Concept explainers

Transactions; financial statements

Bev’s Dry Cleaners is owned and operated by Beverly Zahn. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company at wholesale rates. The assets, liabilities, and common Mock of the business on November 1, 2018, are as follows: Ca.sh, $39,000. Accounts Receivable, $80,000; Supplies, $11,000; Land, $50,000; Accounts Payable, $31,500; Common Stock, $50,000. Business transactions during November are summarized as follows:

- A. A Beverly Zahn invested additional cash in exchange for common stock with a deposit of $21,000 in the business bank account.

- B. B Purchased land adjacent to land currently owned by Bev’s Dry Cleaners to use in the future as a parking lot, paying cash of $35,000.

- C. Paid rent for the month, $4,000.

- D. Charged customers for dry cleaning revenue on account $72,000.

- E. Paid creditors on account $20,000.

- F. Purchased supplies on account, $8,000.

- G. Received cash from customers for dry cleaning revenue, $38,000.

- H. Received cash from customers on account. $77,000.

- I. Received monthly invoice for dry cleaning expense for November (to be paid on December 10), $29,450.

- J. Paid the following: wages expense, $24,000; truck expense, $2,100; utilities expense, $ 1,800; miscellaneous expense, $1,300.

- K. Determined that the cost of supplies on hand was $11300; therefore, the cost of supplies used during the month was $7,200.

- L. Paid dividends, $5,000

Instructions

- 1. Determine the amount of

retained earnings as of November 1. - 2. Slate the assets, liabilities, and stockholders’ equity as of November 1 in equation form similar to that shown in this chapter. In tabular form below the equation, indicate increases and decreases resulting from each transaction and the new balances after each transaction.

- 3. Prepare an income statement for November, a retained earnings statement for November, and a balance sheet as of November 30.

- 4. (Optional) Prepare a statement of

cash flows for November.

a)

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

Assets = Liabilities + Shareholders Equity

To Determine: The retained earnings for BD Cleaners as on November 1, 2018.

Explanation of Solution

Calculate the retained earnings for BD Cleaners as on November 1, 2018.

The retained earnings, for BD Cleaners as on November 1, 2018 are $98,500.

b)

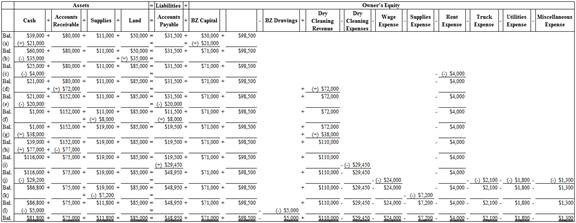

To Indicate: The effect of each given transaction of BD Cleaners on the accounting equation.

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the Shareholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Indicate the effect of the given transactions of BD Cleaners.

(Figure – 1)

c)

To Prepare: The financial statements for BD Cleaners for the month ended November 30, 2018.

Explanation of Solution

Financial statements: Financial statements refer to those statements, which are prepared by the Company according to particular formats in accounting to show its financial position.

Financial statements include the following statements:

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement of BD Cleaners for the month ended November 30, 2018.

| BD Cleaners | ||

| Income Statement | ||

| For the month ended November 30 , 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Dry cleaning revenue | $110,000 | |

| Expenses | ||

| Dry Cleaning expense | $29,450 | |

| Wages expense | $24,000 | |

| Supplies expense | $7,200 | |

| Rent expense | $4,000 | |

| Truck expense | $2,100 | |

| Utilities expense | $1,800 | |

| Miscellaneous expense | $1,300 | |

| Total expenses | $69,850 | |

| Net income | $40,150 | |

Table (1)

Hence, the net income of BD Cleaners for the month ended November 30, 2018 is $40,150.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of Retained earnings for BD Cleaners for the month ended November 30, 2018.

| BD Cleaners | ||

| Statement of Retained Earnings | ||

| For the month ended November 30 , 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, November 1, 2018 | $98,500 | |

| Net income for the month | $40,150 | |

| Deduct - Dividends | $5,000 | |

| Increase in Retained earnings | $35,150 | |

| Retained earnings, November 30, 2018 | $133,650 | |

Table (2)

Hence, the retained earnings of BD Cleaners for the month ended November 30, 2018 are $133,650.

