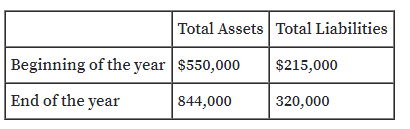

Total Assets Total Liabilities Beginning of the year $550,000 $215,000 End of the year 844,000 320,000

Net income and owner's equity for four businesses

Four different proprietorships, Jupiter, Mars, Saturn, and Venus, show

the same balance sheet data at the beginning and end of a year. These

data, exclusive of the amount of owner's equity, are summarized as

follows:

On the basis of the preceding data and the following additional

information for the year, determine the net income (or loss) of each

company for the year. (Hint: First, determine the amount of increase or

decrease in owner's equity during the year.)

Jupiter: The owner had made no additional investments in the business

and had made no withdrawals from the business.

Mars: The owner had made no additional instments in the business

but had withdrawn $36,000.

Saturn: The owner had made an additional investment of $60,000 but

had made no withdrawals.

Venus: The owner had made an additional investment of $60,000 and

had withdrawn $36,000.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images