Traditional and Contribution Format Income Statements.

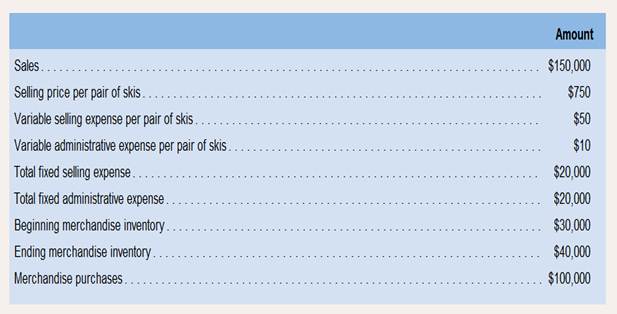

The Alpine House, Inc., is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31:

Required:

1. Prepare a traditional income statement for the quarter ended March 31.

2. Prepare a contribution format income statement for the quarter ended March 31.

3. What was the contribution margin per unit?

1)

Traditional Income Statement

- Traditional Income Statement records the costs of goods manufactured for a particular reporting period by classifying the costs into direct and indirect costs

- Direct costs are variable in nature. Examples: Direct Materials, Direct Labor etc.

- Indirect costs are costs incurred for selling and administrative purposes such as Salary of staff, warehouse rent etc.

- The profit or loss of operations is carried forward to the next period

To Prepare:

Traditional Income Statement for the quarter ended 31 March

Answer to Problem 15E

Solution:

| Particulars | Amount | Particulars | Amount |

| Beginning Merchandise Inventory | $30,000 | Sales | $150,000 |

| Merchandise Purchases | $100,000 | Ending Merchandise Inventory | $40,000 |

| Variable Selling Expense | $10,000 | ||

| Fixed Selling Expense | $20,000 | ||

| Variable Administrative Expense | $2,000 | ||

| Fixed Administrative Expense | $20,000 | ||

| Profit | $8,000 | ||

| $190,000 | $190,000 |

Explanation of Solution

- Given: Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10

Formula Used:

- Calculations:

Variable Selling Expense = 200 @$50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

- Variable costs are costs that are impacted by the volume of goods produced and have a direct correlation with the number of goods produced.

- Fixed costs are costs that have to be incurred irrespective of the volume of goods produced.

- The costs and revenues are recorded in the income statement for the quarter ended 31 March

- The costs consist of the Variable as well as Fixed costs and the cost of purchases

- The difference in the Beginning and Ending Inventory is also considered for calculation of Profit or Loss

Hence the traditional income statement for the quarter ended 31 March is prepared.

2)

Contribution and Fixed and Variable Costs in Manufacturing

- Variable costs refer to the costs of manufacture that have a direct co-relation with the volume of the goods manufactured, i.e. the costs increase with an increase in the goods produced.

- Examples are costs of direct material and direct labor.

- Fixed costs refer to the costs of manufacture that have an inverse co-relation with the volume of the goods manufactured, i.e. the costs decrease with an increase in the goods produced.

- Examples are costs of factory rent, depreciation on plant and equipment

- Manufacturing costs are costs that are directly incurred in connection with manufacture of goods.

- Examples are Direct materials and Manufacturing Overhead

- Contribution is the difference between the Sales revenue and the Variable cost per unit. This is an indicator of the contribution of the goods manufactured to the profit and bottom line of the organization.

To Prepare:

Contribution Income statement for the quarter ended 31 March

Answer to Problem 15E

Solution:

| Particulars | Per unit | Total |

| Sales | 750 | 150000 |

| Direct Materials | 500 | $100,000 |

| Variable Selling Expense | 50 | $10,000 |

| Variable Administrative Expense | 10 | $2,000 |

| Contribution | 190 | $38,000 |

| Fixed Selling Expense | $20,000 | |

| Fixed Administrative Expense | $20,000 | |

| Profit / (Loss) | ($2,000) |

Explanation of Solution

- Given:

Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10 Purchases = $100,000

- Formula Used:

Calculations:

- Variable Selling Expense = 200 @$50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

Direct Materials = $100,000 / 200 = $500 per unit

Contribution = $150,000 - $100,000 - $10,000 - $2,000 = $38,000

- Variable costs are costs that are impacted by the volume of goods produced and have a direct correlation with the number of goods produced.

- Fixed costs are costs that have to be incurred irrespective of the volume of goods produced.

- The costs considered for calculation of contribution are variable costs.

- Contribution is the difference between the Sales and Variable Costs including cost of Materials

Hence the contribution format income statement has been prepared for the quarter ended 31 March.

3)

Contribution and Fixed and Variable Costs in Manufacturing

- Variable costs refer to the costs of manufacture that have a direct co-relation with the volume of the goods manufactured, i.e. the costs increase with an increase in the goods produced.

- Examples are costs of direct material and direct labor.

- Fixed costs refer to the costs of manufacture that have an inverse co-relation with the volume of the goods manufactured, i.e. the costs decrease with an increase in the goods produced.

- Examples are costs of factory rent, depreciation on plant and equipment

- Manufacturing costs are costs that are directly incurred in connection with manufacture of goods.

- Examples are Direct materials and Manufacturing Overhead

- Contribution is the difference between the Sales revenue and the Variable cost per unit. This is an indicator of the contribution of the goods manufactured to the profit and bottom line of the organization.

Contribution Margin Per unit

Answer to Problem 15E

Solution:

The contribution Margin per unit is $190

Explanation of Solution

Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10 Purchases = $100,000

Formula Used:

Calculations:

- Variable Selling Expense = 200 @ $50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

Direct Materials = $100,000 / 200 = $500 per unit

Contribution = $150,000 - $100,000 - $10,000 - $2,000 = $38,000

| Particulars | Per unit | Total |

| Sales | 750 | 150000 |

| Direct Materials | 500 | $100,000 |

| Variable Selling Expense | 50 | $10,000 |

| Variable Administrative Expense | 10 | $2,000 |

| Contribution | 190 | $38,000 |

- The costs considered for calculation of contribution are variable costs.

- Contribution is the difference between the Sales and Variable Costs including cost of Materials

- Contribution per unit is the total Contribution divided by the Units Produced.

Hence the Contribution margin per unit is calculated.

Want to see more full solutions like this?

Chapter 1 Solutions

Introduction To Managerial Accounting

- West Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardSalespersons report and analysis Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forward

- During the first month of operations ended May 31, Big Sky Creations Company produced 40,000 designer cowboy boots, of which 36,000 were sold. Operating data for the month are summarized as follows: During June, Big Sky Creations produced 32,000 designer cowboy boots and sold 36,000 cowboy boots. Operating data for June are summarized as follows: Instructions 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare income statements for (a) May and (b) June. 3. a. Explain the reason for the differences in operating income in (1) and (2) for May. b. Explain the reason for the differences in operating income in (1) and (2) for June. 4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profitably in May or in June? Explain.arrow_forwardUsing the data above, complete the following statements and schedules for the first quarter: 4. Prepare an absorption costing income statement for the quarter ending March 31. 5. Prepare a balance sheet as of March 31. Answer choices for Income Statment [rows 1, 9-15, 17]: (Accounts payable, Accounts receivable, Advertising, Buildings and equipment net, Cash, Common stock, Cost of goods sold, Depreciation, Interest expense, Note payable, Other expenses, Prepaid insurance, Rent, Retained earnings, Salaries and wages, Sales, Shipping) [Rows 3-6]: (Beginning inventory, Ending inventory, Goods available for sale, Purchases) Row 7: (Gross Loss, Gross margin) Row 16: (Net operating income, Net operating loss) Row 18: (Net income, Net loss) Answer Choices for Balance sheet (all rows) (Accounts payable, Accounts receivable, Buildings and equipment net, Cash, Common stock, Cost of goods sold, Interest expense, Inventory, Note payable, Prepaid insurance, Retained earnings)arrow_forwardGallatin County Motors Inc. assembles and sells snowmobile engines.The company began operations on July 1 and operated at 100% ofcapacity during the first month. The attached data summarize theresults for July: a. Prepare an income statement according to the absorptioncosting concept.b. Prepare an income statement according to the variable costingconcept.c. What is the reason for the difference in the amount of operatingincome reported in (a) and (b)?arrow_forward

- Income Statements Segmented by TerritoryScript, Inc., has two product lines. The September income statements of each product line and the company are as follows: SCRIPT, INC.Product Line and Company Income StatementsFor Month of September Pens Pencils Total Sales $25,000 $30,000 $55,000 Less variable expenses (10,000) (12,000) (22,000) Contribution margin 15,000 18,000 33,000 Less direct fixed expenses (8,000) (6,000) (14,000) Product margin $7,000 $12,000 $19,000 Less common fixed expenses (6,000) Net income $13,000 Pens and pencils are sold in two territories, Florida and Alabama, as follows: Florida Alabama Pen sales $11,000 $14,000 Pencil sales 13,000 17,000 Total sales $24,000 $31,000 The preceding common fixed expenses are traceable to each territory as follows: Florida fixed expenses $2,000 Alabama fixed expenses 3,000 Home office administration fixed expenses 1,000 Total common fixed expenses $6,000 The…arrow_forwardIncome Statements Segmented by TerritoryScript, Inc., has two product lines. The September income statements of each product line and the company are as follows: SCRIPT, INC.Product Line and Company Income StatementsFor Month of September Pens Pencils Total Sales $25,000 $30,000 $55,000 Less variable expenses (10,000) (12,000) (22,000) Contribution margin 15,000 18,000 33,000 Less direct fixed expenses (9,000) (8,000) (17,000) Product margin $6,000 $10,000 $16,000 Less common fixed expenses (6,000) Net income $10,000 Pens and pencils are sold in two territories, Florida and Alabama, as follows: Florida Alabama Pen sales $14,000 $11,000 Pencil sales 4,000 26,000 Total sales $18,000 $37,000 The preceding common fixed expenses are traceable to each territory as follows: Florida fixed expenses $2,000 Alabama fixed expenses 3,000 Home office administration fixed expenses 1,000 Total common fixed expenses $6,000 The…arrow_forwardAbsorption and variable costing income statements During the first month of operations ended July 31, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows: Instructions 1. Prepare an income statement based on the absorption costing concept. 2. Prepare an income statement based on the variable costing concept. 3. Explain the reason for the difference in the amount of operating income reported in (1) and (2).arrow_forward

- Income Statements under Absorption and Variable Costing In the coming year, Kalling Company expects to sell 28,700 units at 32 each. Kallings controller provided the following information for the coming year: Required: 1. Calculate the cost of one unit of product under absorption costing. 2. Calculate the cost of one unit of product under variable costing. 3. Calculate operating income under absorption costing for next year. 4. Calculate operating income under variable costing for next year.arrow_forwardSalespersons report and analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.) 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardCost of Goods Manufactured, Income Statement W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for 400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished goods inventory. Phillips accounting records provide the following information: Required: 1. Prepare a statement of cost of goods manufactured. 2. Compute the average cost of producing one unit of product in the year. 3. Prepare an income statement for external users.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning