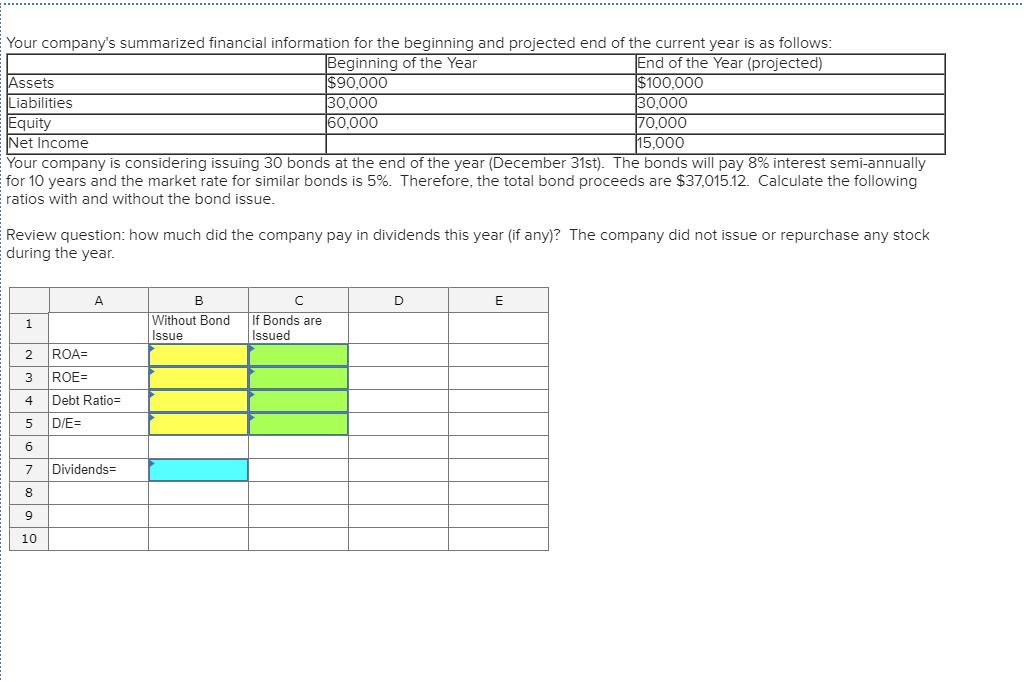

Your company's summarized financial information for the beginning and projected end of the current year is as follows: Beginning of the Year $90,000 30,000 60,000 End of the Year (projected) $100,000 30,000 70,000 15,000 Assets Liabilities Equity Net Income Your company is considering issuing 30 bonds at the end of the year (December 31st). The bonds will pay 8% interest semi-annually for 10 years and the market rate for similar bonds is 5%. Therefore, the total bond proceeds are $37,015.12. Calculate the following ratios with and without the bond issue. Review question: how much did the company pay in dividends this year (if any)? The company did not issue or repurchase any stock during the year. Without Bond Issue If Bonds are Issued 2 ROA= ROE= Debt Ratio= D/E= Dividends= 10

Your company's summarized financial information for the beginning and projected end of the current year is as follows: Beginning of the Year $90,000 30,000 60,000 End of the Year (projected) $100,000 30,000 70,000 15,000 Assets Liabilities Equity Net Income Your company is considering issuing 30 bonds at the end of the year (December 31st). The bonds will pay 8% interest semi-annually for 10 years and the market rate for similar bonds is 5%. Therefore, the total bond proceeds are $37,015.12. Calculate the following ratios with and without the bond issue. Review question: how much did the company pay in dividends this year (if any)? The company did not issue or repurchase any stock during the year. Without Bond Issue If Bonds are Issued 2 ROA= ROE= Debt Ratio= D/E= Dividends= 10

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 16E

Related questions

Question

Transcribed Image Text:Your company's summarized financial information for the beginning and projected end of the current year is as follows:

Beginning of the Year

$90,000

30,000

60,000

End of the Year (projected)

$100,000

30,000

70,000

15,000

Assets

Liabilities

Equity

Net Income

Your company is considering issuing 30 bonds at the end of the year (December 31st). The bonds will pay 8% interest semi-annually

for 10 years and the market rate for similar bonds is 5%. Therefore, the total bond proceeds are $37,015.12. Calculate the following

ratios with and without the bond issue.

Review question: how much did the company pay in dividends this year (if any)? The company did not issue or repurchase any stock

during the year.

Without Bond

Issue

If Bonds are

Issued

2

ROA=

ROE=

Debt Ratio=

D/E=

Dividends=

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 8 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning