Return on assets

Pfizer Inc. (PFE) discovers, produces, and distributes medicines, including Celebrex and Lipitor. Ford (F) Motor Co. develops, markets, and produces automobiles and trucks. Microsoft Corporation (MSFT) develops, produces. and distributes a variety of computer software and hardware products including Windows, Office, Excel, and the Xbox.

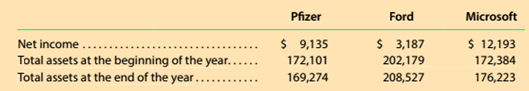

The following data (in millions) were taken from recent financial statements 01 each company: Pfizer Ford Microsoft

Compute the return on assets for each company using the preceding data, and rank the companies’ return on assets from highest to lowest. Round the return on assets to one decimal place.

Trending nowThis is a popular solution!

Chapter 1 Solutions

Survey of Accounting (Accounting I)

Additional Business Textbook Solutions

Managerial Accounting: Tools for Business Decision Making

PRINCIPLES OF TAXATION F/BUS.+INVEST.

FINANCIAL ACCT.FUND.(LOOSELEAF)

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Financial Accounting (11th Edition)

Auditing And Assurance Services

- Analyze and compare Alphabet (Google) and Microsoft Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabets primary source of revenue is from advertising, while Microsofts is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies: a. Compute the working capital for each company for both years. b. Which company has the larger working capital at the end of Year 2? c. Is working capital a good measure of relative liquidity in comparing the two companies? Explain. d. Compute the current ratio for both companies. Round to one decimal place. e. Which company has the larger relative liquidity based on the current ratio? f. Based on your analysis, comment on the short-term debt-paying ability of these two companies.arrow_forwardTrimax Solutions develops software to support e-commerce. Trimax incurs substantial computer software development costs as well as substantial research and development (R&D) costs related to other aspects of its product line. Under GAAP, if certain conditions are met, Trimax capitalizes software development costs but expenses the other R&D costs. The following information is taken from Trimax’s annual reports ($ in thousands): R&Dcosts....................... Netincome....................... Totalassets(atyear-end) ........... Equity(atyear-end)................ Capitalized software costs Unamortized balance (at year-end) . . Amortization expense . . . . . . . . . . . . Required: 1999 $ 400 312 3,368 2,212 20 4 2000 $ 491 367 3,455 2,460 31 7 2001 $ 216 388 3,901 2,612 2002 $ 212 206 4,012 2,809 2003 $ 355 55 4,045 2,889 31 13 2004 $ 419 81 4,077 2,915 42 15 2005 $ 401 167 4,335 3,146 43 15 2006 $ 455 179 4,650 3,312 36 14 27 22 9 12 CHECK (a) Year2006,$7 CHECK (e)…arrow_forwardCoca-Cola and PepsiCo both produce and market beverages that are direct competitors. Key financialfigures for these businesses for a recent year follow.Key Figures ($ millions) Coca-Cola PepsiCoSales . $46,542 $66,504Net income . 8,634 6,462Average assets . . . . . . . . . . . . . . . . . . . . 76,448 70,518Required Compute return on assets for (a) Coca-Cola and (b) PepsiCo.arrow_forward

- AT&T and Verizon produce and market telecommunications products and are competitors. Key financial figures for these businesses for a recent year follow. Key Figures ($ millions) AT&T Verizon Sales . $126,723 $110,875 Net income . 4,184 10,198 Average assets . . . . . . . . . . . . . . . . . . . . 269,868 225,233 Required 1. Compute return on assets for (a) AT&T and (b) Verizon. 2. Which company is more successful in the total amount of sales to consumers? 3. Which company is more successful in returning net income from its assets invested?arrow_forwardReturn on assets Pfizer Inc. (PFE) discovers, produces, and distributes medicines, including Celebrex and Lipitor. Ford (F) Motor Co. develops, markets, and produces automobiles and trucks. Microsoft Corporation (MSFT) develops, produces. and distributes a variety of computer software and hardware products including Windows, Office, Excel, and the Xbox. Without computing thy return on assets, rank from highest to lowest Pfizer, Ford, and Microsoft in terms of their return on assets.arrow_forwardContinuing Company Analysis-Amazon: Asset turnover ratio Amazon.com, Inc. is one of the largest Internet retailers in the world. Netflix, Inc. provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services, however Amazon also sells many other products through the Internet. The sales and total assets (in millions) from recent financial statements were reported as follows for both companies: Amazon Netflix Total revenues (sales) 88,988 5,505 Total assets: Beginning of year 40,159 5,413 End of year 54,505 7,057 A. Based on your knowledge of each company, identify three major assets used by each company in generating revenue. B. Compute the asset turnover ratio for each company. (Round to two decimal places). C. Which company generates sales from total assets more efficiently?arrow_forward

