Financial Accounting (12th Edition) (What's New in Accounting)

12th Edition

ISBN: 9780134725987

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.67AP

LO 4

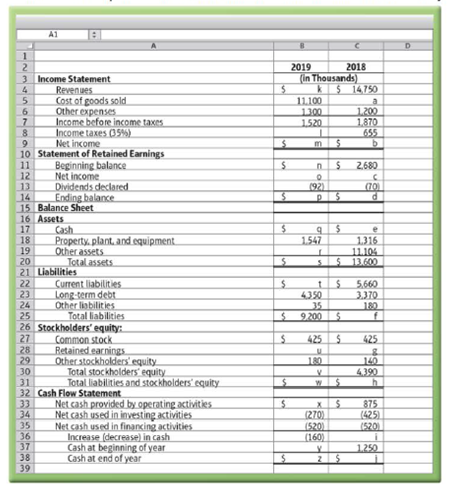

(Learning Objective 4: Construct financial statements) Summarized versions of Calabasa Corporation’s financial statements for two recent years are as follows.

Requirement

- 1. Complete Calabasa Corporation’s financial statements by determining the missing amounts denoted by the letters. If necessary, round numbers up to the nearest whole dollar.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

E3-39B. (Learning Objective 6: Analyze and evaluate liquidity and debt-paying ability) BurnesConsulting Company reported these ratios at December 31, 2018 (dollar amounts in millions):Current ratio = $20 = 2.00 $10 $60 Debt ratio = = 0.50 $30Burnes Consulting completed these transactions during 2019:a. Purchased equipment on account, $4b. Paid long-term debt, $7c. Collected cash from customers in advance, $5d. Accrued interest expense, $6e. Made cash sales, $8Determine whether each transaction improved or hurt the company’s current ratio and debt ratio.

E1-24A. (Learning Objective 4: Construct a balance sheet) At December 31, 2018, LandyProducts has cash of $24,000, receivables of $18,000, and inventory of $80,000. The company’sequipment totals $182,000. Landy owes accounts payable of $22,000 and long-term notespayable of $172,000. Common stock is $34,500. Prepare Landy’s balance sheet at December 31,2018, complete with its proper heading. Use the accounting equation to compute retainedearnings.

(Learning Objective 4: Calculate the effects of business transactions on selectedratios) Financial statement data of Greatland Engineering include the following items:Cash ........................................Short-term investments..............Accounts receivable, net............Inventories ................................Prepaid expenses.......................Total assets ...............................Short-term notes payable...........$ 26,00036,00085,000147,0006,000677,00049,000Accounts payable ......................Accrued liabilities......................Long-term notes payable ...........Other long-term liabilities.........Net income................................Number of commonshares outstanding ...........$107,00032,000163,00034,00099,00046,000Requirements1. Calculate Greatland’s current ratio, debt ratio, and earnings per share. Round all ratios totwo decimal places.2. Calculate the three ratios after evaluating the effect of each transaction that follows.Consider each…

Chapter 1 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Ch. 1 - Financial statements can be used by which of the...Ch. 1 - Prob. 2QCCh. 1 - Hoot Enterprises buys a warehouse for 590,000 to...Ch. 1 - Prob. 4QCCh. 1 - Prob. 5QCCh. 1 - The accounting equation can be expressed as a....Ch. 1 - Prob. 7QCCh. 1 - Alliance Corporation holds cash of 8,000 and owes...Ch. 1 - During the year, ChemClean Corporation has 280,000...Ch. 1 - Prob. 10QC

Ch. 1 - Dynasty Company has current assets of 50,000 and...Ch. 1 - Which financial statement would show how well a...Ch. 1 - On which financial statement would the ending...Ch. 1 - What item flows from the income statement to the...Ch. 1 - What item flows from the income statement to the...Ch. 1 - Prob. 16QCCh. 1 - LO 5 (Learning Objective 5: Identify ethical...Ch. 1 - Prob. 1.1SCh. 1 - Prob. 1.2SCh. 1 - Prob. 1.3SCh. 1 - LO 3 (Learning Objective 3: Apply the accounting...Ch. 1 - LO 3 (Learning Objective 3: Apply the accounting...Ch. 1 - LO 3 (Learning Objective 3: Identify assets,...Ch. 1 - LO 3 (Learning Objective 3: Accounting equation)...Ch. 1 - LO 4 (Learning Objective 4: Identify income...Ch. 1 - LO 4 (Learning Objective 4: Identify appropriate...Ch. 1 - LO 4 (Learning Objective 4: Explain aspects of...Ch. 1 - Prob. 1.11SCh. 1 - LO 4 (Learning Objective 4: Construct an income...Ch. 1 - (Learning Objective 4: Construct a statement of...Ch. 1 - (Learning Objective 4: Construct a balance sheet)...Ch. 1 - LO 4 (Learning Objective 4: Solve for retained...Ch. 1 - Prob. 1.16SCh. 1 - Prob. 1.17SCh. 1 - Prob. 1.18SCh. 1 - LO 1.2, 3, 4. 5 (Learning Objectives 1, 2, 3, 4,...Ch. 1 - Group A LO 3, 4 (Learning Objectives 3, 4: Apply...Ch. 1 - Which company appears to have the strongest...Ch. 1 - LO 3, 4 (Learning Objectives 3, 4: Apply the...Ch. 1 - LO 4 (Learning Objective 4: Identify financial...Ch. 1 - LO 4 (Learning Objective 4: Construct a balance...Ch. 1 - LO 3,4 (Learning Objectives 3, 4: Apply the...Ch. 1 - LO 4 (Learning Objective 4: Construct an income...Ch. 1 - LO 4 (Learning Objective 4: Construct an income...Ch. 1 - LO 4 (Learning Objective 4: Construct a balance...Ch. 1 - Prob. 1.29AECh. 1 - Prob. 1.30AECh. 1 - Prob. 1.31AECh. 1 - Prob. 1.32BECh. 1 - Which company appears to have the strongest...Ch. 1 - LO 3,4 (Learning Objectives 3, 4: Apply the...Ch. 1 - LO 4 (Learning Objective 4: Identify financial...Ch. 1 - LO 4 (Learning Objective 4: Construct a balance...Ch. 1 - (Learning Objectives 3, 4: Apply the accounting...Ch. 1 - Prob. 1.38BECh. 1 - LO 4 (Learning Objective 4: Construct an income...Ch. 1 - LO 4 (Learning Objective 4: Construct a balance...Ch. 1 - LO 4 (Learning Objective 4: Construct a statement...Ch. 1 - Prob. 1.42BECh. 1 - LO 4 (Learning Objective 4: Construct an income...Ch. 1 - An organizations investors and creditors will...Ch. 1 - Prob. 1.45QCh. 1 - Prob. 1.46QCh. 1 - Assets are usually reported at their a. appraised...Ch. 1 - Prob. 1.48QCh. 1 - Prob. 1.49QCh. 1 - Prob. 1.50QCh. 1 - Prob. 1.51QCh. 1 - All of the following are current assets except a....Ch. 1 - Prob. 1.53QCh. 1 - Prob. 1.54QCh. 1 - Prob. 1.55QCh. 1 - Prob. 1.56QCh. 1 - Net income appears on which financial...Ch. 1 - Cash paid to purchase a building appears on the...Ch. 1 - The stockholders equity of Kowalski Company at the...Ch. 1 - Prob. 1.60QCh. 1 - Which of the following factors should influence...Ch. 1 - LO 3, 4 (Learning Objectives 3, 4: Apply the...Ch. 1 - Prob. 1.63APCh. 1 - LO 2, 3, 4 (Learning Objectives 2, 3, 4: Apply...Ch. 1 - LO 3,4 (Learning Objectives 3, 4: Evaluate...Ch. 1 - LO 3, 4 (Learning Objectives 3,4: Evaluate...Ch. 1 - LO 4 (Learning Objective 4: Construct financial...Ch. 1 - Group B LO 3, 4 (Learning Objectives 3, 4: Apply...Ch. 1 - LO 3,4 (Learning Objectives 3, 4: Apply the...Ch. 1 - Prob. 1.70BPCh. 1 - LO 3,4 (Learning Objectives 3, 4: Evaluate...Ch. 1 - LO 3, 4 (Learning Objectives 3,4: Evaluate...Ch. 1 - Prob. 1.73BPCh. 1 - Prob. 1.74SCCh. 1 - Decision Cases LO 1, 4 (Learning Objectives 1, 4:...Ch. 1 - LO 3, 4 (Learning Objectives 3, 4: Evaluate...Ch. 1 - Prob. 1.77EIC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- P1-65A. (Learning Objectives 3, 4: Evaluate business operations; construct and analyzean income statement, a statement of retained earnings, and a balance sheet) The assetsand liabilities of Oak Hill Garden Supply, Inc., as of December 31, 2018, and revenues andexpenses for the year ended on that date are as follows:Equipment........................... $110,000Interest expense................... 10,300Interest payable ................... 2,700Accounts payable ................ 26,000Salary expense..................... 108,400Building............................... 406,000Cash.................................... 44,000Common stock.................... 13,800Land................................... $ 25,000Note payable...................... 99,600Property tax expense .......... 7,400Rent expense ...................... 41,200Accounts receivable............ 84,900Service revenue................... 452,600Supplies.............................. 6,300Utilities expense .................…arrow_forwardP1-70B. (Learning Objectives 2, 3, 4: Apply underlying accounting concepts; evaluatebusiness operations; construct a balance sheet) Hudson Alvarez is a realtor. He organizedhis business as a corporation on June 16, 2019. The business received $75,000 from Alvarezand issued common stock. Consider these facts as of June 30, 2019.a. Alvarez has $17,000 in his personal bank account and $44,000 in the business bankaccount.b. Alvarez owes $6,500 on a personal charge account with a local department store.c. Alvarez acquired business furniture for $17,600 on June 24. Of this amount, the business owes $9,000 on accounts payable at June 30.d. Office supplies on hand at the real estate office total $4,000.e. Alvarez’s business owes $102,000 on a note payable for some land acquired for a totalprice of $162,000.f. Alvarez’s business spent $16,000 for a Realty Experience franchise, which entitles himto represent himself as an agent. Realty Experience is a national affiliation of independent real…arrow_forwardS1-3. (Learning Objective 2: Identify underlying accounting concepts, assumptions, andprinciples) Identify the accounting concept, assumption, or principle that best applies to eachof the following situations:a. Inflation has been about 2.5% for some time. Village Realtors is considering measuringits land values in inflation-adjusted amounts.b. You get an especially good buy on a laptop, paying only $300 when it normally costs$800. What is your accounting value for this laptop?c. Burger King, the restaurant chain, sold a store location to McDonald’s. How canBurger King determine the sale price of the store—by a professional appraisal, BurgerKing’s original cost, or the amount actually received from the sale?d. General Motors wants to determine which division of the company—Chevrolet orCadillac—is more profitable.arrow_forward

- E1-31A. (Learning Objective 4: Construct an income statement, statement of retainedearnings, and balance sheet) During 2018, Edwin Company earned revenues of $150million. Edwin incurred, during that same year, salary expense of $34 million, rent expenseof $23 million, and utilities expense of $16 million. Edwin declared and paid dividends of$16 million during the year. At December 31, 2018, Edwin had cash of $185 million, accountsreceivable of $70 million, property and equipment of $35 million, and other long-term assetsof $22 million. At December 31, 2018, the company owed accounts payable of $56 millionand had a long-term note payable of $26 million. Edwin began 2018 with a balance in retainedearnings of $73 million. At December 31, 2018, Edwin had total stockholders’ equity of$230 million, which consisted of common stock and retained earnings. Edwin has a year-end ofDecember 31. Prepare the following financial statements (with proper headings) for 2018:1. Income statement,2.…arrow_forwardP1-64A. (Learning Objectives 2, 3, 4: Apply underlying accounting concepts; evaluatebusiness operations; construct a balance sheet) Brandon Hilton is a realtor. He organized hisbusiness as a corporation on June 16, 2019. The business received $65,000 cash from Hiltonand issued common stock. Consider the following facts as of June 30, 2019:a. Hilton has $15,000 in his personal bank account and $55,000 in the business bank account.b. Hilton owes $3,400 on a personal charge account at a local department store.c. Hilton acquired business furniture for $30,000 on June 24. Of this amount, the businessowes $16,000 on accounts payable at June 30.d. Office supplies on hand at the real estate office total $8,000.e. Hilton’s business owes $112,000 on a note payable for some land acquired for a totalprice of $165,000.f. Hilton’s business spent $20,000 for a Realty Universe franchise, which entitles him torepresent himself as an agent. Realty Universe is a national affiliation of independentreal…arrow_forwardE1-25A. (Learning Objectives 3, 4: Apply the accounting equation; construct a balancesheet) The following are the assets and liabilities of Jill Carlson Realty Company, as ofJanuary 31, 2018. Also included are revenue, expense, and selected stockholders’ equity figuresfor the year ended on that date (amounts in millions):Total revenue .......................................Receivables...........................................Current liabilities .................................Common stock.....................................Interest expense....................................Salary and other employee expenses.....Long-term liabilities .............................$ 25.70.52.939.21.513.7102.6Investment assets (long-term) ......Property and equipment, net .......Other expenses............................Retained earnings, beginning.......Retained earnings, ending ...........Cash............................................Other assets (long-term)..............$…arrow_forward

- S1-12. (Learning Objective 4: Construct an income statement) MacKensie ServicesCorporation began 2018 with total assets of $230 million and ended 2018 with totalassets of $365 million. During 2018, MacKensie earned revenues of $394 million and hadexpenses of $171 million. MacKensie declared and paid dividends of $27 million in 2018.Prepare the company’s income statement for the year ended December 31, 2018, completewith an appropriate heading.arrow_forwardE1-34B. (Learning Objectives 3, 4: Apply the accounting equation; evaluate business operations) Pillser, Inc.’s, comparative balance sheet at January 31, 2019, and 2018, reports the following (in millions):2019 2018Total assets $72 $49Total liabilities 23 17RequirementsThe following are three situations related to Pillser’s issuance of stock and declaration and payment of dividends during the year ended January 31, 2019. For each situation, use the accounting equation and what you know from the chapter about stockholders’ equity, common stock,and retained earnings to calculate the amount of Pillser’s net income or net loss during the yearended January 31, 2019.1. Pillser issued $3 million of stock and declared no dividends.2. Pillser issued no stock but declared dividends of $4 million.3. Pillser issued $20 million of stock and declared dividends of $8 millionarrow_forwardE1-23A. (Learning Objective 4: Identify financial statement by type of information) ButlerTech, Inc., is expanding into India. The company must decide where to locate and how tofinance the expansion. Identify the financial statement where these decision makers can findthe following information about Butler Tech, Inc. In some cases, more than one statement willreport the needed data.a. Revenueb. Common stockc. Current liabilitiesd. Long-term debte. Dividendsf. Ending cash balanceg. Adjustments to reconcile net income tonet cash provided by operationsh. Cash spent to acquire the buildingi. Income tax expensej. Ending balance of retained earningsk. Selling, general, and administrativeexpensel. Total assetsm. Net incomen. Income tax payablearrow_forward

- (Learning Objective 2: Calculate days’ payable outstanding) The balance of LandyCorporation’s accounts payable at the beginning of the most recent year was $50,000. At theend of the year, the accounts payable balance was $54,000. Landy’s sales revenue for the yearwas $3,105,000, while its cost of goods sold for the year was $1,508,000. Calculate Landy’sdays’ payable outstanding (DPO) for the year. Assume inventory levels are constant throughoutthe year. If the credit terms from Landy’s suppliers are n/30, how would you interpret Landy’sDPO?arrow_forwardS1-10. (Learning Objective 4: Explain aspects of financial statements) Apply yourunderstanding of the relationships among the financial statements to answer thesequestions.a. How can a business earn large profits but have a small balance of retained earnings?b. Give two reasons why a business can have a steady stream of net income over a fiveyear period and still experience a cash shortage.c. If you could pick a single source of cash for your business, what would it be? Why?d. How can a business be unprofitable several years in a row and still have plenty of cash?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Consolidated financial statements; Author: The Finance Storyteller;https://www.youtube.com/watch?v=DTFD912ZJQg;License: Standard Youtube License