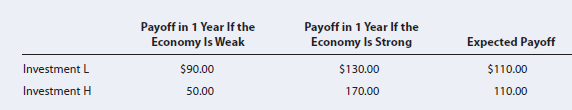

Payoff in 1 Year If the Economy Is Weak Payoff in 1 Year If the Economy Is Strong Expected Payoff Investment L $90.00 50.00 $130.00 $110.00 110.00 Investment H 170.00

Bedrock Company has $70 million in debt and $30 million in equity. The debt matures in1 year and has a 10% interest rate, so the company is promising to pay back $77 million to

its debtholders 1 year from now.The company is considering two possible investments, each of which will require an up-front cost of $100 million. Each investment will last for 1 year, and the payoff from each investment depends on the strength of the overall economy. There is a 50% chance that the

economy will be weak and a 50% chance it will be strong.

Here are the expected payoffs (all dollars are in millions) from the two investments:

Note that the two projects have the same expected payoff, but Project H has higher risk. The

debtholders always get paid first and the stockholders receive any money that is available

after the debtholders have been paid.

Assume that if the company doesn’t have enough funds to pay off its debtholders 1 year

from now, then Bedrock will declare bankruptcy. If bankruptcy is declared, the debtholders

will receive all available funds, and the stockholders will receive nothing.

a. Assume that the company selects Investment L. What is the expected payoff to the

firm’s debtholders? What is the expected payoff to the firm’s stockholders?

b. Assume that the company selects Investment H. What is the expected payoff to the

firm’s debtholders? What is the expected payoff to the firm’s stockholders?

c. Would the debtholders prefer that the company’s managers select Project L or Project

H? Briefly explain your reason.

d. Explain why the company’s managers, acting on behalf of the stockholders, might

select Project H, even though it has greater risk.

e. What actions can debtholders take to protect their interests?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images