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet of BD Cleaners for the month ended November 30, 2018.

| BD Cleaners | ||

| Balance Sheet | ||

| November 30 , 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $81,800 | |

| Accounts receivable | $75,000 | |

| Supplies | $11,800 | |

| Land | $85,000 | |

| Total current assets | $253,600 | |

| Liabilities and Stockholders’ Equity | ||

| Liabilities | ||

| Accounts payable | $48,950 | |

| Owner's equity | ||

| Common Stock | $71,000 | |

| Retained earnings | $133,650 | |

| Total stockholders’ equity | 204,650 | |

| Total liabilities and stockholders’ equity | $253,600 | |

Table (3)

The balance sheet of BD Cleaners shows asset balance of $253,600 which is same as the balance of liabilities and owner's equity.

d)

To Prepare: The statement of cash flow for BD Cleaners for the month ended November 30, 2018.

Answer to Problem 1.5BPR

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Prepare the statement of cash flows for BD Cleaners for the month ended November 30, 2018.

| DD Cleaners | ||

| Statement of Cash Flows | ||

| For the month ended November 30, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | $115,000 | |

| Cash payments for expenses (1) | $33,200 | |

| Payments to creditors | $20,000 | $53,200 |

| Net cash flow used for operating activities | $61,800 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | (-) $35,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $21,000 | |

| Deduct - Withdrawals | (-) $5,000 | |

| Net cash flow from financing activities | $16,000 | |

| Net Increase in cash during November | $42,800 | |

| Cash Balance on November 1, 2019 | $39,000 | |

| Cash Balance on November 30 , 2019 | $81,800 | |

Table (4)

The statement of cash flows for BD Cleaners for the month ended November 30, 2018, shows cash balance of $81,800 on November 30, 2018

Explanation of Solution

Working Note:

Calculate the expenses made through cash payments.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial & Managerial Accounting

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (4th Edition)

Principles of Accounting Volume 2

FINANCIAL ACCT.FUND.(LOOSELEAF)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Financial Accounting (11th Edition)

- Income Statement and Balance Sheet Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended January 31, 2016. Prepare a balance sheet at January 31, 2016. What information would you need about Notes Payable to fully assess Fort Worths longterm viability? Explain your answer.arrow_forwardIncome Statement and Balance Sheet Green Bay Corporation began business in July 2016 as a commercial fishing operation and a passenger service between islands. Shares of stock were issued to the owners in exchange for cash. Boats were purchased by making a down payment in cash and signing a note payable for the balance. Fish are sold to local restaurants on open account, and customers are given 15 days to pay their account. Cash fares are collected for all passenger traffic. Rent for the dock facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Green Bay Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended July 31, 2016. Prepare a balance sheet at July 31, 2016. What information would you need about Notes Payable to fully assess Green Bays long-term viability? Explain your answer.arrow_forwardThe transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.arrow_forward

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.arrow_forwardAnalyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forwardUsing the income statement for Adventure Travel Service shown in Practice Exercise 1-4A, prepare a statement of owners equity for the year ended April 30, 2019. Jerome Foley, the owner, invested an additional 60,000 in the business during the year and withdrew cash of 40,000 for personal use. Jerome Foley, capital as of May 1, 2018, was 1,020,000.arrow_forward

- EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.arrow_forwardJournalize for Harper and Co. each of the following transactions or state no entry required and explain why. Be sure to follow proper journal writing rules. A. A corporation is started with an investment of $50,000 in exchange for stock. B. Equipment worth $4,800 is ordered. C. Office supplies worth $750 are purchased on account. D. A part-time worker is hired. The employee will work 15–20 hours per week starting next Monday at a rate of $18 per hour. E. The equipment is received along with the invoice. Payment is due in three equal monthly installments, with the first payment due in sixty days.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College