Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 6PEB

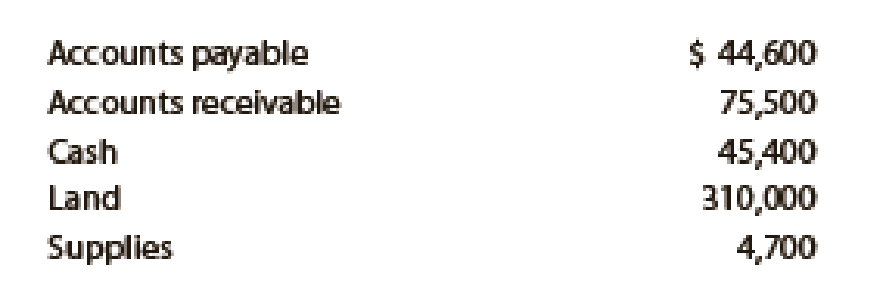

Using the following data for Sentinel Travel Service as well as the statement of owner’s equity shown in Practice Exercise 1-5B, prepare a report form balance sheet as of August 31, 2019:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

prepare a balance sheet using the following information for Mike consulting as of january 31,2019

Bamboo Consulting is a consulting firm owned and operated by Lisa Gooch. Thefollowing end-of-period spreadsheet was prepared for the year ended July 31, 2019:Based on the preceding spreadsheet, prepare an income statement, statement ofowner’s equity, and balance sheet for Bamboo Consulting

Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2019, are as follows

Prepare a statement of owner’s equity for the year.

Chapter 1 Solutions

Financial Accounting

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Josh Reilly is the owner of Dispatch Delivery...Ch. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - A business had revenues of 640,000 and operating...Ch. 1 - The financial statements are interrelated. (a)...

Ch. 1 - On February 3, Clairemont Repair Service extended...Ch. 1 - On March 31, Higgins Repair Service extended an...Ch. 1 - Terry Fleming is the owner and operator of...Ch. 1 - Fritz Evans is the owner and operator of...Ch. 1 - Bridgeport Delivery Service is owned and operated...Ch. 1 - Interstate Delivery Service is owned and operated...Ch. 1 - The revenues and expenses of Adventure Travel...Ch. 1 - The revenues and expenses of Sentinel Travel...Ch. 1 - Using the income statement for Adventure Travel...Ch. 1 - Using the income statement for Sentinel Travel...Ch. 1 - Using the following data for Adventure Travel...Ch. 1 - Using the following data for Sentinel Travel...Ch. 1 - A summary of cash flows for Adventure Travel...Ch. 1 - A summary of cash flows for Sentinel Travel...Ch. 1 - The following data were taken from Mesa Companys...Ch. 1 - The following data were taken from Alvarado...Ch. 1 - The following is a list of well-known companies:...Ch. 1 - A fertilizer manufacturing company wants to...Ch. 1 - Prob. 3ECh. 1 - Prob. 4ECh. 1 - The total assets and total liabilities (in...Ch. 1 - Determine the missing amount for each of the...Ch. 1 - Annie Rasmussen is the owner and operator of Go44,...Ch. 1 - Indicate whether each of the following is...Ch. 1 - Describe how the following business transactions...Ch. 1 - Prob. 10ECh. 1 - Indicate whether each of the following types of...Ch. 1 - The following selected transactions were completed...Ch. 1 - Teri West operates her own catering service....Ch. 1 - The income statement of a proprietorship for the...Ch. 1 - Four different proprietorships, Jupiter, Mars,...Ch. 1 - From the following list of selected items taken...Ch. 1 - From the following list of selected items taken...Ch. 1 - Financial information related to Udder Products...Ch. 1 - Dairy Services was organized on August 1, 2019. A...Ch. 1 - One item is omitted in each of the following...Ch. 1 - Prob. 21ECh. 1 - Prob. 22ECh. 1 - Indicate whether each of the following activities...Ch. 1 - A summary of cash flows for Ethos Consulting Group...Ch. 1 - We-Sell Realty, organized August 1, 2019, is owned...Ch. 1 - Prob. 26ECh. 1 - Prob. 27ECh. 1 - On June 1 of the current year, Chad Wilson...Ch. 1 - The amounts of the assets and liabilities of...Ch. 1 - Seth Feye established Reliance Financial Services...Ch. 1 - Prob. 4PACh. 1 - DLite Dry Cleaners is owned and operated by Joel...Ch. 1 - The financial statements at the end of Wolverine...Ch. 1 - Amy Austin established an insurance agency on...Ch. 1 - The amounts of the assets and liabilities of...Ch. 1 - Jose Loder established Bronco Consulting on August...Ch. 1 - On April 1, 2019, Maria Adams established Custom...Ch. 1 - Bevs Dry Cleaners is owned and operated by Beverly...Ch. 1 - The financial statements at the end of Atlas...Ch. 1 - Peyton Smith enjoys listening to all types of...Ch. 1 - Marco Brolo is one of three partners who own and...Ch. 1 - Colleen Fernandez, president of Rhino Enterprises,...Ch. 1 - Prob. 4CPCh. 1 - Prob. 5CPCh. 1 - Prob. 6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following data for Adventure Travel Service as well as the statement of owners equity shown in Practice Exercise 1-5A, prepare a report form balance sheet as of April 30, 2019:arrow_forwardUsing the following data for Sentinel Travel Service as well as the statement of owners equity shown in Practice Exercise 1-5B, prepare a balance sheet as of August 31, 2016:arrow_forwardFinancial information related to Udder Products Company, a proprietorship, for the month ended April 30, 2019, is as follows: a. Prepare a statement of owners equity for the month ended April 30, 2019. b. Why is the statement of owners equity prepared before the April 30, 2019, balance sheet?arrow_forward

- Prepare a balance sheet using the following information for Mikes Consulting as of January 31, 2019.arrow_forwardUsing the following data for Ousel Travel Service as well as the statement of owners equity shown in Practice Exercise 1-5A, prepare a balance sheet as of November 30, 2016:arrow_forwardSelected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2019, are as follows: Prepare a statement of owners equity for the year.arrow_forward

- Prepare a balance sheet using the following information for the Ginger Company as of March 31, 2019.arrow_forwardKelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closingtrial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a twocolumn journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forward

- Prepare a statement of owners equity using the following information for the Can Due Shop for the month of September 2018.arrow_forwardJose Loder established Bronco Consulting on August 1, 2019. The effect of each transaction and the balances after each transaction for August follow: Instructions 1. Prepare an income statement for the month ended August 31, 2019. 2. Prepare a statement of owners equity for the month ended August 31, 2019. 3. Prepare a balance sheet as of August 31, 2019. 4. (Optional) Prepare a statement of cash flows for the month ending August 31, 2019.arrow_forwardApex Systems Co. offers its services to residents in the Seattle area. Selected accounts from the ledger of Apex Systems Co. for the fiscal year ended December 31, 2016, are as follows: Prepare a statement of owners equity for the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License