Concept explainers

Missing amounts from financial statements Obj.4

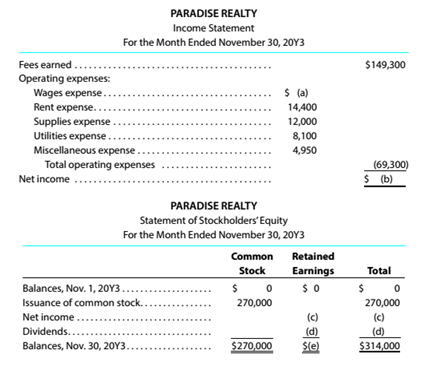

The financial statements at the end of Paradise Reaky’s first month of operations are shown

2. By analyzing the interrelationships among the financial statements, determine the proper amounts for (a) through (o).

Introduction:

Financial Statements:

It is a set of records of all financial activities of a business entity prepared by the management that shows the ability of the business entity in utilizing the funds entrusted by the stockholders and lenders.

To calculate:

The wages expense and net income in income statement of company X, dividend and retained earnings closing balance in statement of stockholder's equity, balances of land, stock holder's equity and total liabilities and stockholder's equity as shown in balance sheet of company X. Also, to calculate cash received from customers, net cash flow from operating activities, net cash flow from financing activities, net increase in cash during month ended November 30, 20Y3 and cash as on November 30, 20Y3 as shown in statement of cash flows.

Answer to Problem 1.2.2P

Income Statement of company X

- Wages expense - $29850

- Net Income - $80000

- Net Income- $80000

- Dividends- $36000

- Retained Earnings total = $44000

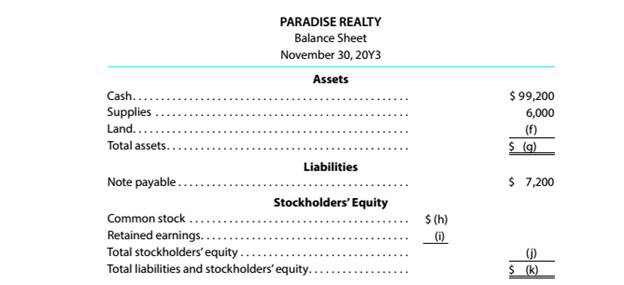

- Land- $216000

- Total assets- $321200

- Common stock- $270000

- Retained earnings- $44000

- Total stockholder's equity- $314000

- Total liabilities and stockholder's equity- $321200

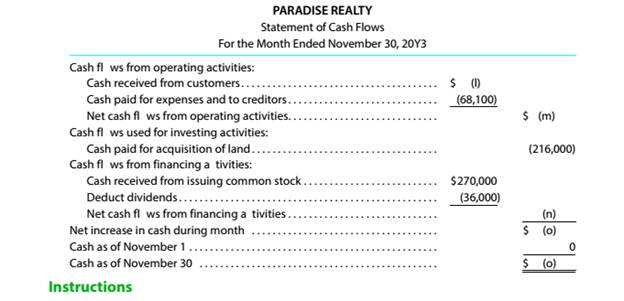

- Cash received from customers- $149300

- Net cash flow from operating activities- $81200

- Net cash flow from financing activities- $234000

- Net increase in cash during the month - $99200

Statement of stockholders' equity

Balance Sheet

Statement of cash flows

cash as on November 30, 20Y3

Explanation of Solution

Calculation of missing amounts in financial statements of company X:

Income Statement of company X

Statement of stockholder's equity of company X

Balance Sheet:

Statement of Cash flows

Want to see more full solutions like this?

Chapter 1 Solutions

Survey of Accounting (Accounting I)

Additional Business Textbook Solutions

Fundamentals Of Financial Accounting

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Advanced Financial Accounting

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Introduction To Managerial Accounting

- Missing amounts from financial statements The financial statements at the end of Wolverine Realtys first month of operations are as follows: Chapter 1 Introduction to Accounting and Business 47 Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (r).arrow_forwardAdjusting entries and errors At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: Net income for April 120,000 Total assets at April 30 750,000 Total liabilities at April 30 300,000 Total stockholders equity at April30 450,000 In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and Stockholders equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forwardMissing amounts from financial statements The financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (r).arrow_forward

- Adjusting entries and errors At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker jacobs, an attorney: Net income for August 112,500 Total assets at August 31 650,000 Total liabilities at August 31 225,000 Total stockholders equity at August 31 425,000 In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and stockholders equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forwardThe financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (p).arrow_forwardMissing amounts from financial statements The financial statements at the end of Wolverine Realtys first month of operations are as follows Wolverine Realty Income Statement For the Month Ended April 30, 2018 Fees earned A Expenses: Wages expense 300,000 Rent expense 100 Supplies expense B Utilities expense 20,000 Miscellaneous expense .. 25,000 Total expenses 475,000 Net income 275,000 Wolverine Realty Retained Earnings Statement For the Month Ended April 30,2018 Retained earnings, April 1,2018 c Net income D Dividends (125,000) Change in retained earnings E Retained earnings, April 30, 2018 F Wolverine Realty Balance Sheet April 30, 2018 Assets Cash 462,500 Supplies 12,500 Land 150,000 Total assets G Liabilities Accounts payable 100,000 Stockholders' Equity Common stock 375,000 Retained earnings H Total stockholders' equity I Total liabilities and stockholders' equity, J Wolverine Realty Statement of Cash Flows For the Month Ended April 30/ 2018 Cash flows from operating activities: Cash received from customers K Cash payments for expenses and payments to creditors (387,500) Net cash flows from operating activities L Cash flows used for investing activities: Cash payments for acquisition of land M Cash flows from financing activities: Cash received from issuing common stock N Cash dividends 0 Net cash flows from financing activities P Net increase (decrease) in cash and April 30,2018, cash balance Q Instructions By analyzing the interrelationships among the four financial statements, determine the proper amounts for A through Q.arrow_forward

- Income statement After its first month of operations, the following amounts were taken from the accounting records of Big Mountain Realty Inc. as of June 30. 20Y9. Prepare an income statement for the month ending June 30, 20Y9.arrow_forwardMultiple-step income statement and report form of balance sheet The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2016: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a report form of balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain (a) how multiple-step and single-step income statements differ and (b) how report-form and account-form balance sheets differ.arrow_forwardFinancial statements Padget Home Services began its operations on January 1, 20Y7 (see Problem 2-3). After its second year of operations. the following amounts were taken from the accounting records of Padget Home Services, Inc., as of December 31, 20Y8. Instructions Prepare an income statement for the year ending December 31, 20Y8.arrow_forward

- Adjusting entries and errors At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: Net income for April 120,000 Total assets at April 30 750,000 Total liabilities at April 30 300,000 Total stockholders equity at April30 450,000 In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and Stockholders equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forwardTrial Balance The following account titles, arranged in alphabetical order, are from the records of Hadley Realty Corporation. The balance in each account is the normal balance for that account. The balances are as of December 31, after adjusting entries have been made. Prepare an adjusted trial balance, listing the accounts in the following order: (1) assets; (2) liabilities; (3) stockholders equity accounts, including dividends; (4) revenues; and (5) expenses.arrow_forwardCornerstone Exercise 3-18 Accrued Expense Adjusting Entries Manning Manufacturing Inc. had the following items that require adjustment at year end. Salaries of $5,320 that were earned in December are unrecorded and unpaid. Used $1,970 Of utilities in December, which are unrecorded and unpaid. Interest of $925 on a note payable has not been or paid. Required: Prepare the adjusting entries needed at December 31. What is the effect on the financial statements if these adjusting entries are not made?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning