(This serial problem begins in this chapter and continues through most Of the book. It is helpful, but not necessary, to use the Working papers that accompany the book.)

SP 1 Santana Rey, owner of Business Solutions, decides to diversify her business by also manufacturing computer workstation furniture.

Required

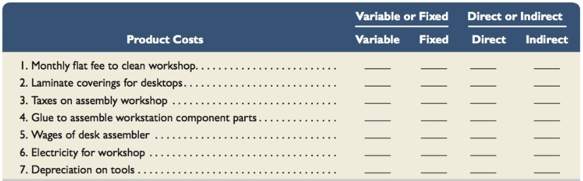

- Classify the following

manufacturing costs of Business Solutions as either (a) variable or fixed and (b) direct or indirect.

- Prepare a schedule of cost of goods manufactured for Business Solutions for the month ended January 31, 2016. Assume the following manufacturing costs:

Direct materials: $2,2000

Beginning work in process: none (December 31, 2015)

Ending work in process: $540 (January 31, 2016)

- Prepare the cost of goods sold section of a partial income statement for Business Solutions for the month ended January 31, 2016.

Concept introduction:

Variable cost:

The costs which are associated with the amount of goods produced or services provided. These vary directly with the production level i.e. company’s variable cost increases as the production increases and vice-a-versa.

Fixed cost:

These costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. They remain same even if the company does not produce any product or provide any service during an accounting period.

Direct cost:

These costs, as the name specifies, are traceable to the production of specific product or service. These are connected to specific cost object which can be a product, department or project.

Indirect cost:

These costs are necessary for production but not traceable to act of production. These costs are necessary to keep business operational. They go beyond the costs associated with creating a product to include the costs of maintaining the entire company.

Requirement 1:

Classification of manufacturing costs of Business Solutions as (a) variable or fixed and (b) direct or indirect.

Answer to Problem 1SP

Classification of manufacturing costs of Business Solutions:

| Particulars | Variable or Fixed cost | Direct or Indirect cost |

| Monthly flat fee to clean workshop | Fixed | Indirect |

| Laminate coverings for desktops | Variable | Direct |

| Taxes on assembly workshops | Fixed | Indirect |

| Glue to assemble workstation component parts | Variable | Indirect |

| Wages of desk assembler | Variable | Direct |

| Electricity for workshop | Variable | Indirect |

| Depreciation on tools | Fixed | Indirect |

Explanation of Solution

The manufacturing costs of Business Solutions can be classified into variable or fixed and direct or indirect costs based on their nature i.e. on the basis of their behavior and traceability as explained below:

Variable costs vary directly with the production level i.e. company’s variable cost increases as the production increases and vice-a-versa. Therefore, following costs would be classified as Variable:

- Laminate coverings for desktops: The number of desktops held by Business Solutions would determine the costs for their laminate coverings which would vary

- Glue to assemble workstation component parts: Component parts held by Business Solutions at its workstation would determine the costs for glue required for their assembly

- Wages of desk assembler: Number of desk assembler may vary at different periods, thereby leading to variation in their wages

- Electricity for workshop: Electricity cost for workshop would vary in proportion of number of units consumed

Fixed costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. Therefore, those costs which are fixed in nature would be covered under fixed costs as given below:

- Monthly flat fee to clean workshop: The cost that would be incurred for cleaning of workshop monthly is fixed in nature

- Taxes on assembly workshops: Taxes incurred on assembly workshops are fixed irrespective of the level of production

- Depreciation on tools: The depreciation charge on tools would remain fixed and would not change with the level of production

Direct costs are traceable to the production of specific product or service. These are connected to specific cost object which can be a product, department or project. Following would be classified as direct costs:

- Laminate coverings for desktops: These costs are traceable to the production of specific product

- Wages of desk assembler: These costs are traceable to the production of specific product

Indirect costs are necessary for production but not traceable to act of production. These costs are necessary to keep business operational. They go beyond the costs associated with creating a product to include the costs of maintaining the entire company. Following are the indirect cost given in the problem:

- Monthly flat fee to clean workshop are associated with costs of maintenance

- Taxes on assembly workshops are not traceable to act of production

- Glue to assemble workstation component parts are not traceable to act of production

- Electricity for workshop are costs necessary to keep business operational

- Depreciation on tools are associated with costs of maintenance

Therefore, classification of manufacturing costs of Business Solution as asked in the given problem is shown below in the tabular manner:

Classification of manufacturing costs of Business Solutions:

| Particulars | Variable or Fixed cost | Direct or Indirect cost |

| Monthly flat fee to clean workshop | Fixed | Indirect |

| Laminate coverings for desktops | Variable | Direct |

| Taxes on assembly workshops | Fixed | Indirect |

| Glue to assemble workstation component parts | Variable | Indirect |

| Wages of desk assembler | Variable | Direct |

| Electricity for workshop | Variable | Indirect |

| Depreciation on tools | Fixed | Indirect |

Concept introduction:

Cost of goods manufactured:

Cost of goods manufactured, also known as cost of goods completed calculates the total value of inventory that was produced during the period and is ready for sale. It is the total amount of expenses incurred to turn work in process into finished goods. It includes total manufacturing costs including all direct materials, direct labor, factory overheads to the beginning work in process inventory and subtracting ending work in process inventory which can be seen below:

Requirement 2:

To calculate:

Cost of goods manufactured for Business Solutions for the month ended January 31, 2016.

