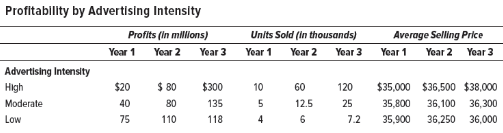

As a marketing manager for one of the world’s largest automakers, you are responsible for the advertising campaign for a new energy-efficient sports utility vehicle. Your support team has prepared the accompanying table, which summarizes the (year-end) profitability, estimated number of vehicles sold, and average estimated selling price for alternative levels of advertising. The accounting department projects that the best alternative use for the funds used in the advertising campaign is an investment returning 9 percent. In light of the staggering cost of advertising (which accounts for the lower projected profits in years 1 and 2 for the high and moderate advertising intensities), the team leader recommends a low advertising intensity in order to maximize the value of the firm Do you agree? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Managerial Economics & Business Strategy (Mcgraw-hill Series Economics)

Additional Business Textbook Solutions

Principles of Economics (MindTap Course List)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Engineering Economy (17th Edition)

Principles of Economics, 7th Edition (MindTap Course List)

Microeconomics (9th Edition) (Pearson Series in Economics)

- A multinational engineering consulting firm that wants to provide resort accommodations to special clients is considering the purchase of a three-bedroom lodge in upper Montana that will cost $295,000. The property in that area is rapidly appreciating in value because people anxious to get away from urban developments are bidding up the prices. If the company spends an average of $775 per month for utilities and the investment increases at a rate of 0.75% per month, how long would it be before the company could sell the property for $100,000 more than it has invested in it? The time it will take is ____________months.arrow_forwardAs a prospective business owner in the waste management business, you have researched the waste management truck market and you are attracted by two similarly functional truck offers. An identical cash price of $550,000 for the ARSLAN truck and the HIDRO-MAX truck with two different monthly repayment schedules offered by the respective financiers. The repayment schedule for the ARSLAN truck requires a down payment of 10% while the repayment schedule for the HIDRO-MAX truck requires a down payment of 15%. If the repayment is over a period of 7 years at an annual loan rate of 6%, what would be the monthly repayment amount for both schedules? Assume that the monthly repayment starts 1 month after the mortgage contract is signed and the down payment made. Show all calculations.arrow_forwardYou are presented 2 investment options. Which one gives you a better return? In option A, you pay $3,000 today and receive $750 at the end of the year for the next 5 years. In option b, you pay $2,000 today and receive $3,000 at the end of five yearsarrow_forward

- You are considering two types of automobiles. Model A costs $18,000, andModel B costs $15,624.Although the two models are essentially the same, Model A can be sold for $9,000 after four years of use while Model B can be sold for $6,500 after the same amount of time. Model A commands a better resale value because its styling is popular among young college students. Determine the rate of return on the incremental investment of $2,376. For what range of values of your MARR is Model A preferable?arrow_forwardA firm that manufactures freezer for delivery vans currently has excess capacity. The firm expects that it will exhaust its excess capacity in three years. At that time it will have to invest P2,500,000 to build new capacity. Suppose that the firm can accept additional work as a subcontractor for another company. By doing so, the firm will receive a net cash inflow of P150,000 immediately and in each of the next three years. However, the firm will have to begin expansion two years earlier than originally planned to bring new capacity on line. Assume a discount rate of 12%. a. What is the NPV if the firm accepts the subcontractor job? b. What is the minimum amount that should be received from the subcontractor job for the company to accept it?arrow_forwardYou have just won the lottery. The state offers you an amortized payout of $200,000 at the end of each year for 30 years. The payout is taxable and the tax rate is 60%. You do not expect the government (who pays the payout) to go bankrupt. The risk-free rate is 9% per year and the total expected market return is 17%. What is the value of the lump-sum payment that would cause you to be indifferent between taking the lump-sum or the amortized payout?arrow_forward

- Show in excel A firm has a capital budget of $30,000 and is considering three possible independent projects. Project A has a present outlay of $12,000 and yields $4, 281 per annum for 5 years. Project B has a present outlay of $10,000 and yields $4,184 per annum for 5 years. Project C has a present outlay of $17,000 and yields $5,802 per annum for 10 years. Funds which are not allocated to one of the projects can be placed in a bank deposit where they will earn 15%. (a) Identify six combinations of project investments and a bank deposit which exhaust the budget. (b) Which of the above combinations should the firm choose: when the reinvestment rate is 15%? (ii) when the reinvestment rate is 20%?arrow_forwardBy outbidding its competitors, Turbo Image Processing (TIP), a defense contractor, has received a contract worth $7,300,000 to build navy flight simulators for U.S. Navy pilot training over two years. For some defense contracts, the U.S. government makes an advance payment when the contract is signed, but in this case, the government will make two progressive payments: $4,300,000 at the end of the first year and the $3.000,000 balance at the end of the second year. The expected cash outflows required in order to produce these simulators are estimated to be $1,000,000 now, $2.000,000 during the first year, and $4,320,000 during the second year. The expected net cash flows from this project are summarized as follows: In normal situations, TIP would not even consider a marginal project such as this one in the first place. However, hoping that TIP can establish itself as a technology leader in the field. management felt that it was worth outbidding its competitors by providing the lowest…arrow_forwardSuppose that you plan to retire at 65. You invest $8,000 per year on your birthday for 10 years starting on your 25th and ending on your 34th birthday. Since you are young, you take more risks with your investments, and earn a rate of return of 12%. Then, you have children and decide to put all your retirement savings into investing in a college fund for them. You leave all accumulated funds in the retirement account, and it earns 6% per year, reflecting an (unwise) rise in caution during middle age. How much money will you have to retire on at 65 (31 years after you stop contributing)arrow_forward

- Recently, Air Liquide signed a long-term contract with Yan’an Energy and Chemical Co., a subsidiary of Yanchang Petroleum Group—one of China’s largest firms engaged in oil and natural gas exploration and production as well as oil refining. The new contract specifies that Air Liquide invest approximately 80 million euros in two air separation units (ASUs), which will supply air gases for Yan’an’s production of plastics. Air Liquide is a French multinational firm that supplies industrial gases to a wide range of industries, including chemical manufacturers. Why is a long-term contract preferable to a spot exchange or vertical integration between Yan’an and Air Liquide?arrow_forwardThere may be no correct option, or more than one correct option..arrow_forwardIt is well established that indoor air quality (IAQ) has a significant effect on general health and productivity of employees at a workplace. A study showed that enhancing IAQ by increasing the building ventilation from 5 cfm (cubic feet per minute) to 20 cfm increased the productivity by 0.25 percent, valued at $90 per person per year, and decreased the respiratory illnesses by 10 percent for an average annual savings of $39 per person while increasing the annual energy consumption by $6 and the equipment cost by about $4 per person per year (ASHRAE Journal, December 1998). For a workplace with 120 employees, determine the net monetary benefit of installing an enhanced IAQ system to the employer per year.arrow_forward

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning