Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 5MAD

Compare Papa John’s and Yum! Brands

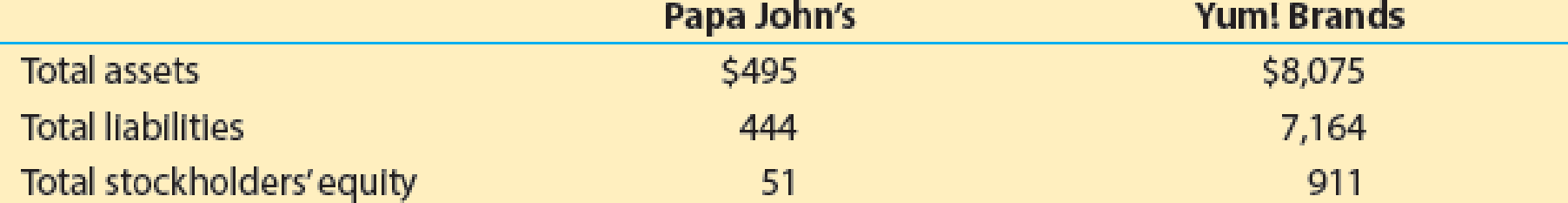

The following total liabilities and stockholders’ equity information (in millions) is provided for Papa John’s International, Inc. (PZZA) and Yum! Brands, Inc. (YUM) at the end of a recent year:

Yum! Brands is a much larger company than is Papa John’s; however, both companies compete internationally in the fast food business. Papa John’s is primarily in the carry-out and delivery pizza business, while Yum! Brands is in the quick-service restaurant business with its Pizza Hut, Taco Bell, and KFC brands.

- a. Compute the ratio of liabilities to stockholders’ equity for each company. Round to one decimal place.

- b. What conclusions regarding the margin of protection to creditors can you draw for these two companies?

- c. Which company is more risky to creditors?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following total liabilities and stockholders* equity information (in millions) is provided for Papa John's International, Inc. (PZZA) and Yum! Brands, Inc. (YUM) at the end of a recent year:

Yum! Brands is a much larger company than is Papa John's; however, both companies compete internationally in the fast food business. Papa John's is primarily in the carry-out and delivery pizza business, while Yum! Brands is in the quick-service restaurant business with its Pizza Hut, Taco Bell, and KFC brands.a. Compute the ratio of liabilities to stockholders' equity for each company. Round to one dec imal place.b. What conclusions regarding the margin of protection to creditors can you draw for these two companies?c. Which company is more risky to creditors?

Recent balance sheet information for two companies in the food industry, Santa Fe Company and Madrid Company, is as follows (in thousands):

Santa Fe

Madrid

Net property, plant, and equipment

$565,680

$773,920

Current liabilities

305,732

747,820

Long-term debt

697,672

696,528

Other long-term liabilities

245,128

270,872

Stockholders' equity

304,520

381,160

a. Determine the ratio of liabilities to stockholders' equity for both companies. Round your answers to one decimal place.

Santa Fe

fill in the blank 1

Madrid

fill in the blank 2

b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round your answers to one decimal place.

Santa Fe

fill in the blank 3

Madrid

fill in the blank 4

Recent balance sheet information for two companies in the food industry, Santa Fe Company and Madrid Company, is as follows (in thousands):

Santa Fe

Madrid

Net property, plant, and equipment

$428,320

$817,800

Current liabilities

104,441

471,040

Long-term debt

396,196

588,816

Other long-term liabilities

139,204

228,984

Stockholders' equity

172,930

322,210

a. Determine the ratio of liabilities to stockholders' equity for both companies. Round to one decimal place.

Santa Fe

Madrid

b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round to one decimal place.

Santa Fe

Madrid

Chapter 1 Solutions

Financial And Managerial Accounting

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Josh Reilly is the owner of Dispatch Delivery...Ch. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - A business had revenues of 640,000 and operating...Ch. 1 - The financial statements are interrelated. (A)...

Ch. 1 - Prob. 1BECh. 1 - Accounting equation Be-The-One is a motivational...Ch. 1 - Transactions Interstate Delivery Service is owned...Ch. 1 - Income statement The revenues and expenses of...Ch. 1 - Statement of stockholders equity Using the income...Ch. 1 - Balance sheet Using the following data for...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Ratio of liabilities to stockholders equity The...Ch. 1 - Prob. 1ECh. 1 - Prob. 2ECh. 1 - Prob. 3ECh. 1 - Accounting equation The total assets and total...Ch. 1 - Prob. 5ECh. 1 - Accounting equation Determine the missing amount...Ch. 1 - Accounting equation Inspirational Inc. is a...Ch. 1 - Asset, liability, and stockholders equity items...Ch. 1 - Effect of transactions on accounting equation What...Ch. 1 - Effect of transactions on accounting equation A. A...Ch. 1 - Effect of transactions on stockholders equity...Ch. 1 - Transactions The following selected transactions...Ch. 1 - Nature of transactions Teri West operates her own...Ch. 1 - Net income and dividends The income statement for...Ch. 1 - Net income and stockholders equity for four...Ch. 1 - Balance sheet items From the following list of...Ch. 1 - Income statement items Based on the data presented...Ch. 1 - Statement of stockholders equity Financial...Ch. 1 - Income statement Imaging Services was organized on...Ch. 1 - Prob. 20ECh. 1 - Balance sheets, net income Financial information...Ch. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Financial statements We-Sell Realty was organized...Ch. 1 - Transactions On April 1 of the current year,...Ch. 1 - Financial statements The assets and liabilities of...Ch. 1 - Financial statements Seth Feye established...Ch. 1 - Transactions; financial statements On August 1,...Ch. 1 - Transactions; financial statements DLite Dry...Ch. 1 - Missing amounts from financial statements The...Ch. 1 - Transactions Amy Austin established an insurance...Ch. 1 - PR 1-2 B Financial statements The assets and...Ch. 1 - Financial statements 1. Net income: 10,900 Jose...Ch. 1 - Transactions; financial statements 2. Net income:...Ch. 1 - Transactions; financial statements Bevs Dry...Ch. 1 - Missing amounts from financial statements The...Ch. 1 - Peyton Smith enjoys listening to all types of...Ch. 1 - Prob. 1MADCh. 1 - Analyze The Home Depot for three years The Home...Ch. 1 - Analyze Lowes for three years Lowes Companies,...Ch. 1 - Compare The Home Depot and Lowes Using your...Ch. 1 - Compare Papa Johns and Yum! Brands The following...Ch. 1 - Prob. 1TIFCh. 1 - Prob. 2TIFCh. 1 - Prob. 4TIFCh. 1 - Prob. 5TIFCh. 1 - Prob. 6TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyze and compare Bank of America and Wells Fargo Bank of America Corporation (BAC) and Wells Fargo Company (WFC) are two large financial services companies. The following data (in millions) were taken from a recent years financial statements for both companies: a. Compute the earnings per share for both companies. Round to the nearest cent. a. Which company appears to be more profitable on an earnings-per-share basis? b. Which company would you expect to have the larger quoted market price?arrow_forwardMike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the companys financial statements for the 2 most recent years. Required: Note: Round all answers to two decimal places. 1. Compute the following for each year: (a) return on assets, (b) return on stockholders equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f ) dividend payout ratio. 2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?arrow_forwardSuppose the years 2005 to 2009 were a period of rapid growth for a certain chain of coffeehouses and the company's revenues grew by more than 50% during that period. Use the hypothetical financial data for the company to answer the questions. Selected Financial Data (In millions, except earnings per share) As of and for the fiscal year ended Sept. 27,2009(52 wks) Sept. 28,2008(52 wks) Sept. 30,2007(52 wks) Oct. 1,2006(52 wks) Oct. 2,2005(52 wks) Results of Operations Net revenues: Company-operated retail $8,090.1 $8,671.9 $7,918.3 $6,453.1 $5,301.9 Specialty: Licensing 1,222.3 1,171.6 1,026.3 860.6 673.0 Food service and other 372.2 439.5 386.9 343.2 304.4 Total specialty 1,594.5 1,611.1 1,413.2 1,203.8 977.4 Total net revenues $9,684.6 $10,283.0 $9,331.5 $7,656.9 $6,279.3 Operating income $562.0 $503.9 $1,053.9 $894.0 $780.5 Earnings before cumulative effect of change in accounting principle 510.8 415.5 772.6 691.5 624.4 Cumulative…arrow_forward

- Suppose the years 2005 to 2009 were a period of rapid growth for a certain chain of coffeehouses and the company's revenues grew by more than 50% during that period. Use the hypothetical financial data for the company to answer the questions. Selected Financial Data (In millions, except earnings per share) As of and for the fiscal year ended Sept. 27,2009(52 wks) Sept. 28,2008(52 wks) Sept. 30,2007(52 wks) Oct. 1,2006(52 wks) Oct. 2,2005(52 wks) Results of Operations Net revenues: Company-operated retail $8,110.1 $8,691.9 $7,888.3 $6,463.1 $5,261.9 Specialty: Licensing 1,222.3 1,171.6 1,026.3 860.6 673.0 Food service and other 372.2 439.5 386.9 343.2 304.4 Total specialty 1,594.5 1,611.1 1,413.2 1,203.8 977.4 Total net revenues $9,704.6 $10,303.0 $9,301.5 $7,666.9 $6,239.3 Operating income $562.0 $503.9 $1,053.9 $894.0 $780.5 Earnings before cumulative effect of change in accounting principle 520.8 395.5 782.6 691.5 584.4 Cumulative…arrow_forwardSuppose the years 2005 to 2009 were a period of rapid growth for a certain chain of coffeehouses and the company's revenues grew by more than 50% during that period. Use the hypothetical financial data for the company to answer the questions. Selected Financial Data (In millions, except earnings per share) As of and for the fiscal year ended Sept. 27,2009(52 wks) Sept. 28,2008(52 wks) Sept. 30,2007(52 wks) Oct. 1,2006(52 wks) Oct. 2,2005(52 wks) Results of Operations Net revenues: Company-operated retail $8,110.1 $8,691.9 $7,888.3 $6,463.1 $5,261.9 Specialty: Licensing 1,222.3 1,171.6 1,026.3 860.6 673.0 Food service and other 372.2 439.5 386.9 343.2 304.4 Total specialty 1,594.5 1,611.1 1,413.2 1,203.8 977.4 Total net revenues $9,704.6 $10,303.0 $9,301.5 $7,666.9 $6,239.3 Operating income $562.0 $503.9 $1,053.9 $894.0 $780.5 Earnings before cumulative effect of change in accounting principle 520.8 395.5 782.6 691.5 584.4 Cumulative…arrow_forwardSuppose the years 2005 to 2009 were a period of rapid growth for a certain chain of coffeehouses and the company's revenues grew by more than 50% during that period. Use the hypothetical financial data for the company to answer the questions. Selected Financial Data (In millions, except earnings per share) As of and for the fiscal year ended Sept. 27,2009(52 wks) Sept. 28,2008(52 wks) Sept. 30,2007(52 wks) Oct. 1,2006(52 wks) Oct. 2,2005(52 wks) Results of Operations Net revenues: Company-operated retail $8,090.1 $8,671.9 $7,918.3 $6,453.1 $5,301.9 Specialty: Licensing 1,222.3 1,171.6 1,026.3 860.6 673.0 Food service and other 372.2 439.5 386.9 343.2 304.4 Total specialty 1,594.5 1,611.1 1,413.2 1,203.8 977.4 Total net revenues $9,684.6 $10,283.0 $9,331.5 $7,656.9 $6,279.3 Operating income $562.0 $503.9 $1,053.9 $894.0 $780.5 Earnings before cumulative effect of change in accounting principle 510.8 415.5 772.6 691.5 624.4 Cumulative…arrow_forward

- Wendy’s International, Inc., and McDonald’s Corporation, two leading fast-food chains, are classified in SIC code 5812—Eating Places. Recent results for each company, along with industry averages, follow. Wendy’s McDonald’s Industry Average Return on assets 7.7 % 9.9 % 6.4 % Return on common stockholders’equity 11.9 % 17.7 % 14.0 % Net income as a percentage of sales 7.4 % 12.7 % 2.9 % Debt-to-equity ratio 0.67 0.98 1.04 How do Wendy’s and McDonald’s compare to the industry averages? Based on your analysis, would you consider these two companies to be industry leaders? Why or why not? The industry data reported here represent Dun and Bradstreet’s industry median. Dun and Bradstreet also reports industry norms for the upper quartile (top 25%) of companies in the industry. In the top quartile, return on assets was 15.1%, return on common stockholders’ equity was 34.7%,…arrow_forwardUse the information provided below to answer the question. The ratios are for last year, for ABC Inc and the average of its industry as follows ABC Inc Industry Average Inventory $150,000 $100,000 Accounts Receivable 24,000 24,000 Other Assets 76,000 76,000 Total Assets $250,000 $200,000 Profit Margin 1.8% 2% Equity $ 125,000 $ 125,000 Sales $ 1,100,000 $ 1,000,000 What is ABC’s Return on Equity (ROE)?arrow_forwardCompute the values of each of the ratios in Exhibit 5.27 for Starbucks for 2012. Starbucks had 749.3 million common shares outstanding at the end of fiscal 2012, and the market price per share was 50.71. For days accounts receivable outstanding, use only specialty revenues in your calculations, because accounts receivable are primarily related to licensing and food service operations, not the retail operations.arrow_forward

- Neiman Marcus Group (NMG) is one of the largest luxury fashion retailers in the world. Kohls Corporation (KSS) sells moderately priced private and national branded products through more than 1,100 department stores located throughout the United States. The current assets and current liabilities at the end of a recent year for both companies are as follows (in millions): a. Would an analysis of working capital between the two companies be meaningful? Explain. b. Compute the quick ratio for both companies. Round to one decimal place. c. Interpret your results.arrow_forwardFor a recent year, OfficeMax and Staples are two companies competing in the retail office supply business. OfficeMax had a net income of 34,894,000, while Staples had a net loss of 210,706,000. OfficeMax had preferred stock of 28,726,000 with preferred dividends of 2,123,000. Staples had no preferred stock. The average outstanding common shares for each company were as follows: a. Determine the earnings per share for each company. Round to the nearest cent. b. Evaluate the relative profitability of the two companies.arrow_forwardJCPenney operates a chain of retail department stores, selling apparel, shoes, jewelry, and home furnishings. It also offers most of its products through catalog distribution. During fiscal Year 5, it sold Eckerd Drugs, a chain of retail drugstores, and used the cash proceeds, in part, to repurchase shares of its common stock. Exhibit 4.27 presents selected data for JCPenney for fiscal Year 3, Year 4, and Year 5. REQUIRED a. Calculate the rate of ROA for fiscal Year 3, Year 4, and Year 5. Disaggregate ROA into the profit margin for ROA and total assets turnover components. The income tax rate is 35%. b. Calculate the rate of ROCE for fiscal Year 3, Year 4, and Year 5. Disaggregate ROCE into the profit margin for ROCE, assets turnover, and capital structure leverage components. c. Suggest reasons for the changes in ROCE over the three years. d. Compute the ratio of ROCE to ROA for each year. e. Calculate the amount of net income available to common stockholders derived from the use of financial leverage with respect to creditors capital, the amount derived from the use of preferred shareholders capital, and the amount derived from common shareholders capital for each year. f. Did financial leverage work to the advantage of the common shareholders in each of the three years? Explain. Exhibit 4.27arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License