Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3EA

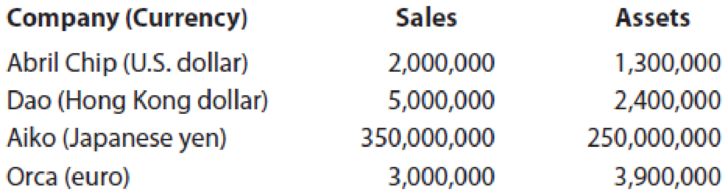

You have been asked to compare the sales and assets of four companies that make computer chips to determine which company is the largest in each category. You have gathered the following data, but they cannot be used for direct comparison because each company’s sales and assets are in its own currency:

Assuming that the exchange rates in Exhibit 2 are current and appropriate, convert all the figures to U.S. dollars (multiply amount by exchange rate) and determine which company is the largest in sales and which is the largest in assets.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose that Salem Co, a U.S.-based MNC that both purchases supplies from Canada and sells exports in Canada, is seeking to measure the economic exposure of its cash flows. Salem wishes to analyze how its cash flows might change under different exchange rates for the Canadian dollar (the only foreign currency in which it deals).

Salem believes that the value of the Canadian dollar will be $0.70, $0.75, or $0.80, and seeks to analyze its cash flows under each of these scenarios.

The following table shows Salem’s cash flows under each of these exchange rates.

Use the table to answer the question that follows.

Exchange Rate Scenario

Exchange Rate Scenario

Exchange Rate Scenario

C$1=$0.70

C$1=$0.75

C$1=$0.80

(Millions)

(Millions)

(Millions)

Sales

(1) U.S. Sales

$315

$315

$315

(2) Canadian Sales

$3.50

$4.00

$4.00

(3) Total Sales in U.S. $

$318.50

$318.75

$319.00

Cost of Materials and Operating Expenses

(4)…

Suppose a U.S. firm builds a factory in China, staffs it with Chinese workers, uses materials supplied by Chinese companies, and finances the entire operation with a loan from a Chinese bank located in the same town as the factory. This firm is most likely trying to greatly reduce, or eliminate, which one of the following?

Interest rate disparities

Short-run exposure to exchange rate risk

Long-run exposure to exchange rate risk

Political risk associated with the foreign operations

Translation exposure to exchange rate risk

Assume a Japanese company, Ascent Robotics, sells its equipment to a U.S. client invoicing half of the bill in yen and the remaining half in U.S. dollars. Which type of hedging through invoice currency does this situation represent?

Shifting exchange exposure

Money market hedge

Sharing exchange exposure

Diversifying exchange exposure

Chapter 1 Solutions

Principles of Accounting

Ch. 1 - What makes accounting a valuable discipline?Ch. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - How are expenses and withdrawals similar, and how...Ch. 1 - How do generally accepted accounting principles...Ch. 1 - Why do managers in governmental and not-for-profit...Ch. 1 - Prob. 1SECh. 1 - Match the descriptions that follow with the...Ch. 1 - Determine the amount missing from each accounting...Ch. 1 - Use the accounting equation to answer each...

Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Prob. 6SECh. 1 - Use the following accounts and balances to prepare...Ch. 1 - Randall Company engaged in activities during the...Ch. 1 - Prob. 9SECh. 1 - Prob. 10SECh. 1 - Prob. 1EACh. 1 - Financial accounting uses money measures to gauge...Ch. 1 - You have been asked to compare the sales and...Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Daiichi Companys total assets and liabilities at...Ch. 1 - 1. Indicate whether each of the following accounts...Ch. 1 - Listed in random order are some of Oxford Services...Ch. 1 - Dukakis Company had the following accounts and...Ch. 1 - Prob. 9EACh. 1 - Prob. 10EACh. 1 - Complete the financial statements that follow by...Ch. 1 - Prob. 12EACh. 1 - Match the terms that follow with the appropriate...Ch. 1 - Prob. 14EACh. 1 - Prob. 15EACh. 1 - Prob. 1PCh. 1 - The following three independent sets of financial...Ch. 1 - Fuel Designs financial accounts follow. The...Ch. 1 - The accounts of Frequent Ad, an agency that...Ch. 1 - Athena Riding Clubs financial statements follow.Ch. 1 - A list of financial statement items follows....Ch. 1 - Three independent sets of financial statements...Ch. 1 - Prob. 8APCh. 1 - Prob. 9APCh. 1 - Aqua Swimming Clubs financial statements follow....Ch. 1 - Costco Wholesale Corporation is Americas largest...Ch. 1 - Prob. 2CCh. 1 - Prob. 3CCh. 1 - Prob. 4CCh. 1 - Refer to the CVS annual report and the financial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that a German corporation exports electronic equipment to USA in a transaction denominated in dollar. Is this transaction a foreign currency transaction? Is it a foreign transaction? Explain the difference between these two concepts and their application here.arrow_forwardPlease answer this ONE question on Foreign Exchange markets Statoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. a) Statoil sold 1 million barrels of crude oil to the Norwegian petrol station chain, Circle K, today for 120 Nok per barrel (Nok denotes the Norwegian Krone). Statoil expects to receive the full payments from Circle K in 3 months’ time when the crude oil is delivered to Circle K’s facilities in Norway. Statoil is informed that Circle K will pay for the oil in Norwegian Krone. Ari is asked by the Chief Financial Officer (CFO) about the strategy to reduce the uncertainty around the expected payment from Circle K. Ari is faced with the following market…arrow_forwardStatoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. Answer the following two independent questions a) and b): Statoil sold 1 million barrels of crude oil to the Norwegian petrol station chain, Circle K, today for 120 Nok per barrel (Nok denotes the Norwegian Krone). Statoil expects to receive the full payments from Circle K in 3 months’ time when the crude oil is delivered to Circle K’s facilities in Norway. Statoil is informed that Circle K will pay for the oil in Norwegian Krone. Ari is asked by the Chief Financial Officer (CFO) about the strategy to reduce the uncertainty around the expected payment from Circle K. Ari is faced with the following market…arrow_forward

- Statoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. Answer the following two independent questions a) and b): a) Statoil sold 1 million barrels of crude oil to the Norwegianpetrol station chain, Circle K, today for 120 Nok per barrel (Nok denotes the Norwegian Krone). Statoil expects to receive the full payments from Circle K in 3 months’ timewhen the crude oil is delivered to Circle K’s facilities in Norway. Statoil is informed that Circle K will pay for the oil in Norwegian Krone. Ari is asked by the Chief Financial Officer (CFO) about the strategy to reduce the uncertainty around the expected payment from Circle K. Ari is faced with the following market…arrow_forwardStatoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. Answer the following two independent questions a) and b): a) Statoil sold 1 million barrels of crude oil to the Norwegianpetrol station chain, Circle K, today for 120 Nok per barrel (Nok denotes the Norwegian Krone). Statoil expects to receive the full payments from Circle K in 3 months’ time when the crude oil is delivered to Circle K’s facilities in Norway. Statoil is informed that Circle K will pay for the oil in Norwegian Krone. Ari is asked by the Chief Financial Officer (CFO) about the strategy to reduce the uncertainty around the expected payment from Circle K. Ari is faced with the following market…arrow_forwardSuppose a U.S. firm purchases some Chinese handicrafts. The china costs 1,000 Chinese yuan. At the exchange rate of $1.00 = 6.2 yuan, the dollar price of the goods is:arrow_forward

- If a U.S.-based company regularly purchases goods from foreign suppliers in Japan with the invoice price denominated in Japanese Yen. And if the U.S. company has experienced several foreign exchange losses due to the appreciation of the Japanese Yen. I am confused about which type of hedging instrument (Foreign currency forward contract or foreign currency option) the company should employ. Can you please help me to understand a justification for the selection? Maybe to illustrate, you can compare the advantages and disadvantages of using (Forward contracts) and (Options) to hedge foreign exchange risk.arrow_forwardStatoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates withinthe global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. Answer the following two independent questions a) and b):a) Statoil sold 1 million barrels of crude oil to the Norwegian petrol station chain, Circle K, today for 120 Nok per barrel (Nok denotes the Norwegian Krone). Statoil expects to receive the full payments from Circle K in 3 months’ time when the crude oil is delivered to Circle K’s facilities in Norway. Statoil is informed that Circle K will pay for the oil in Norwegian Krone. Ari is asked by the Chief Financial Officer (CFO) about the strategy to reduce the uncertainty around the expected payment from Circle K. Ari is faced with the following market…arrow_forwardStatoil, the national company in Norway, and is an active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. Answer the following two independent questions a) and b): Statoil sold 1 million barrels of crude oil to the Norwegian petrol station chain, Circle K, today for 120 Nok per barrel (Nok denotes the Norwegian Krone). Statoil expects to receive the full payments from Circle K in 3 months’ time when the crude oil is delivered to Circle K’s facilities in Norway. Statoil is informed that Circle K will pay for the oil in Norwegian Krone. Ari is asked by the Chief Financial Officer (CFO) about the strategy to reduce the uncertainty around the expected payment from Circle K. Ari is faced with the following market rates: Spot…arrow_forward

- Statoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar($), rather than the Norwegian krone(Nok), as its functional currency.Ari Karlsen is a currency trading strategist for Statoil. Answer the following question: In a daily meeting, the Chief Financial Officer (CFO) gave Ari the following table of market rate Spot exchange rate: Yen 106/$ U.S. dollar interest rateper annum 10% Japanese Yen interest rateper annum 6% and told Ari that the company’s financial analyst expected the Japanese Yen to depreciate against the U.S. dollar by 3.46%in 90 days.Assume there are 360 days in a year, and all interest rates are simple interest rates.If the financial analyst’s prediction about the US dollar and Japanese Yen turned out to be true: Required for part B 1) What would the…arrow_forwardStatoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. In a daily meeting, the Chief Financial Officer (CFO) gave Ari the following table of market rates: Spot exchange rate: Yen 106/$U.S. dollar interest rate: per annum 10%Japanese Yen interest rate: per annum 6% and told Ari that the company’s financial analyst expected the Japanese Yen to depreciate against the U.S. dollar by 3.46% in 90 days. Assume there are 360 days in a year, and all interest rates are simple interest rates. If the financial analyst’s prediction about the US dollar and Japanese Yen turned out to be true: What would the spot exchange rate (Yen/$) be in 90 days?arrow_forwardStatoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. In a daily meeting, the Chief Financial Officer (CFO) gave Ari the following table of market rates Spot exchange rate: Yen 106/$ U.S. dollar interest rate per annum 10% Japanese Yen interest rate per annum 6% and told Ari that the company’s financial analyst expected the Japanese Yen to depreciate against the U.S. dollar by 3.46% in 90 days. Assume there are 360 days in a year, and all interest rates are simple interest rates. If the financial analyst’s prediction about the US dollar and Japanese Yen turned out to be true: What would the spot exchange rate (Yen/$) be in 90 days?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License