Freeman Неyward Jones Ramirez Beginning of the year. Assets $ 900,000 $490,000 $115,000 (d) Liabilities 360,000 260,000 81,000 $120,000 End of the year: 675,000 220,000 270,000 136,000 Assets 1,260,000 100,000 Liabilities 330,000 80,000 During the year: Additional investment in the business (a) 150,000 10,000 55,000 Withdrawals from the business 75,000 32,000 (c) 39,000 Revenue 570,000 (b) 115,000 122,500 115,000 Expenses 240,000 128,000 128,000

Freeman Неyward Jones Ramirez Beginning of the year. Assets $ 900,000 $490,000 $115,000 (d) Liabilities 360,000 260,000 81,000 $120,000 End of the year: 675,000 220,000 270,000 136,000 Assets 1,260,000 100,000 Liabilities 330,000 80,000 During the year: Additional investment in the business (a) 150,000 10,000 55,000 Withdrawals from the business 75,000 32,000 (c) 39,000 Revenue 570,000 (b) 115,000 122,500 115,000 Expenses 240,000 128,000 128,000

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 8EP

Related questions

Question

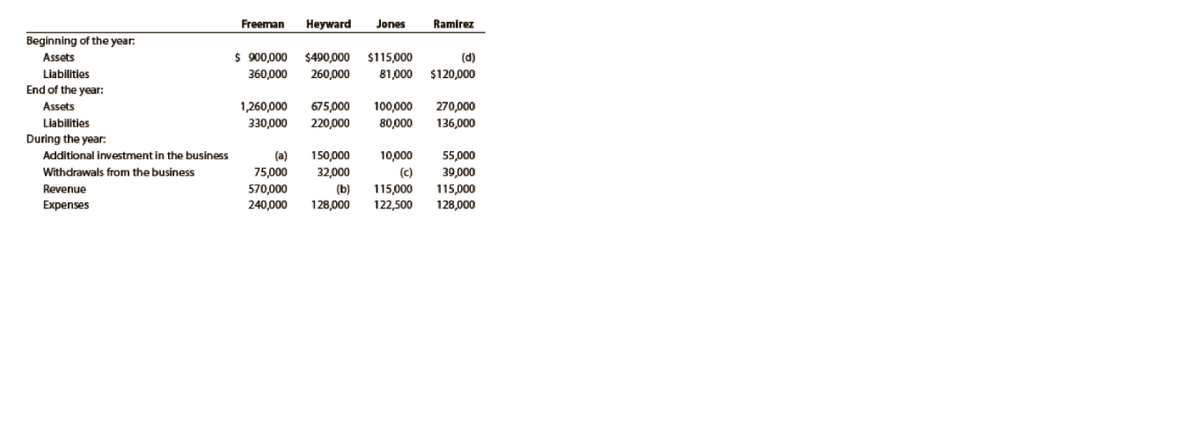

One item is omitted in each of the following summaries of balance sheet and income statement data for the following four different proprietorships:

Determine the missing amounts, identifying them by letter. (Hint: First, determine the amount of increase or decrease in owner’s equity during the year.)

Transcribed Image Text:Freeman

Неyward

Jones

Ramirez

Beginning of the year.

Assets

$ 900,000

$490,000

$115,000

(d)

Liabilities

360,000

260,000

81,000

$120,000

End of the year:

675,000

220,000

270,000

136,000

Assets

1,260,000

100,000

Liabilities

330,000

80,000

During the year:

Additional investment in the business

(a)

150,000

10,000

55,000

Withdrawals from the business

75,000

32,000

(c)

39,000

Revenue

570,000

(b)

115,000

122,500

115,000

Expenses

240,000

128,000

128,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College