round answers to 0 decimal places, eg. $38,487.) Preferred Common 12,420 340,580 () The preferred stock is noncumulative and is participating in distributions in excess of a 8% dividend rate on the common stock. (Round the rate of participation to 4 decimal places, eg.1.4278. Round answers to o decimal places, eg. S38,487.) Preferred Common 45.292 307,708

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 19E: Lyon Company shows the following condensed income statement information for the year ended December...

Related questions

Question

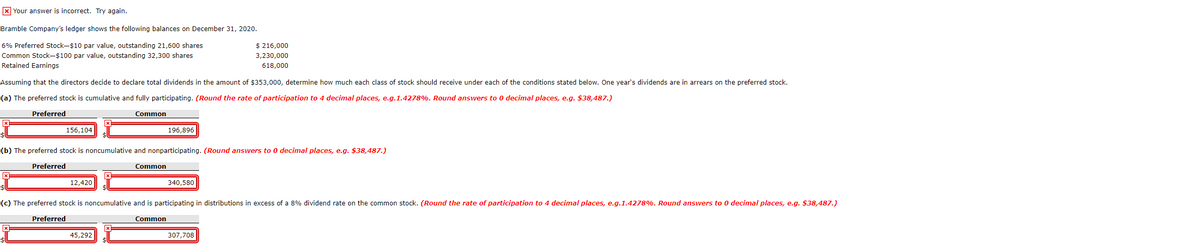

Transcribed Image Text:X Your answer is incorrect. Try again.

Bramble Company's ledger shows the following balances on December 31, 2020.

6% Preferred Stock-$10 par value, outstanding 21,600 shares

$ 216,000

Common Stock-$100 par value, outstanding 32,300 shares

3,230,000

Retained Earnings

618,000

Assuming that the directors decide to declare total dividends in the amount of $353,000, determine how much each class of stock should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock.

(a) The preferred stock is cumulative and fully participating. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to 0 decimal places, e.g. $38,487.)

Preferred

Common

156,104

196,896

(b) The preferred stock is noncumulative and nonparticipating. (Round answers to o decimal places, e.g. $38,487.)

Preferred

Common

12,420

340,580

(c) The preferred stock is noncumulative and is participating in distributions in excess of a 8% dividend rate on the common stock. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to 0 decimal places, e.g. $38,487.)

Preferred

Common

45,292

307,708

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College