Answer to Problem 1SP

Cost of goods manufactured = $3, 050

Explanation of Solution

To calculate cost of goods manufactured, following formula would be used:

In the given problem, following information is given:

Direct materials = $2, 200

Direct labor = $900

Factory overheads = $490

Beginning work in process inventory = Nil

Ending work in process inventory = $540

Therefore, schedule of cost of goods manufactured as asked in the given problem is given below:

Schedule of cost of goods manufactured of Business Solutions (Amount in $):

| Particulars | (Amount in $) | (Amount in $) |

| Direct materials | 2, 200 | |

| Add: Direct labor | 900 | |

| Add: Factory overheads | 490 | |

| Total manufacturing costs | 3, 590 | |

| Add: Beginning work in process inventory | 0 | |

| Less: Ending work in process inventory | (540) | |

| Cost of goods manufactured | 3, 050 |

Thus, cost of goods manufactured = $3, 050.

Concept introduction:

Cost of goods sold:

Cost of goods sold is the costs incurred for manufacturing or acquiring the products sold by a company in a given year. It includes all the direct costs incurred for the products sold. It can be calculated using the following formula:

Requirement 3:

Cost of goods sold section of partial income statement for the month ended January 31, 2016.

Answer to Problem 1SP

Cost of goods sold = $2, 700

Explanation of Solution

For calculating cost of goods sold, following formula would be used:

We have already calculated cost of goods manufactured as $3, 050. In the given problem, it is given that Beginning finished goods inventory is Nil and Ending finished goods inventory are $350.

Therefore, Cost of goods sold section of partial income statement for the month ended January 31, 2016 would be:

Cost of goods sold section of partial income statement for the month ended January 31, 2016 of Business Solutions (Amount in $):

| Particulars | (Amount in $) | (Amount in $) |

| Cost of goods manufactured | 3, 050 | |

| Add: Beginning finished goods inventory | 0 | |

| Total manufacturing costs | 3, 050 | |

| Less: Ending finished goods inventory | (350) | |

| Cost of goods sold | 2, 700 |

Thus, Cost of goods sold = $2, 700.

Want to see more full solutions like this?

Chapter 1 Solutions

MANAGERIAL ACCOUNTING ACCT 2302 >IC<

- Classify the following costs of this new product as direct materials, direct labor, manufacturing overhead, selling, or administrative 1. President's salary. 2. Packages used to hold the skin wipes. 3. Cleaning materials used to clean the skin wipe packages. 4. Wages of workers who package the product. 5. Cost of advertising the product. 6. The salary of the supervisor of the workers who package the product. 7. Cost accountant's salary (the accountant works in the factory). 8. Cost of a market research survey. 9. Sales commissions paid as a percent of sales. 10. Depreciation of administrative office building. Problem B Classify the costs listed in the previous problem as either product costs or period costs.arrow_forwardThe Write Way manufactures double sided pens- a pen on one side, a highlighteron the other. As the accounting manager, Shade is responsible for presenting three different versions of the company's income statement to the rest of the management team at year-end. Team members are very familiar with absorbtion costing, as they have been evaluating gross margin amounts and percentages for years. They are lesss keen on how fixed-MOH impacts the income statment, so Shade gathers the following current information. The information includes three possible capacity levels for calculating the fixed-MOH rate. Shade also notes there are no price or efficiency variances this period. Any fixed-MOH volume variase is written off to COGS.Theoretical level - 80,000 units Practical level - 60,000 units Normal level - 50,000 units Actual production - 65,000 units Sales Volume - 60,000 units Budgeted fixed-MOH cost - $240,000 Budgeted DM cost - $2.25 per unit Budgeted DL cost -$1.30 per unit Budgeted…arrow_forwardMesa Designs produces a variety of hardware products, primarily for the do-it-yourself (DIY) market. As part of your job interview as a summer intern at Mesa, the cost accountant provides you with the following (fictitious) data for the year (in $000). Inventory information: 1/1/00 12/31/00 Direct materials $96 $110 Work-in-process 152 136 Finished goods 1,974 2,026 Other information: For the year ’00 Administrative costs $4,200 Depreciation (Factory) 5,560 Depreciation (Machines) 9,240 Direct labor 13,000 Direct materials purchased 10,300 Indirect labor (Factory) 3,340 Indirect materials (Factory) 960 Property taxes (Factory) 370 Selling costs 2,140 Sales revenue 60,220 Utilities (Factory) 1,060 Required: 1. Prepare a cost of goods sold statement. 2. Prepare an income statement.arrow_forward

- Ethan Manufacturing Incorporated produces floor mats for automobiles. The owner, Joseph Ethan, has asked you to assist in estimating maintenance costs. Together, you and Joseph determine that the single best cost driver for maintenance costs is machine hours. These data are from the previous fiscal year for maintenance costs and machine hours: 1. What is the cost equation for maintenance costs using the high-low method? 2. Calculate the mean absolute percentage error (MAPE) for the cost equation you developed in requirement 1. Month Maintenance Costs Machine Hours 1 $ 2,660 1,750 2 2,820 1,830 3 2,970 1,910 4 3,080 1,930 5 3,160 1,960 6 3,130 1,940 7 3,070 1,920 8 2,910 1,900 9 2,680 1,760 10 2,280 1,160 11 2,290 1,360 12 2,510 1,650arrow_forwardCompany XYZ Manufacturer Limited is involved in the production of antiseptic products. Recently Company has started manufacturing of Sanitizers due to overwhelming demand of this product in the market. As company has already expertise in production of disinfectants therefore this new product will increase the product line of business. You are required to describe whether this company is involved in Job order costing or Process costing method to calculate product cost also differentiate between these two types. Company’s CEO has directed the financial manger to calculate the total cost of production for sanitizers during the year 2020. For this purpose the accountants have recorded and prepared the following cost data related to production of five thousand sanitizers for year 2020 in company’s accounting record under the title of Job “A111” Indirect Material Rs. 38,000 Other Costs incurred: Rs. Indirect Labor 78,000 Purchases of Raw Material (Both Direct and Indirect)…arrow_forwardGala Company is a manufacturer of laptop computers. Various costs and expenses associated with its operations are as follows.The company intends to classify these costs and expenses into the following categories: (a) direct materials, (b) direct labor, (c) manufacturing overhead, and (d) period costs.For each item, indicate the cost category to which it belongs. (A,B,C, or D) Item Category 1. Property taxes on the factory building. select the cost category 2. Production superintendents’ salaries. select the cost category 3. Memory boards and chips used in assembling computers. select the cost category 4. Depreciation on the factory equipment. select the cost category 5. Salaries for assembly-line quality control inspectors. select the cost category 6. Sales commissions paid to sell laptop computers. select the cost category 7. Electrical components used in assembling computers. select the…arrow_forward

- You are working as a manager accountant for a retail company which markets and sells two products product 1 and product 2. The following information is available for last year. The actual fixed product overheads for the same period were 95000 and fixed administration overheads were 25000. a) Please develop both marginal costing and absorption costing income statements. b) elaborate the findings, key advantages and limitations. Please donot provide solution in image format provide solution in step by step format and fast solutionarrow_forwardClassify each cost listed below as either product costs or period costs for the purpose of preparing the financial statements for the bank. Cost Product Cost/Period Cost 1. Depreciation on chairs and tables in the factory lunchroom 2. The wages of the receptionist in the administrative offices 3. Cost of leasing the corporate jet used by the company's executives 4. The cost of renting rooms at a Florida resort for the annual sales conference 5. The cost of packaging the company's productarrow_forwardThe following data refer to San Fernando Fashions Company for the year 20x2: 2. Cost of goods sold: $580,000 Required:1. Prepare San Fernando Fashions’ schedule of cost of goods manufactured for the year.2. Prepare San Fernando Fashions’ schedule of cost of goods sold for the year.3. Prepare San Fernando Fashions’ income statement for the year.4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if raw-material purchases amounted to $190,000 and indirect labor was $20,000.arrow_forward

- The Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry Love, the firm’s new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Listed below are activity and cost information relating to two of Chocolate Baker’s major products. Muffins Cheesecake Revenue $53,000 $46,000 Cost of goods sold 26,000 21,000 Delivery activity: Number of deliveries 150 85 Average length of delivery 10 minutes 15 minutes Cost per hour for delivery $20.00 $20.00 Using activity-based costing, which one of the following statements is correct? A. The cheesecakes are $75 more profitable. B. The muffins have a higher profitability as a percentage of sales and therefore are more advantageous. C. The muffins are $2,000 more…arrow_forwardThe Ferndale Furniture Company produces custom furniture for walk-in customers. Products include coffee tables, shelving units, mirrors, and hutches and can be constructed with either pine or oak. Custom kitchen cabinetry and installation will also be considered during the slower winter season. The company is owned and operated by Ken McMann, who has one full-time employee working for him. Ken has worked in this industry for many years and has just started the company. Currently, for customer pricing inquiries, Ken provides a quote based on his best estimate and years of experience in the business and applies a 40% markup on cost. Ken’s son Owen has returned home for the summer after completing his first semester of an accounting program. Owen described to Ken the benefits of a job-order costing system to track costs and as a basis for quoting sales prices to prospective customers. Ken believes he could use this cost accounting system in his new business and sets aside a few hours to…arrow_forwardThe Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry White, the firms new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Following are activity and cost information relating to two of Chocolate Bakers major products: Using activity-based costing, which of the following statements is correct? a. The muffins are 2,000 more profitable. b. The cheesecakes are 75 more profitable. c. The muffins are 1,925 more profitable. d. The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning