Concept explainers

The following is a list of costs incurred by several manufacturing companies:

a. Bonus for vice president of marketing

b. Costs of operating a research laboratory

c. Cost of unprocessed milk for a dairy

d.

e. Entertainment expenses for sales representatives

f. Factory supplies

g. First-aid nurse for factory workersh. Health insurance premiums paid for factory workers

i. Hourly wages of warehouse laborers

j. Lumber used by furniture manufacturer

k. Maintenance

l. Microprocessors for a microcomputer manufacturer

m. Packing supplies for products sold, which are insignificant to the total cost of the product

n. Paper used by commercial printer

o. Paper used in processing various managerial reports

p. Protective glasses for factory machine operators

q. Salaries of quality control personnel

r. Sales commissions

s. Seed for grain farmer

t. Television advertisement

u. Prebuilt transmissions for an automobile manufacturer

v. Wages of a machine operator on the production line

w. Wages of secretary of company controller

x. Wages of telephone operators for a toll-free, customer hotline

Instructions

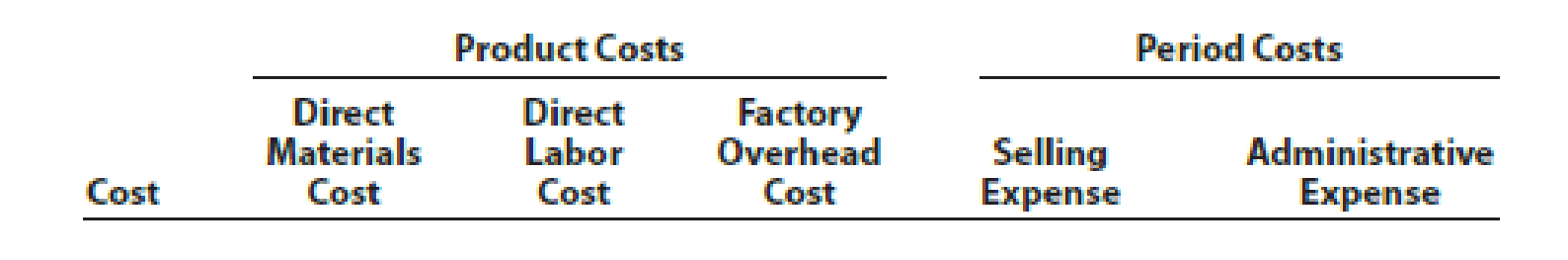

Classify each of the preceding costs as a product cost or period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overhead cost. Indicate whether each period cost is a selling expense or an administrative expense. Use the following tabular headings for preparing your answer. Place an “X” in the appropriate column.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Managerial Accounting

- Listed as follows are various costs found in businesses. Classify each cost as a fixed or variable cost, and as a product and/or period cost. Wages of administrative staff Shipping costs on merchandise sold Wages of workers assembling computers Cost of lease on factory equipment Insurance on factory Direct materials used in production of lamps Supervisor salary, factory Advertising costs Property taxes, factory Health insurance cost for company executives Rent on factoryarrow_forwardFor apparel manufacturer Abercrombie Fitch, Inc. (ANF), classify each of the following costs as either a product cost or a period cost: a. Advertising expenses b. Chief financial officers salary c. Depreciation on office equipment d. Depreciation on sewing machines e. Fabric used during production f. Factory janitorial supplies g. Factory supervisors salaries h. Property taxes on factory building and equipment i. Oil used to lubricate sewing machines j. Repairs and maintenance costs for sewing machines k. Research and development costs l. Sales commissions m. Salaries of distribution center personnel n. Salaries of production quality control supervisors o. Travel costs of media relations employees p. Utility costs for office building q. Wages of sewing machine operatorsarrow_forwardThis list contains costs that various organizations incur; they fall into three categories: direct materials (DM), direct labor (DL), or overhead (OH).t Classify each of these items as direct materials, direct labor, or overhead. Glue used to attach labels to bottles containing a patented medicine. Compressed air used in operating paint sprayers for Student Painters, a company that paints houses and apartments. Insurance on a factory building and equipment. A production department supervisors salary. Rent on factory machinery. Iron ore in a steel mill. Oil, gasoline, and grease for forklift trucks in a manufacturing companys warehouse. Services of painters in building construction. Cutting oils used in machining operations. Cost of paper towels in a factory employees washroom. Payroll taxes and fringe benefits related to direct labor. The plant electricians salaries. Crude oil to an oil refinery. Copy editors salary in a book publishing company. Assume your classifications could be challenged in a court case. Indicate to your attorneys which of your answers for part a might be successfully disputed by the opposing attorneys and why. In which answers are you completely confident?arrow_forward

