a.

The total product cost and average cost per unit

a.

Explanation of Solution

Product cost:

It is the cost incurred by the company during the process of manufacturing the product.

Given information:

- Raw material $39,000.

- Wages for production workers $27,000.

- Manufacturing equipment is $58,000, its salvage value is $4,000, and an expected life is 6years.

- The completed production of Company Z is 12,000 units.

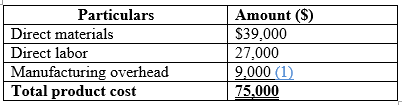

The calculation of total product cost for the year 2019 is as follows:

Table (1)

Hence, the total cost of the product for the year 2018 is $75,000.

The calculation average cost per unit for the year 2019 is as follows:

Hence, the average cost per unit for the year 2018 is $6.25.

Working notes:

The calculation of manufacturing overheads is as follows:

Hence, the manufacturing overheads is $9,000.

(1)

b.

The cost of goods sold that appears in 2019 income statement.

b.

Explanation of Solution

Cost of goods sold

The cost of goods sold is the accumulation of all the direct costs incurred in the process of producing a product. It excludes the indirect expenses.

Given information:

- The total number of units sold by Company Z is 10,000 units.

The calculation of total cost of goods sold for the year 2019 is as follows:

Hence, the total cost of goods sold is $62,500.

c.

The cost of ending inventory that appears on 31st December 2019 balance sheet.

c.

Explanation of Solution

Inventory:

It is the term for products those are ready for sale and the raw materials used in making the final product.

Given information:

- The total number of units sold by Company Z is 10,000 units.

- The completed production of Company Z is 12,000 units.

The calculation of ending inventory for the year 2019 is as follows:

Hence, the ending inventory for the year 2019 is $12,500.

d.

The total amount of net income for the year 2019.

d.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from the business operations and the result of those operations as a net income or net loss for a particular time period is referred to as the income statement.

Given information:

- Raw material $39,000.

- Manufacturing equipment is $58,000, its salvage value is $4,000, and an expected life is 6years.

- The total number of units sold by Company Z is 10,000 units at cost of $15 per unit.

- The completed production of Company Z is 12,000 units.

- Common stock of the Company Z is $89,000.

- Purchased furniture for office at $28,000 and an expected life is 4years.

- The Company pays $20,000 as salary and $27,000 as wages for the production purpose.

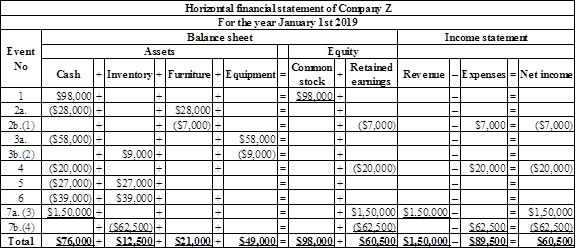

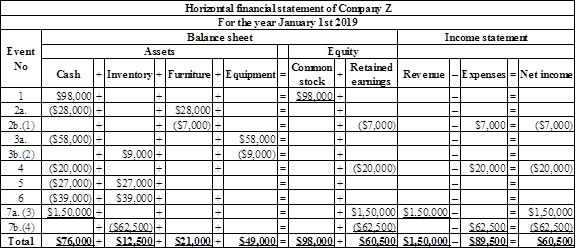

The calculation of net income of the Company Z for the year 2019 is as follows:

0.

Table (2)

Hence, the net income of the Company for the year 2018 is $60,500.

Working note:

The calculation of

Hence, the depreciation value of furniture is $7,000.

(1)

The calculation of depreciation value for manufacturing equipment is as follows:

Hence, the depreciation value of manufacturing equipment is $9,000.

(2)

The calculation of total units sold at the rate of $9 per unit is as follows:

The total units sold by the Company Z are 150,000.

(3)

The calculation of total inventory at the average cost per unit is as follows:

The total inventory at the average cost is 62,500.

(4)

e.

The total amount of

e.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from business operations and the result of those operations as a net income or net loss for a particular time period is referred to as the income statement.

Given information:

- Raw material $39,000.

- Manufacturing equipment is $58,000, its salvage value is $4,000 and an expected life is 6years.

- The total number of units sold by Company Z is 10,000 units at cost of $15 per unit.

- The completed production of Company Z is 12,000 units.

- Common stock of the Company Z is $89,000.

- Purchased furniture for office at $28,000 and an expected life is 4years.

- The Company pays $20,000 as salary and $27,000 as wages for the production purpose.

The calculation of retained earnings of the Company Z for the year 2018 is as follows:

Table (3)

Hence, the retained earnings of the Company for the year 2019 is $60,500.

Working note:

The calculation of depreciation value for furniture is as follows:

Hence, the depreciation value of furniture is $7,000.

(1)

The calculation of depreciation value for manufacturing equipment is as follows:

Hence, the depreciation value of manufacturing equipment is $9,000.

(2)

The calculation of total units sold at the rate of $9 per unit is as follows:

The total units sold by the Company Z are 150,000.

(3)

The calculation of total inventory at the average cost per unit is as follows:

The total inventory at the average cost is 62,500.

(4)

f.

The total assets that appears on the balance sheet.

f.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from business operations and the result of those operations as a net income or net loss for a particular time period is referred to as the income statement.

Given information:

- Raw material $39,000.

- Manufacturing equipment is $58,000, its salvage value is $4,000 and an expected life is 6years.

- The total number of units sold by Company Z is 10,000 units at cost of $15 per unit.

- The completed production of Company Z is 12,000 units.

- Common stock of the Company Z is $89,000.

- Purchased furniture for office at $28,000 and an expected life is 4years.

- The Company pays $20,000 as salary and $27,000 as wages for the production purpose.

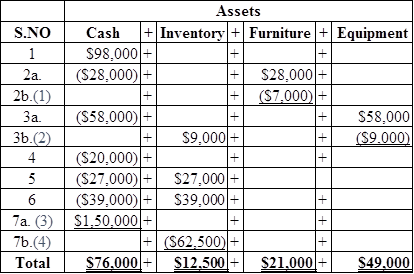

Table showing the calculation of assets is given below:

Table (4)

The calculation of total assets is as follows:

Hence, the total amount of assets of the Company for the year 2019 is $158,500.

Working note:

The calculation of depreciation value for furniture is as follows:

Hence, the depreciation value of furniture is $7,000.

(1)

The calculation of depreciation value for manufacturing equipment is as follows:

Hence, the depreciation value of manufacturing equipment is $9,000.

(2)

The calculation of total units sold at the rate of $9 per unit is as follows:

The total units sold by the Company Z are 150,000.

(3)

The calculation of total inventory at the average cost per unit is as follows:

The total inventory at the average cost is 62,500.

(4)

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education