Your manager is trying to determine what forecasting method to use. Based on the following historical data, calculate the following forecasts and specify what procedure you would utilize. Month Actual Demand 1 64 2 67 3 69 4 65 5 71 6 73 7 76 8 77 9 77 10 82 11 83 12 85 Calculate the simple three-month moving average forecast for periods 4–12.(Round your answers to 3 decimal places.) Month Actual Demand 4 66.667 5 67.000 6 68.333 7 69.666 8 73.333 9 75.333 10 76.666 11 78.666 12 80.666 Calculate the weighted three-month moving average for periods 4–12 using weights of 0.30 (for the period t−1); 0.20 (for the period t−2), and 0.50 (for the period t−3). (Do not round intermediate calculations. Round your answers to 1 decimal place.) Month Actual Demand 4 66.7 5 67.0 6 68.3 7 69.7 8 73.3 9 75.3 10 76.7 11 78.7 12 80.7

Your manager is trying to determine what forecasting method to use. Based on the following historical data, calculate the following forecasts and specify what procedure you would utilize. Month Actual Demand 1 64 2 67 3 69 4 65 5 71 6 73 7 76 8 77 9 77 10 82 11 83 12 85 Calculate the simple three-month moving average forecast for periods 4–12.(Round your answers to 3 decimal places.) Month Actual Demand 4 66.667 5 67.000 6 68.333 7 69.666 8 73.333 9 75.333 10 76.666 11 78.666 12 80.666 Calculate the weighted three-month moving average for periods 4–12 using weights of 0.30 (for the period t−1); 0.20 (for the period t−2), and 0.50 (for the period t−3). (Do not round intermediate calculations. Round your answers to 1 decimal place.) Month Actual Demand 4 66.7 5 67.0 6 68.3 7 69.7 8 73.3 9 75.3 10 76.7 11 78.7 12 80.7

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter13: Regression And Forecasting Models

Section: Chapter Questions

Problem 42P: The file P13_42.xlsx contains monthly data on consumer revolving credit (in millions of dollars)...

Related questions

Question

100%

Your manager is trying to determine what

|

Month |

Actual Demand |

|

1 |

64 |

|

2 |

67 |

|

3 |

69 |

|

4 |

65 |

|

5 |

71 |

|

6 |

73 |

|

7 |

76 |

|

8 |

77 |

|

9 |

77 |

|

10 |

82 |

|

11 |

83 |

|

12 |

85 |

- Calculate the simple three-month moving average forecast for periods 4–12.(Round your answers to 3 decimal places.)

|

Month |

Actual Demand |

|

4 |

66.667 |

|

5 |

67.000 |

|

6 |

68.333 |

|

7 |

69.666 |

|

8 |

73.333 |

|

9 |

75.333 |

|

10 |

76.666 |

|

11 |

78.666 |

|

12 |

80.666 |

- Calculate the weighted three-month moving average for periods 4–12 using weights of 0.30 (for the period t−1); 0.20 (for the period t−2), and 0.50 (for the period t−3). (Do not round intermediate calculations. Round your answers to 1 decimal place.)

|

Month |

Actual Demand |

|

4 |

66.7 |

|

5 |

67.0 |

|

6 |

68.3 |

|

7 |

69.7 |

|

8 |

73.3 |

|

9 |

75.3 |

|

10 |

76.7 |

|

11 |

78.7 |

|

12 |

80.7 |

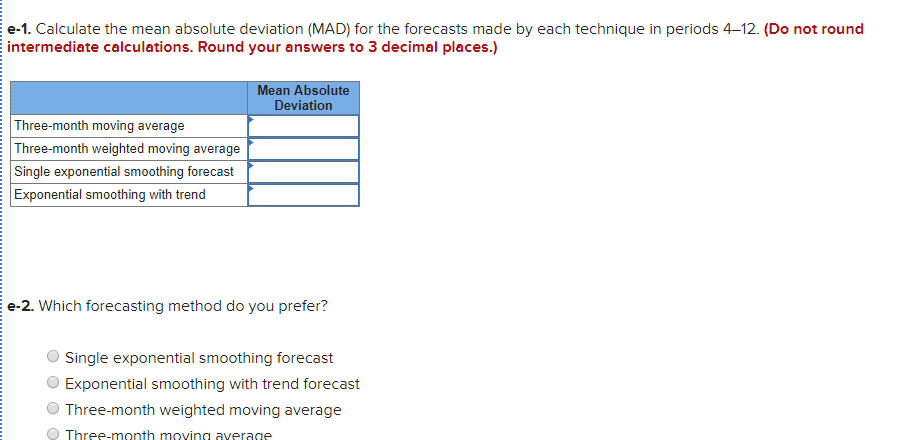

Transcribed Image Text:e-1. Calculate the mean absolute deviation (MAD) for the forecasts made by each technique in periods 4–12. (Do not round

intermediate calculations. Round your answers to 3 decimal places.)

Mean Absolute

Deviation

Three-month moving average

Three-month weighted moving average

Single exponential smoothing forecast

Exponential smoothing with trend

e-2. Which forecasting method do you prefer?

Single exponential smoothing forecast

Exponential smoothing with trend forecast

Three-month weighted moving average

Three-month mnving ayerage

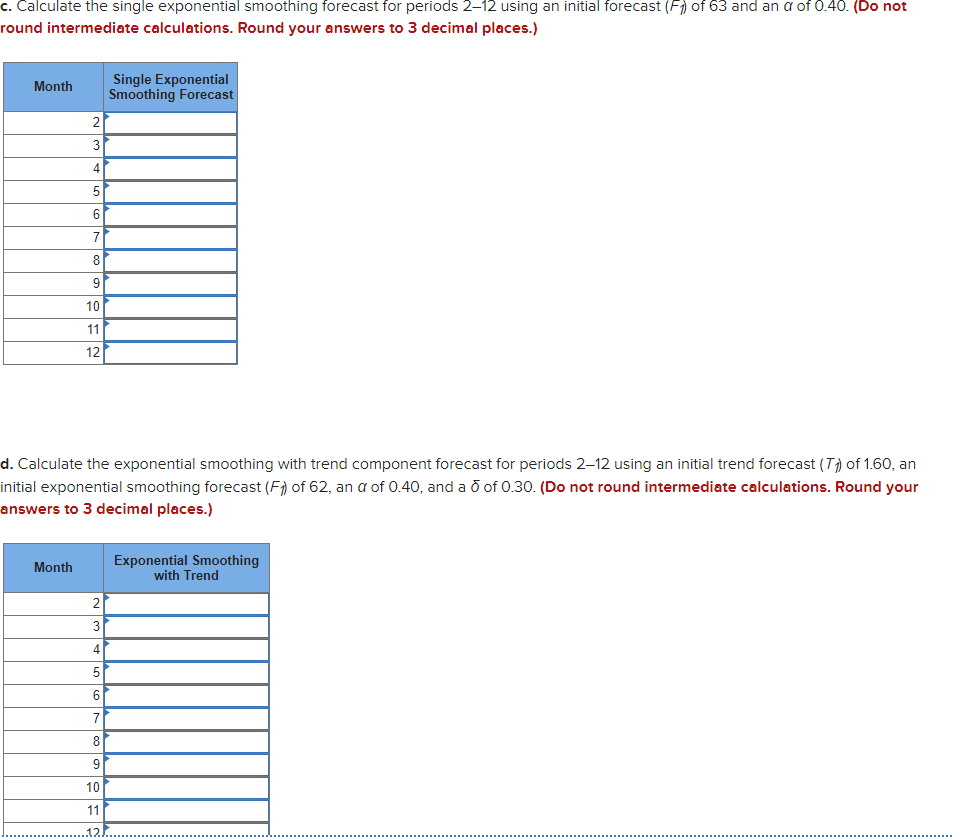

Transcribed Image Text:c. Calculate the single exponential smoothing forecast for periods 2–12 using an initial forecast (F) of 63 and an a of 0.40. (Do not

round intermediate calculations. Round your answers to 3 decimal places.)

Single Exponential

Smoothing Forecast

Month

2

3

4

5

7

8

10

11

12

d. Calculate the exponential smoothing with trend component forecast for periods 2–12 using an initial trend forecast (T) of 1.60, an

initial exponential smoothing forecast (F) of 62, an a of 0.40, and a o of 0.30. (Do not round intermediate calculations. Round your

answers to 3 decimal places.)

Exponential Smoothing

with Trend

Month

2

4

6.

7

8

9

10

11

12.

9,

LO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Contemporary Marketing

Marketing

ISBN:

9780357033777

Author:

Louis E. Boone, David L. Kurtz

Publisher:

Cengage Learning

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Contemporary Marketing

Marketing

ISBN:

9780357033777

Author:

Louis E. Boone, David L. Kurtz

Publisher:

Cengage Learning

Marketing

Marketing

ISBN:

9780357033791

Author:

Pride, William M

Publisher:

South Western Educational Publishing