- Indicate whether the following costs of Procter Gamble (PG), a maker of consumer products, would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Depreciation on assembly line equipment in the Mehoopany, Pennsylvania, paper products plant b. Licensing payments for use of Disney characters on children products c. Maintenance supplies d. Packaging materials e. Paper used in bath tissue f. Plant manager salary for the Iowa City, Iowa, plant g. Resins for body wash products h. Salary of process engineers i. Scents and fragrances used in making soaps and detergents j. Wages of production line employees at the Pineville, Louisiana, soap and detergent plantarrow_forwardThe following is a list of costs incurred by several manufacturing companies: a. Annual picnic for plant employees and their families b. Cost of fabric used by clothing manufacturer c. Cost of plastic for a toy manufacturer d. Cost of sewing machine needles used by a shirt manufacturer e. Cost of television commercials f. Depreciation of copying machines used by the Marketing Department g. Depreciation of microcomputers used in the factory to coordinate and monitor the production schedules h. Depreciation of office building i. Depreciation of robotic equipment used to assemble a product j. Electricity used to operate factory machinery k. Factory janitorial supplies I. Fees charged by collection agency on past-due customer accounts m. Fees paid to lawn service for office grounds n. Maintenance costs for factory equipment o. Oil lubricants for factory plant and equipment p. Pens, paper, and other supplies used by the Accounting Department q. Repair costs for factory equipment r. Rent for a warehouse used to store work in process and finished products s. Salary of a physical therapist who treats plant employees t. Salary of the manager of a manufacturing plant u. Telephone charges by corporate office v. Travel costs of marketing executives to annual sales meeting w. Wages of a machine operator on the production line x. Wages of production quality control personnel Instructions Classify each of the preceding costs as a product cost or period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overhead cost. Indicate whether each period cost is a selling expense or an administrative expense. Use the following tabular headings for preparing your answer, placing an X in the appropriate column:arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forward

- A manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardFollowing is a list of manufactured products. For each product, would a job order or a process cost system be used to account for the costs of production? a. lumber b. buildings c. airplanes d. gasoline e. cereal f. textbooks g. paint h. jeansarrow_forwardThe following information is available for the first year of operations of Creston Inc., a manufacturer of fabricating equipment: Determine the following amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forward

- Roper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forwardThe following is a list of costs incurred by several businesses:a. Cost of fabric used by clothing manufacturerb. Maintenance and repair costs for factory equipmentc. Rent for a warehouse used to store raw materials and work in processd. Wages of production quality control personnele. Oil lubricants for factory plant and equipmentf. Depreciation of robot used to assemble a productg. Travel costs of marketing executives to annual sales meetingh. Depreciation of copying machines used by the Marketing Departmenti. Fees charged by collection agency on past-due customer accountsj. Electricity used to operate factory machineryk. Maintenance costs for factory equipmentl. Pens, paper, and other supplies used by the Accounting Department in preparing various managerial reportsm. Charitable contribution to United Fundn. Depreciation of microcomputers used in the factory to coordinate and monitor the production scheduleso. Fees paid to lawn service for office grounds upkeepp. Cost of sewing…arrow_forwardBelow is a table showing the various costs incurred by various companies. In each column, indicate the proper classification of these costs. Write NA if not applicable. Cost Manufacturing/Product (M) or Non-Manufacturing/Period (NM) Direct Materials (DM), Direct Labor (DL) or Factory Overhead (FOH) General and Administrative (GA) or Marketing and Selling (MS) m. Commissions paid to sales personnel n. Salaries of the executive staff o. Car leases for sales agents p. Electricity to run machineries in a lumber yard q. Food for company banquet r. Sugar in a bakeshoparrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning