Advanced Financial Accounting

12th Edition

ISBN: 9781259916977

Author: Christensen, Theodore E., COTTRELL, David M., Budd, Cassy

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.11E

Balances Reported Following Combination

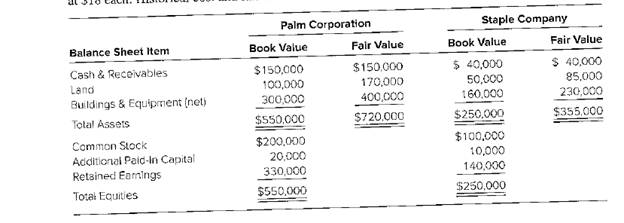

Palm Corporation and Staple Company have announced terms of an exchange agreement underwhich Palm will issue 8,000 shares of its $10 par value common stock to acquire all of Staple Company’s assets. Palm shares currently are trading at $50, and Staple $5 par value shares are tradingat $18 each. Historical Cost and fair value balance sheet data on January 1, 20X2, are as follows;

Required

What amount will be reported immediately following the business combination for each of the following items in the combined balance sheet?

a. Common Stock.

b. Cash and Receivables.

c. Land.

d. Buildings and Equipment (net).

e.

f. Additional Paid-In Capital.

g.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Palm Corporation and Staple Company have announced terms of an exchange agreement under which Palm will issue 8,500 shares of its $15 par value common stock to acquire all of Staple Company’s assets. Palm shares currently are trading at $59, and Staple $10 par value shares are trading at $23 each. Historical cost and fair value balance sheet data on January 1, 20X2, are as follows:

Palm Corporation

Staple Company

Balance Sheet Item

Book Value

Fair Value

Book Value

Fair Value

Assets

Cash & Receivables

$

151,000

$

151,000

$

46,000

$

46,000

Land

110,000

190,000

57,000

83,000

Buildings & Equipment (net)

313,000

411,000

176,000

230,000

Total Assets

$

574,000

$

752,000

$

279,000

$

359,000

Equities

Common Stock

$

200,000

$

81,000

Additional Paid-In Capital

18,000

9,900

Retained Earnings…

KING COMPANY issued 120,000 shares of P25 par ordinary shares for all the outstanding stock of FISHER CORPORATION in a business combination consummated on July 1, 2018. King’s ordinary shares were selling at P40 per share at the time of consummation of the combination. In addition, cash payment of P 200,000.00 was made and a deffered cash payment of P 1500,000.00 payable on July 1, 2019. Market rate of interest is 12%. FISHER’s Net assets are P3.8 million at book value. Out of pocket costs of the combination were as follows: legal and accounting fees related with the issuance of shares, P 12,000.00 and printing cost of stock certificates, P9400.00. A contingent consideration which is probable and can be reasonably estimated amounted to P 50,200.00.

1. What is the total cost of the investment?a. P 6,389,486b. P 8,983,864c. P 6,983,684d. P 8,389,648

P Company issues Php500,000 shares of its own Php10 par common stock for the net assets of S Company in a merger consummated on July 1, 2020. On this date, P stock is quoted at P20 per share. Summary of Balance sheet data for the two companies at July 1, 2020, just before combination, are as follows:

Calculate the retained earnings of P Company immediately after the combination:

Chapter 1 Solutions

Advanced Financial Accounting

Ch. 1 - What types of circumstances would encourage...Ch. 1 - How would the decision to dispose of a segment of...Ch. 1 - Prob. 1.3QCh. 1 - Prob. 1.4QCh. 1 - Prob. 1.5QCh. 1 - Prob. 1.6QCh. 1 - Prob. 1.7QCh. 1 - Prob. 1.8QCh. 1 - Prob. 1.9QCh. 1 - Prob. 1.10Q

Ch. 1 - Prob. 1.11QCh. 1 - Prob. 1.12QCh. 1 - Prob. 1.13QCh. 1 - Prob. 1.14QCh. 1 - Within the measurement period following a business...Ch. 1 - Prob. 1.16QCh. 1 - Prob. 1.1CCh. 1 - Prob. 1.2CCh. 1 - Prob. 1.3CCh. 1 - Prob. 1.4CCh. 1 - Risks Associated with Acquisitions Not all...Ch. 1 - Prob. 1.6CCh. 1 - Prob. 1.1.1ECh. 1 - Prob. 1.1.2ECh. 1 - Prob. 1.1.3ECh. 1 - Multiple-Choice Questions on Complex Organizations...Ch. 1 - Prob. 1.1.5ECh. 1 - Prob. 1.2.1ECh. 1 - Prob. 1.2.2ECh. 1 - Multiple-Choice Questions on Recording Business...Ch. 1 - Prob. 1.2.4ECh. 1 - Multiple-Choice Questions on Recording Business...Ch. 1 - Multiple-Choice Questions on Reported Balances...Ch. 1 - Multiple-Choice Questions on Reported Balances...Ch. 1 - Prob. 1.3.3ECh. 1 - Prob. 1.3.4ECh. 1 - Prob. 1.4.1ECh. 1 - Prob. 1.4.2ECh. 1 - Prob. 1.4.3ECh. 1 - Multiple-Choice Questions Involving Account...Ch. 1 - Prob. 1.4.5ECh. 1 - Prob. 1.5ECh. 1 - Prob. 1.6ECh. 1 - Prob. 1.7ECh. 1 - Prob. 1.8ECh. 1 - Prob. 1.9ECh. 1 - Prob. 1.10ECh. 1 - Balances Reported Following Combination Palm...Ch. 1 - Goodwill Recognition Spur Corporation reported the...Ch. 1 - Acquisition Using Debentures Planter Corporation...Ch. 1 - Bargain Purchase Using the data resented in E1-13,...Ch. 1 - Prob. 1.15ECh. 1 - Prob. 1.16ECh. 1 - Prob. 1.17ECh. 1 - Prob. 1.18ECh. 1 - Prob. 1.19ECh. 1 - Prob. 1.20ECh. 1 - Prob. 1.21ECh. 1 - Prob. 1.22ECh. 1 - Prob. 1.23ECh. 1 - Prob. 1.24PCh. 1 - Prob. 1.25PCh. 1 - Prob. 1.26PCh. 1 - Acquisition in Multiple Steps Peal Corporation...Ch. 1 - Prob. 1.28PCh. 1 - Prob. 1.29PCh. 1 - Prob. 1.30PCh. 1 - Prob. 1.31PCh. 1 - Computation of Account Balances Saspro Division is...Ch. 1 - Prob. 1.33PCh. 1 - Prob. 1.34PCh. 1 - Prob. 1.35PCh. 1 - Business Combination Following are the balance...Ch. 1 - Prob. 1.37PCh. 1 - Prob. 1.38PCh. 1 - Prob. 1.39PCh. 1 - Prob. 1.40P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License