- Deere: Profitability analysis Deere Company manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere's credit division loans money to customers to finance the purchase of their farm and construction equipment. The following information is available for three recent years (in millions except per-share amounts): 1. Calculate the following ratios for each year (round ratios and percentages to one decimal place, except for per-share amounts): A. Return on total assets B. Return on stockholders equity C. Earnings per share D. Dividend yield E. Price-earnings ratio 2. Based on these data, evaluate Deere s profitability.arrow_forwardReturn on assets ExxonMobil Corporation (XOM) explores, produces, and distributes oil and natural gas. The Coca-Cola Company (KO) produces and distributes soft drink beverages, including Coke. Wal-Mart Stores, Inc.., (WMT) operates retail stores and supermarkets. The following data (in millions) were taken from recent financial statements of each company: Compute the return on assets for each company using the preceding data, and rank the companies’ return on assets from highest to lowest. Round the return on assets to one decimal place.arrow_forwardComparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the end of this book and answer the following questions: Required What is the dollar amount of inventories that each company reports on its balance sheet at the end of the most recent year? What percentage of total assets do inventories represent for each company? What does this tell you about the nature of their business? Refer to Note 1 in Chipotles annual report. What inventory valuation method does the company use? Refer to Note 2 in Panera Breads annual report. What inventory valuation method does the company use? How do both companies deal with situations in which the market value of inventory is less than its cost? Given the nature of their businesses, which inventory system, periodic or perpetual, would you expect both Chipotle and Panera Bread to use? Explain your answer.arrow_forward

- CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below:Sales .................................................................................. $3,000,000Net operating income ......................................................... $150,000Average operating assets .................................................. $750,000Required:Consider each question below independently. Carry out all computations to two decimal places.1. Compute the company’s return on investment (ROI).2. The entrepreneur who founded the company is convinced that sales will increase next year by 50%and that net operating income will increase by 200%, with no increase in average operating assets.What would be the company’s ROI?3. The chief financial officer of the company believes a more realistic scenario would be a $1,000,000increase in sales, requiring a $250,000 increase in average operating assets, with a resulting…arrow_forwardCoca-Cola and PepsiCo both produce and market beverages that are direct competitors. Key financialfigures for these businesses for a recent year follow.Key Figures ($ millions) Coca-Cola PepsiCoSales . $46,542 $66,504Net income . 8,634 6,462Average assets . . . . . . . . . . . . . . . . . . . . 76,448 70,518Required Which company is more successful in returning net income from its assets invested?arrow_forwardCalculate the profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). How has the company’s profitability changed during the last year? A computer manufacturer has financial statements as follows: Income Statements for Year Ending December 31 (Thousands of Dollars) 2019 2018 Sales $945,000 $900,000 Expenses excluding depreciation and amortization 812,700 774,000 EBITDA $132,300 $126,000 Depreciation and amortization 33,100 31,500 EBIT $99,200 $94,500 Interest Expense 10,470 8,600 EBT $88,730 $85,900 Taxes (25%) 22,183 21,475 Net income $66,547 $64,425 Common dividends $56,609 $54,115 Addition to retained earnings $9,938 $10,310 Balance Sheets for Year Ending December 31 (Thousands of Dollars) Assets 2019 2018 Cash and…arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning