1.

Journalize the transactions using special journals for August.

1.

Explanation of Solution

Special journal: It is a book which records some specific kinds of transactions such as cash receipts, cash payments, credit sales, and credit purchases. Special journal is created for any kind of transaction. A business uses special journals depending on the types of transactions that occur most repeatedly. If a specific type of transactions occur often, it is more likely a special journal of that type would be beneficial for the business.

Journalize the transactions using special journals.

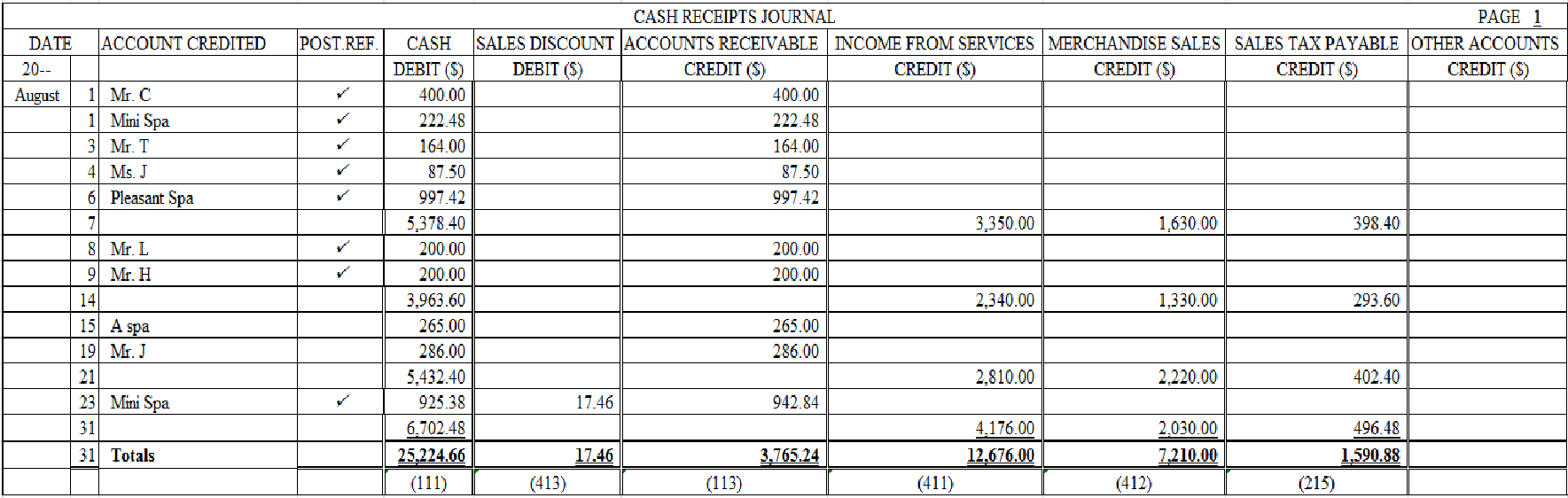

- Cash Receipts Journal

Table (1)

Equality of debits and credits for cash receipts journal.

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 25224.66 | 3765.24 |

| 17.46 | 12,676.00 |

| 7,210.00 | |

| 1,590.88 | |

| $25,242.12 | $25,242.12 |

Table (2)

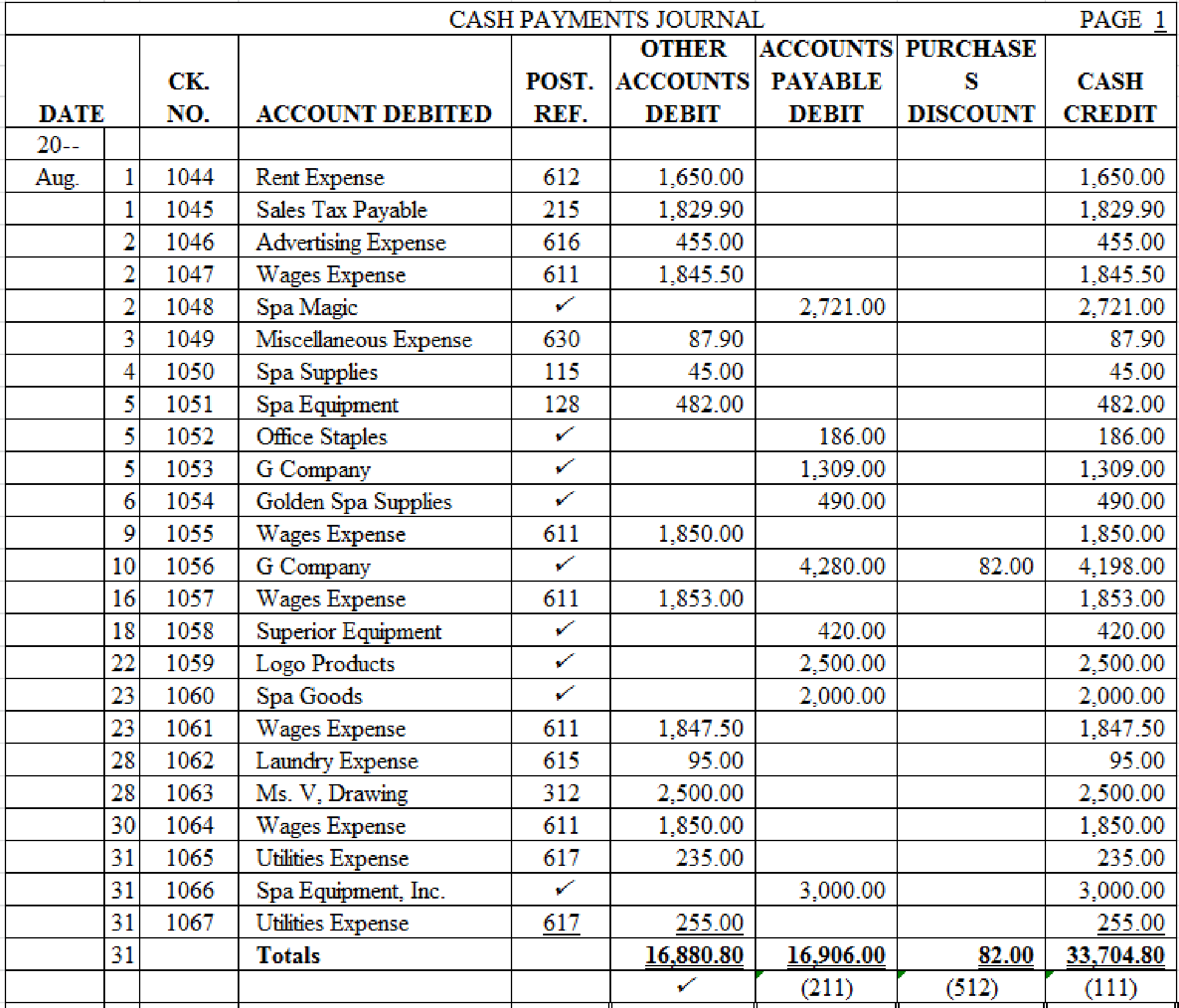

- Cash Payments Journal

Table (3)

Equality of debits and credits for cash payments journal:

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 16,649.66 | 33,867.7 |

| 17,300 | 82.00 |

| 33,949.66 | 33,949.66 |

Table (4)

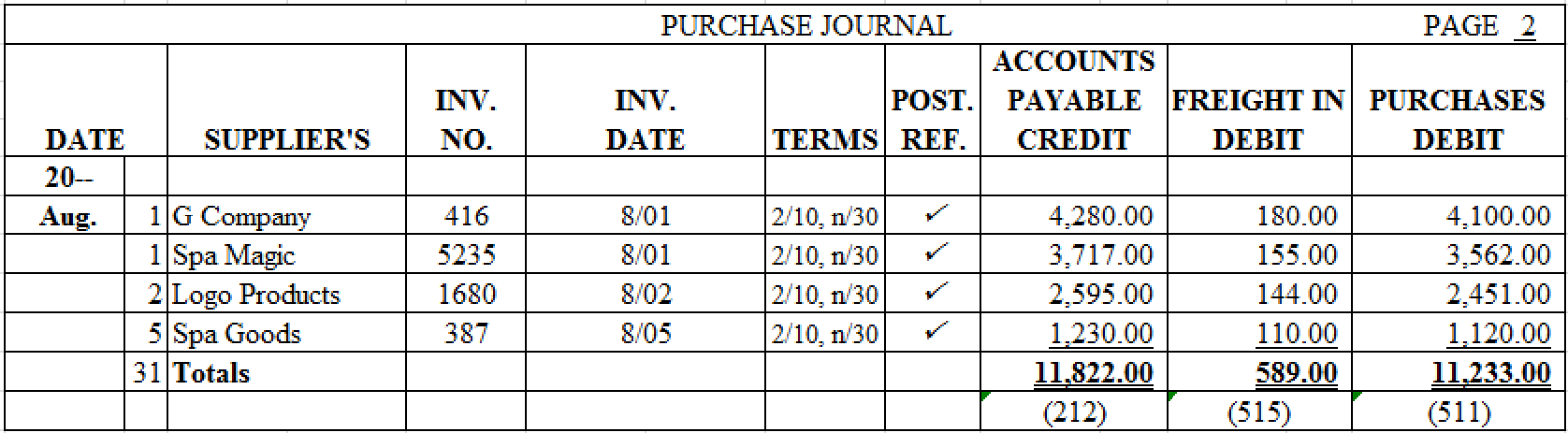

- Purchase Journal

Table (5)

Equality of debits and credits for purchase journal:

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 16,880 | 33704.80 |

| 16,906 | 82.00 |

| 33,786.80 | 33,786.80 |

Table (6)

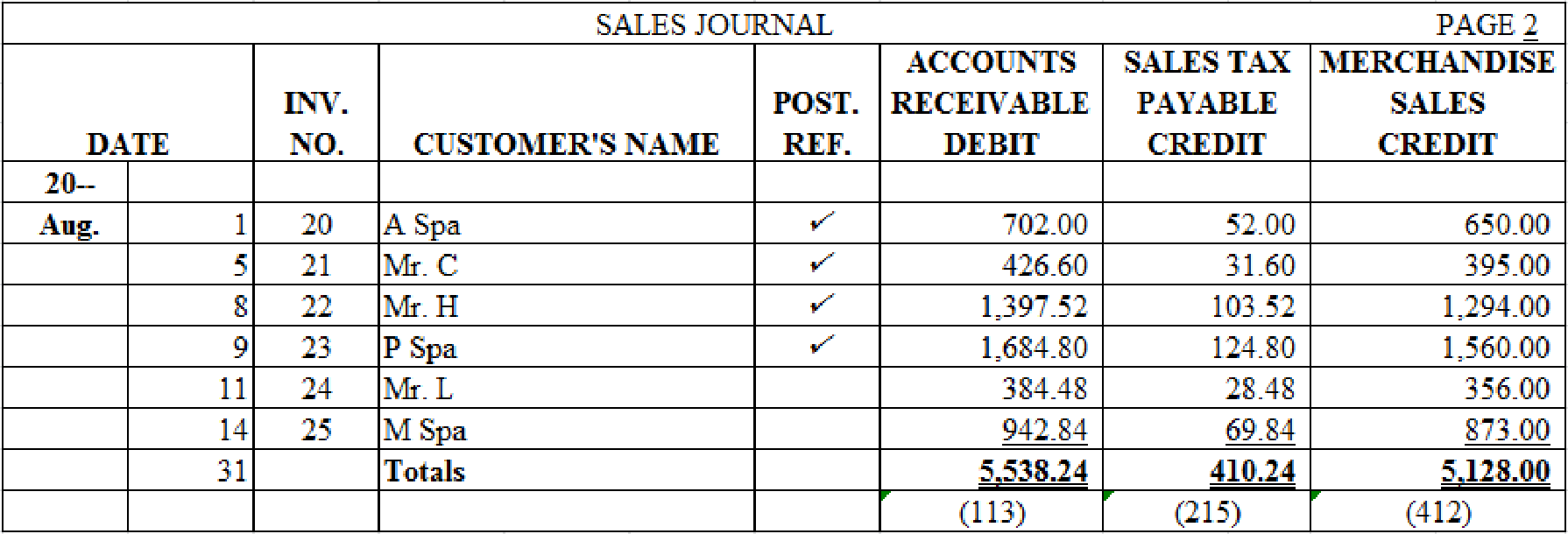

- Sales Journal

Table (7)

Equality of debits and credits for sales journal:

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 5,538.24 | 410.24 |

| 5,128.00 | |

| 5,538.24 | 5,538.24 |

Table (8)

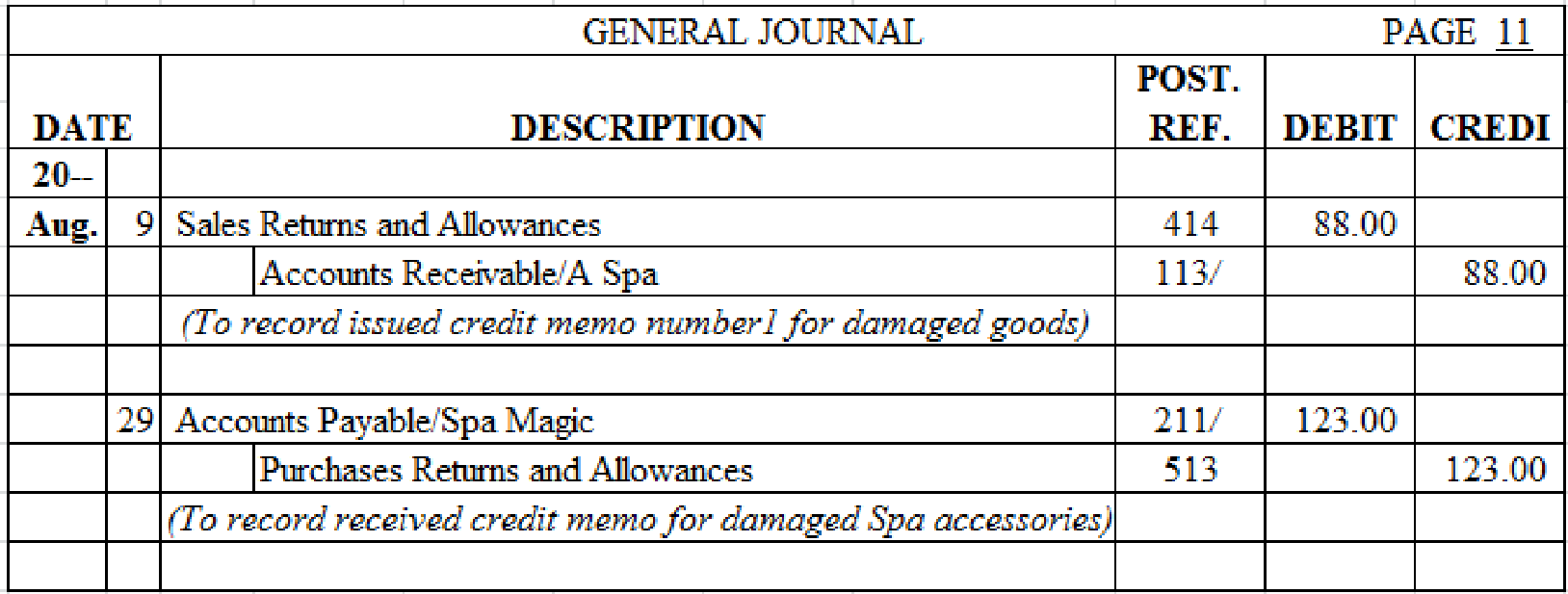

- General Journal

Table (9)

2.

Post the entries to the accounts receivable, accounts payable and general ledger.

2.

Explanation of Solution

Account receivable: The amount of money to be received by a company for the sale of goods and services to the customers is referred to as account receivable.

Account payable: The amount of money owned by a company to its creditor is referred to as accounts payable.

General ledger: General ledger is a record of all accounts of assets, liabilities, and

- Accounts Receivable Ledger

| Accounts Receivable Ledger | ||||||

| Name: A Spa | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 521.59 | ||

| August | 1 | S2 | 702.00 | 1,223.59 | ||

| 9 | J11 | 88.00 | 1,135.59 | |||

| 15 | CR1 | 265.00 | 870.59 | |||

| Name: Mr. J | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 175.00 | ||

| 4 | CR1 | 87.50 | 87.50 | |||

| Name: Mr. C | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 520.02 | ||

| August | 1 | CR1 | 400.00 | 120.02 | ||

| 5 | S2 | 426.60 | 546.62 | |||

| Name: Mr. T | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 164 | ||

| 3 | CR1 | 164 | 0 | |||

| Name: Mr. L | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 351 | ||

| 8 | CR1 | 200 | 151 | |||

| 11 | S2 | 384.48 | 535 | |||

| Name: Mini Spa | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 222 | ||

| 1 | CR1 | 222.48 | — | |||

| 14 | S2 | 942.84 | 942.84 | |||

| 23 | S2 | 942.84 | — | |||

| Name: Mr. J | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 286 | ||

| 19 | CR1 | 286 | ||||

| Name: Pleasant Spa | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 1,961 | ||

| 6 | CR1 | 997.00 | 963.81 | |||

| 9 | S2 | 1,684.80 | 2,648.61 | |||

| Name: Ms. J | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

Table (10)

- Accounts Payable Ledger

| Accounts Payable Ledger | ||||||

| Name: A company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| Name: G company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 1,309.00 | ||

| 1 | P2 | 4,280.00 | 5,589.00 | |||

| 5 | CP1 | 1,309.00 | 4,280.00 | |||

| 10 | CP1 | 4,280.00 | ||||

| Name: G spa supplies | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 490 | ||

| 6 | CP1 | 490 | ||||

| Name: Logo products | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 3,796 | ||

| August | 2 | P2 | 2,595 | 6,391 | ||

| 22 | CP1 | 2,500 | 3,891 | |||

| Name: Office staples | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 304.00 | ||

| 5 | CP1 | 186.00 | 118.00 | |||

| Name: Spa equipment, Inc. | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 6,235 | ||

| 5 | CP1 | 3,000 | 3,235 | |||

| Name: Spa goods | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 27,221 | ||

| August | 1 | P2 | 3,717 | 6,438 | ||

| 2 | CP1 | 2,721 | 3,717 | |||

| 29 | J11 | 123 | 3,594 | |||

| Name: Superior equipment | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 420 | ||

| 5 | CP1 | 420 | ||||

Table (11)

- General Ledger

| General ledger | ||||||||

| Account: Cash | Account No:111 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | 25,224.66 | 70,193.92 | ||||

| 31 | CP1 | 33,704.80 | 36,489.12 | |||||

| Account: Accounts receivable | Account No:113 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | CR1 | 3,765.24 | 715.55 | |||

| 31 | S2 | S2 | 6,253.79 | |||||

| Account: Office Supplies | Account No:114 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 248.00 | ||||

| Account: Spa Supplies | Account No:115 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 695.00 | ||||

| 4 | J12 | 45 | 740.00 | |||||

| Account: Prepaid insurance | Account No:116 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 800 | ||||

| Account: Office Equipment | Account No:121 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 1,570.00 | ||||

| Account: | Account No:129 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 10.00 | ||||

| Account: Spa Equipment | Account No:128 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 17,601.00 | ||||

| 5 | J11 | 482 | 18,083.00 | |||||

| Account: Accumulated Depreciation, Spa Equipment | Account No:129 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 64.88 | ||||

| Account: Accounts Payable | Account No:211 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CP1 | 16,906.00 | 3,691.00 | ||||

| 31 | P2 | 11,822.00 | 15,513.00 | |||||

| Account: Wages Payable | Account No:212 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| Account: Sales Tax Payable | Account No:215 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | 1,590.88 | 1,590.88 | ||||

| 31 | S2 | 410.24 | 2,001.12 | |||||

| Account: Ms. V, Capital | Account No:311 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 50,219.62 | ||||

| Account: Ms. V, Drawing | Account No:312 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 2,500.00 | ||||

| 28 | CP1 | 2,500.00 | 5,000.00 | |||||

| Account: Income Summary | Account No:313 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Income from Service | Account No:411 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| 31 | CR1 | 12,676.00 | 25,398.00 | |||||

| Account: Merchandise Sales | Account No:411 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | 7,210.00 | 17,361.65 | ||||

| 31 | S2 | 5,128.00 | 22,489.65 | |||||

| Account: Sales discounts | Account No:413 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 23 | CR1 | 17.46 | 17.46 | ||||

| Account: Sales return and allowance | Account No:414 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 9 | J11 | 88 | 88 | ||||

| Account: Purchases | Account No:511 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | P2 | 11,233 | 11,233 | ||||

| Account: Purchase discount | Account No:512 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 10 | CP1 | 82 | 82 | ||||

| Account: Purchase returns and allowances | Account No:513 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 29 | J11 | 123 | 123 | ||||

| Account: Freight in | Account No:515 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | P2 | 589 | 992 | ||||

| Account: Wages expense | Account No:611 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 7,004.00 | ||||

| 2 | CP1 | 1,845.50 | 8,849.50 | |||||

| 9 | CP1 | 1,850.00 | 10,699.50 | |||||

| 16 | CP1 | 1,853.00 | 12,552.50 | |||||

| 23 | CP1 | 1,847.50 | 14,400.00 | |||||

| 30 | CP1 | 1,850.00 | 16,250.00 | |||||

| Account: Rent expense | Account No:612 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 1,650.00 | ||||

| 1 | CP1 | 1,650.00 | 3,300.00 | |||||

| Account: Office supplies expense | Account No:613 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Spa supplies expense | Account No:614 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Laundry expense | Account No:615 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | ✓ | 84 | |||||

| 28 | CP1 | 95 | 179 | |||||

| Account: Advertising expense | Account No:616 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 2 | CP1 | 455 | 455 | ||||

| Account: Utilities expense | Account No:617 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 473 | ||||

| 31 | CP1 | 235 | 708 | |||||

| 31 | CP1 | 235 | 963.00 | |||||

| Account: Insurance expense | Account No:618 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Depreciation expense, Office Equipment | Account No:619 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | ||||||||

| Account: Depreciation expense, Spa Equipment | Account No:620 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | ||||||||

| Account: Miscellaneous expense | Account No:630 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 284 | ||||

| 3 | CP1 | 87.9 | 371.9 | |||||

Table (12)

3.

Prepare a

3.

Explanation of Solution

Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the

Prepare a trial balance.

| A Spa | ||

| Trail balance | ||

| August 31, 20__ | ||

| Account Name | Debit ($) | Credit($) |

| Cash | 36,489.12 | |

| Accounts Receivable | 6,253.79 | |

| Office Supplies | 248.00 | |

| Spa Supplies | 740.00 | |

| Prepaid Insurance | 800.00 | |

| Office Equipment | 1,570.00 | |

| Accumulated | 10.00 | |

| Spa Equipment | 18,083.00 | |

| Accumulated Depreciation, Spa Equipment | 64.88 | |

| Accounts Payable | 15,513.00 | |

| Sales Tax Payable | 2,001.12 | |

| A. V, Capital | 50,219.62 | |

| A. V, Drawing | 5,000.00 | |

| Income from Services | 25,398.00 | |

| Merchandise Sales | 22,489.65 | |

| Sales Discounts | 17.46 | |

| Sales Returns and Allowances | 88.00 | |

| Purchases | 24,101.00 | |

| Purchases Discounts | 82.00 | |

| Purchases Returns and Allowances | 123.00 | |

| Freight In | 992.00 | |

| Wages Expense | 16,250.00 | |

| Rent Expense | 3,300.00 | |

| Laundry Expense | 179.00 | |

| Advertising Expense | 455.00 | |

| Utilities Expense | 963.00 | |

| Miscellaneous Expense | 371.90 | |

| Totals | 115,901.27 | 115,901.27 |

Table (13)

4.

Prepare a schedule of accounts receivable for 31st August.

4.

Explanation of Solution

Accounts receivable schedule: This is the schedule which is prepared to verify that the total balances of all the customers in the accounts receivable ledger, equals the balance of Accounts Receivable in the general ledger.

Schedule of accounts receivable:

| A Spa | ||

| Schedule of Accounts Receivable | ||

| August 31, 20__ | ||

| Particulars | Amount($) | |

| A Spa | 870.59 | |

| Mr. J | 87.50 | |

| Mr. C | 546.62 | |

| Mr. H | 1,564.99 | |

| Mr. L | 535.48 | |

| Pleasant Spa | 2,648.61 | |

| Total accounts receivable | 6,253.79 | |

Table (14)

Therefore, the total accounts receivable is $6,253.79.

5.

Prepare a schedule of accounts payable for 31st August.

5.

Explanation of Solution

Schedule of accounts payable: This is the schedule which is prepared to verify that the total balances of all the suppliers in the accounts payable ledger, equals the balance of Accounts Payable in the general ledger.

Schedule of accounts payable:

| A Spa | ||

| Schedule of Accounts Payable | ||

| August 31, 20__ | ||

| Particulars | Amount($) | |

| Logo products | 3,891.00 | |

| Office staples | 118.00 | |

| Spa equipment, Inc. | 3,235.00 | |

| Spa goods | 4,675.00 | |

| Spa magic | 3,594.00 | |

| Total accounts payable | 15,513.00 | |

Table (15)

Therefore, the total accounts payable is $15,513.

Want to see more full solutions like this?

Chapter 10 Solutions

College Accounting (Book Only): A Career Approach

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a general journal, page 1. Assume the periodic inventory method is used. If using QuickBooks, record transactions using either the journal entry method or the forms-based approach as directed by your instructor. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. If using QuickBooks or general ledger, ignore Steps 2, 3, and 4. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable (A/R Aging Detail report in QuickBooks) and a schedule of accounts payable (A/P Summary Detail report in QuickBooks). Do the totals equal the balances of the related controlling accounts?arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardTransactions related to purchases and cash payments completed by Wisk Away Cleaning Services Inc. during the month of May 20Y5 are as follows: Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those illustrated in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Wisk Away Cleaning Services Inc. uses the following accounts:arrow_forward

- Transactions related to revenue and cash receipts completed by Sycamore Inc. during the month of March 20Y8 are as follows: Prepare a single-column revenue journal and a cash receipts journal to record these transactions. Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. Place a check mark () in the Post. Ref. column to indicate when the accounts receivable subsidiary ledger should be posted.arrow_forwardThe following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a general journal, page 1. Assume the periodic inventory method is used. If using QuickBooks, record transactions using either the journal entry method or the forms-based approach, as directed by your instructor. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable (A/R Aging Detail report in QuickBooks) and a schedule of accounts payable (A/P Aging Detail report in QuickBooks). Do the totals equal the balances of the related controlling accounts? If using QuickBooks or general ledger, ignore Steps 2, 3, and 4.arrow_forwardThe following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forward

- CASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. REQUIRED 1. Record the transactions starting on page 20 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardHappy Tails Inc. has a September 1, 20Y4, accounts payable balance of 620, which consists of 320 due Labradore Inc. and 300 due Meow Mart Inc. Transactions related to purchases and cash payments completed by Happy Tails Inc. during the month of September 20Y4 are as follows: a. Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those used in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Happy Tails Inc. uses the following accounts: b. Prepare a listing of accounts payable creditor balances on September 30, 20Y4. Verify that the total of the accounts payable creditor balances equals the balance of the accounts payable controlling account on September 30, 20Y4. c. Why does Happy Tails Inc. use a subsidiary ledger for accounts payable?arrow_forwardCASH PAYMENTS TRANSACTIONS Kay Zembrowski operates a retail variety store. The books include a general journal and an accounts payable ledger. Selected account balances on May 1 are as follows: The following transactions are related to cash payments for the month of May: May 1Issued Check No. 326 in payment of May rent (Rent Expense), 2,600. 4Issued Check No. 327 to Cortez Distributors in payment of merchandise purchased on account, 4,200, less a 3% discount. Check was written for 4,074. 7Issued Check No. 328 to Indra Velga in partial payment of merchandise purchased on account, 6,200. A cash discount was not allowed. 11Issued Check No. 329 to Toy Corner for merchandise purchased on account, 4,600, less a 1% discount. Check was written for 4,554. 15Issued Check No. 330 to County Power and Light (Utilities Expense), 1,500. 19Issued Check No. 331 to Builders Warehouse for a cash purchase of merchandise, 3,500. 25Issued Check No. 332 to Troutman Outlet for merchandise purchased on account, 4,400, less a 2% discount. Check was written for 4,312. May 30Issued Check No. 333 to Rapid Transit Company for freight charges on merchandise purchased (Freight-In), 800. 31Issued Check No. 334 to City Merchants for a cash purchase of merchandise, 2,350. Required 1. Enter the transactions starting with page 9 of a general journal. 2. Post from the general journal to the general ledger and the accounts payable ledger. Use general ledger account numbers as shown in the chapter.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning