Geoff and Sandy Harland own and operate Wayward Kennel and Pet Supply. Their motto is, “If your pet is not becoming to you, he should be coming to us.” The Harlands maintain a sales tax payable account throughout the month to account for the 6% sales tax. They use a general journal, general ledger, and accounts receivable ledger. The following sales and cash collections took place during the month of September:

Sept. 2 Sold a fish aquarium on account to Ken Shank, $125 plus tax of $7.50, terms n/30. Sale No. 101.

3 Sold dog food on account to Nancy Truelove, $68.25 plus tax of $4.10, terms n/30. Sale No. 102.

5 Sold a bird cage on account to Jean Warkentin, $43.95 plus tax of $2.64, terms n/30. Sale No. 103.

8 Cash sales for the week were $2,332.45 plus tax of $139.95.

10 Received cash for boarding and grooming services, $625 plus tax of $37.50.

11 Jean Warkentin stopped by the store to point out a minor defect in the bird cage purchased in Sale No. 103. The Harlands offered a sales allowance of $10 plus tax on the price of the cage which satisfied Warkentin.

12 Sold a cockatoo on account to Tully Shaw, $1,200 plus tax of $72, terms n/30. Sale No. 104.

14 Received cash on account from Rosa Alanso, $256.

15 Rosa Alanso returned merchandise, $93.28 including tax of $5.28.

15 Cash sales for the week were $2,656.85 plus tax of $159.41.

16 Received cash on account from Nancy Truelove, $58.25.

18 Received cash for boarding and grooming services, $535 plus tax of $32.10.

19 Received cash on account from Ed Cochran, $63.25.

20 Sold pet supplies on account to Susan Hays, $83.33 plus tax of $5, terms n/30. Sale No. 105.

21 Sold three Labrador Retriever puppies to All American Day Camp, $375 plus tax of $22.50, terms n/30. Sale No. 106.

22 Cash sales for the week were $3,122.45 plus tax of $187.35.

23 Received cash for boarding and grooming services, $515 plus tax of $30.90.

25 Received cash on account from Ken Shank, $132.50.

26 Received cash on account from Nancy Truelove, $72.35.

27 Received cash on account from Joe Gloy, $273.25.

28 Borrowed cash to purchase a pet limousine, $11,000.

29 Cash sales for the week were $2,835.45 plus tax of $170.13.

30 Received cash for boarding and grooming services, $488 plus tax of $29.28.

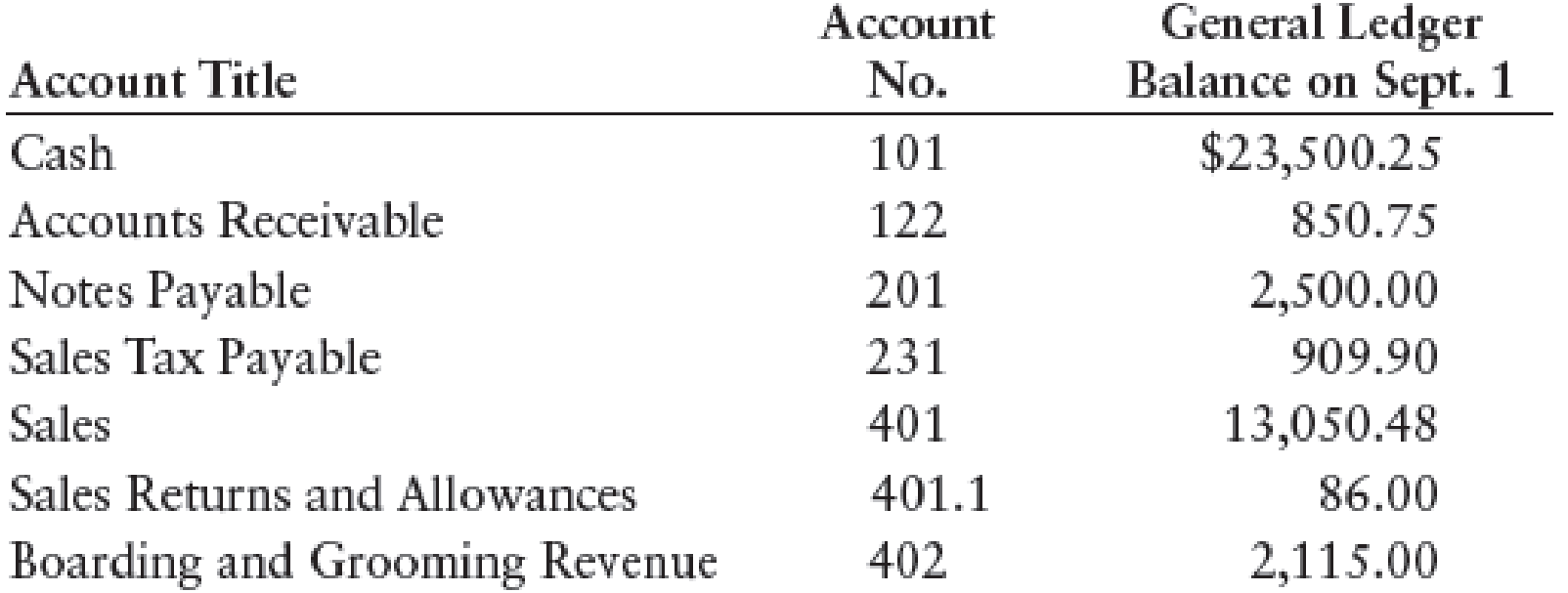

Wayward had the following general ledger account balances as of September 1:

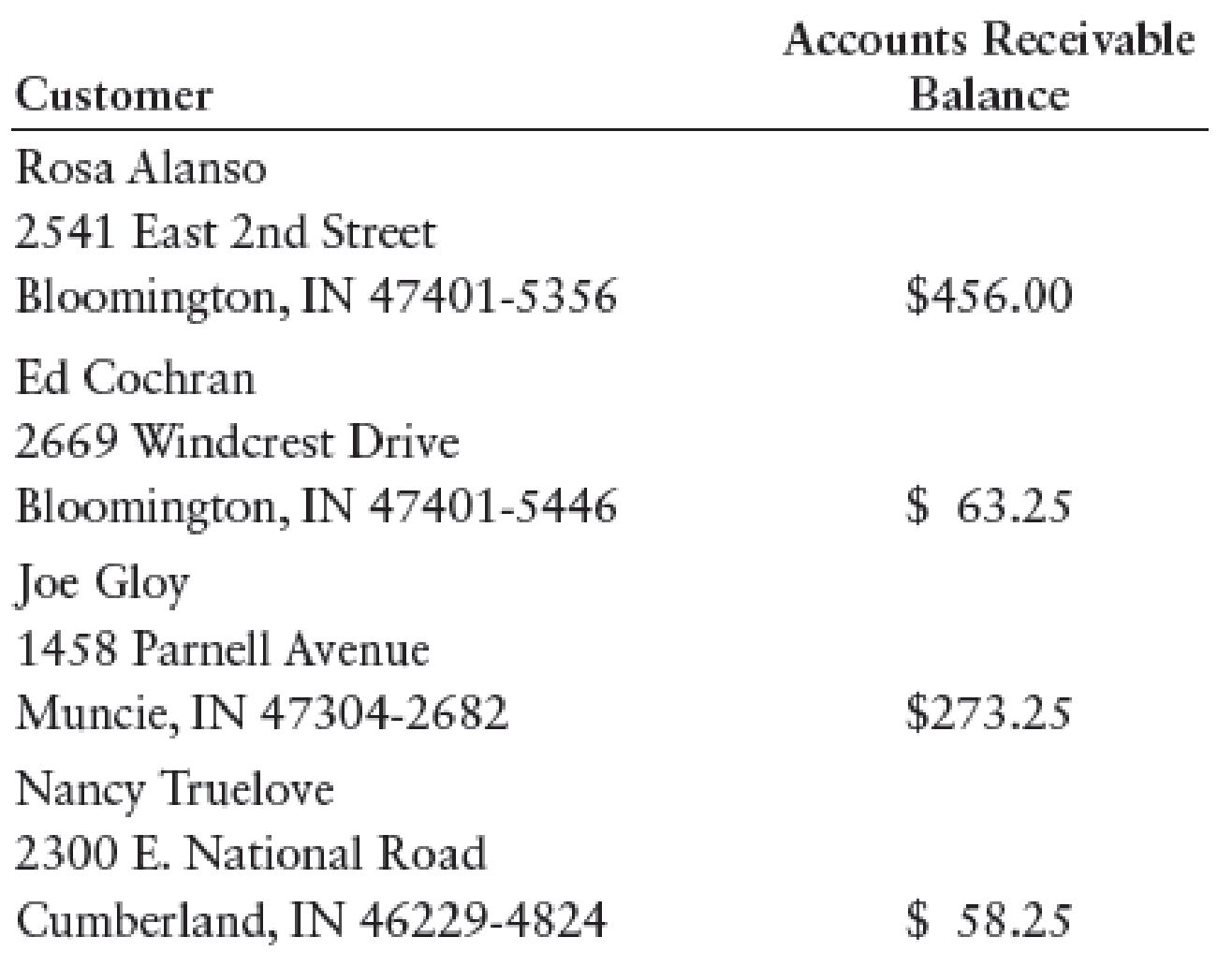

Wayward also had the following accounts receivable ledger balances as of September 1:

New customers opening accounts during September were as follows:

All American Day Camp

3025 Old Mill Run

Bloomington, IN 47408-1080

Tully Shaw

3315 Longview Avenue

Bloomington, IN 47401-7223

Susan Hays

1424 Jackson Creek Road

Nashville, IN 47448-2245

Jean Warkentin

1813 Deep Well Court

Bloomington, IN 47401-5124

Ken Shank

6422 E. Bender Road

Bloomington, IN 47401-7756

REQUIRED

- 1. Enter the transactions for the month of September in a general journal. (Begin with page 7.)

- 2. Post the entries to the general and subsidiary ledgers. Open new accounts for any customers who did not have a balance as of September 1.

- 3. Prepare a schedule of accounts receivable.

- 4. Compute the net sales for the month of September.

1.

Journalize the transactions for the month of September.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the transactions for the month of September.

Transaction on September 2:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 2 | Accounts Receivable, KS | 122/✓ | 132.50 | ||

| Sales | 401 | 125.00 | ||||

| Sales Tax Payable | 231 | 7.50 | ||||

| (Record credit sale) | ||||||

Table (1)

Description:

- Accounts Receivable, KS is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 3:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 3 | Accounts Receivable, NT | 122/✓ | 72.35 | ||

| Sales | 401 | 68.25 | ||||

| Sales Tax Payable | 231 | 4.10 | ||||

| (Record credit sale) | ||||||

Table (2)

Description:

- Accounts Receivable, NT is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 5:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 5 | Accounts Receivable, JW | 122/✓ | 46.59 | ||

| Sales | 401 | 43.95 | ||||

| Sales Tax Payable | 231 | 2.64 | ||||

| (Record credit sale) | ||||||

Table (3)

Description:

- Accounts Receivable, JW is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 8:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 8 | Cash | 101 | 2,472.40 | ||

| Sales | 401 | 2,332.45 | ||||

| Sales Tax Payable | 231 | 139.95 | ||||

| (Record cash sales) | ||||||

Table (4)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 10:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 10 | Cash | 101 | 662.50 | ||

| Boarding and Grooming Revenue | 402 | 625.00 | ||||

| Sales Tax Payable | 231 | 37.50 | ||||

| (Record cash sales) | ||||||

Table (5)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 11:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 11 | Sales Returns and Allowances | 401.1 | 10.00 | ||

| Sales Tax Payable | 231 | 0.60 | ||||

| Accounts Receivable, JW | 122/✓ | 10.60 | ||||

| (Record grant of sales allowance) | ||||||

Table (6)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, JW is an asset account. Since sales allowance is granted, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 1:

Compute sales tax payable amount.

Working Note 2:

Compute accounts receivable amount (Refer to Working Note 1 for value of sales tax payable).

Transaction on September 12:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 12 | Accounts Receivable, TS | 122/✓ | 1,272 | ||

| Sales | 401 | 1,200 | ||||

| Sales Tax Payable | 231 | 72 | ||||

| (Record credit sale) | ||||||

Table (7)

Description:

- Accounts Receivable, TS is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 14:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 14 | Cash | 101 | 256 | ||

| Accounts Receivable, RA | 122/✓ | 256 | ||||

| (Record cash received for sales on account) | ||||||

Table (8)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, RA is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 15:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 15 | Sales Returns and Allowances | 401.1 | 88.00 | ||

| Sales Tax Payable | 231 | 5.28 | ||||

| Accounts Receivable, RA | 122/✓ | 93.28 | ||||

| (Record goods returned) | ||||||

Table (9)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, RA is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Transaction on September 15:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 15 | Cash | 101 | 2,816.26 | ||

| Sales | 401 | 2,656.85 | ||||

| Sales Tax Payable | 231 | 159.41 | ||||

| (Record cash sales) | ||||||

Table (10)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 16:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 16 | Cash | 101 | 58.25 | ||

| Accounts Receivable, NT | 122/✓ | 58.25 | ||||

| (Record cash received for sales on account) | ||||||

Table (11)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, NT is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 18:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 18 | Cash | 101 | 567.10 | ||

| Boarding and Grooming Revenue | 402 | 535.00 | ||||

| Sales Tax Payable | 231 | 32.10 | ||||

| (Record cash sales) | ||||||

Table (12)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 19:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 19 | Cash | 101 | 63.25 | ||

| Accounts Receivable, EC | 122/✓ | 63.25 | ||||

| (Record cash received for sales on account) | ||||||

Table (13)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, EC is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 20:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 20 | Accounts Receivable, SH | 122/✓ | 88.33 | ||

| Sales | 401 | 83.33 | ||||

| Sales Tax Payable | 231 | 5.00 | ||||

| (Record credit sale) | ||||||

Table (14)

Description:

- Accounts Receivable, SH is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 21:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 21 | Accounts Receivable, AD Camp | 122/✓ | 397.50 | ||

| Sales | 401 | 375.00 | ||||

| Sales Tax Payable | 231 | 22.50 | ||||

| (Record credit sale) | ||||||

Table (15)

Description:

- Accounts Receivable, AD Camp is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 22:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 22 | Cash | 101 | 3,309.80 | ||

| Sales | 401 | 3,122.45 | ||||

| Sales Tax Payable | 231 | 187.35 | ||||

| (Record cash sales) | ||||||

Table (16)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 23:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 23 | Cash | 101 | 545.90 | ||

| Boarding and Grooming Revenue | 402 | 515.00 | ||||

| Sales Tax Payable | 231 | 30.90 | ||||

| (Record cash sales) | ||||||

Table (17)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 25:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 25 | Cash | 101 | 132.50 | ||

| Accounts Receivable, KS | 122/✓ | 132.50 | ||||

| (Record cash received for sales on account) | ||||||

Table (18)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, KS is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 26:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 26 | Cash | 101 | 72.35 | ||

| Accounts Receivable, NT | 122/✓ | 72.35 | ||||

| (Record cash received for sales on account) | ||||||

Table (19)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, NT is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 27:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 27 | Cash | 101 | 273.25 | ||

| Accounts Receivable, JG | 122/✓ | 273.25 | ||||

| (Record cash received for sales on account) | ||||||

Table (20)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, JG is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 28:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 28 | Cash | 101 | 11,000 | ||

| Notes Payable | 201 | 11,000 | ||||

| (Record cash borrowed) | ||||||

Table (21)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Notes Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 29:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 29 | Cash | 101 | 3,005.58 | ||

| Sales | 401 | 2,835.45 | ||||

| Sales Tax Payable | 231 | 170.13 | ||||

| (Record cash sales) | ||||||

Table (22)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 30:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 30 | Cash | 101 | 517.28 | ||

| Boarding and Grooming Revenue | 402 | 488.00 | ||||

| Sales Tax Payable | 231 | 29.28 | ||||

| (Record cash sales) | ||||||

Table (23)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

2.

Post the journalized entries into the accounts of the general ledger, and the customer accounts in accounts receivable ledger.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the journalized entries into the accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 23,500.25 | |||

| 8 | J7 | 2,472.40 | 25,972.65 | ||||

| 10 | J7 | 662.50 | 26,635.15 | ||||

| 14 | J7 | 256.00 | 26,891.15 | ||||

| 15 | J7 | 2,816.26 | 29,707.41 | ||||

| 16 | J7 | 58.25 | 29,765.66 | ||||

| 18 | J7 | 567.10 | 30,332.76 | ||||

| 19 | J7 | 63.25 | 30,396.01 | ||||

| 22 | J7 | 3,309.80 | 33,705.81 | ||||

| 23 | J7 | 545.90 | 34,251.71 | ||||

| 25 | J7 | 132.50 | 34,384.21 | ||||

| 26 | J7 | 72.35 | 34,456.56 | ||||

| 27 | J7 | 273.25 | 34,729.81 | ||||

| 28 | J7 | 11,000.00 | 45,729.81 | ||||

| 29 | J7 | 3,005.58 | 48,735.39 | ||||

| 30 | J7 | 517.28 | 49,252.67 | ||||

Table (24)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 850.75 | |||

| 2 | J7 | 132.50 | 983.25 | ||||

| 3 | J7 | 72.35 | 1,055.60 | ||||

| 5 | J7 | 46.59 | 1,102.19 | ||||

| 11 | J7 | 10.60 | 1,091.59 | ||||

| 12 | J7 | 1,272.00 | 2,363.59 | ||||

| 14 | J7 | 256.00 | 2,107.59 | ||||

| 15 | J7 | 93.28 | 2,014.31 | ||||

| 16 | J7 | 58.25 | 1,956.06 | ||||

| 19 | J7 | 63.25 | 1,892.81 | ||||

| 20 | J7 | 88.33 | 1,981.14 | ||||

| 21 | J7 | 397.50 | 2,378.64 | ||||

| 25 | J7 | 132.50 | 2,246.14 | ||||

| 26 | J7 | 72.35 | 2,173.79 | ||||

| 27 | J7 | 273.25 | 1,900.54 | ||||

Table (25)

| ACCOUNT Notes Payable ACCOUNT NO. 201 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 2,500 | |||

| 28 | J7 | 11,000 | 13,500 | ||||

Table (26)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 909.90 | |||

| 2 | J7 | 7.50 | 917.40 | ||||

| 3 | J7 | 4.10 | 921.50 | ||||

| 5 | J7 | 2.64 | 924.14 | ||||

| 8 | J7 | 139.95 | 1,064.09 | ||||

| 10 | J7 | 37.50 | 1,101.59 | ||||

| 11 | J7 | 0.60 | 1,100.99 | ||||

| 12 | J7 | 72.00 | 1,172.99 | ||||

| 15 | J7 | 5.28 | 1,167.71 | ||||

| 15 | J7 | 159.41 | 1,327.12 | ||||

| 18 | J7 | 32.10 | 1,359.22 | ||||

| 20 | J7 | 5.00 | 1,364.22 | ||||

| 21 | J7 | 22.50 | 1,386.72 | ||||

| 22 | J7 | 187.35 | 1,574.07 | ||||

| 23 | J7 | 30.90 | 1,604.97 | ||||

| 29 | J7 | 170.13 | 1,775.10 | ||||

| 30 | J7 | 29.28 | 1,804.38 | ||||

Table (27)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 13,050.48 | |||

| 2 | J7 | 125.00 | 13,050.48 | ||||

| 3 | J7 | 68.25 | 13,243.73 | ||||

| 5 | J7 | 43.95 | 13,287.68 | ||||

| 8 | J7 | 2,332.45 | 15,620.13 | ||||

| 12 | J7 | 1,200.00 | 16,820.13 | ||||

| 15 | J7 | 2,656.85 | 19,476.98 | ||||

| 20 | J7 | 83.33 | 19,560.31 | ||||

| 21 | J7 | 375.00 | 19,935.31 | ||||

| 22 | J7 | 3,122.45 | 23,057.76 | ||||

| 29 | J7 | 2,835.45 | 25,893.21 | ||||

Table (28)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 86.00 | |||

| 11 | J7 | 10.00 | 96.00 | ||||

| 15 | J7 | 88.00 | 184.00 | ||||

Table (29)

| ACCOUNT Boarding and Grooming Revenue ACCOUNT NO. 402 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 2,115.00 | |||

| 10 | J7 | 625.00 | 2,740.00 | ||||

| 18 | J7 | 535.00 | 3,275.00 | ||||

| 23 | J7 | 515.00 | 3,790.00 | ||||

| 30 | J7 | 488.00 | 4,278.00 | ||||

Table (30)

Post the journalized entries into the customer accounts in accounts receivable ledger.

| NAME AD Camp | ||||||

| ADDRESS 3025, OM Run, City B, State IN 47408-1080 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 21 | J7 | 397.50 | 397.50 | ||

Table (31)

| NAME RA | ||||||

| ADDRESS 2541, E Street, City B, State IN 47401-5356 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 456.00 | ||

| 14 | J7 | 256.00 | 200.00 | |||

| 15 | J7 | 93.28 | 106.72 | |||

Table (32)

| NAME EC | ||||||

| ADDRESS 2669, W Drive, City B, State IN 47401-5446 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 63.25 | ||

| 19 | J7 | 63.25 | 0 | |||

Table (33)

| NAME JG | ||||||

| ADDRESS 1458, P Avenue, City B, State IN 47304-2682 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 273.25 | ||

| 27 | J7 | 273.25 | 0 | |||

Table (34)

| NAME SH | ||||||

| ADDRESS 1424, JC Road, City N, State IN 47448-2245 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 20 | J7 | 88.33 | 88.33 | ||

Table (35)

| NAME KS | ||||||

| ADDRESS 6422, EB Road, City B, State IN 47401-7756 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 2 | Balance | J7 | 132.50 | 132.50 | |

| 19 | J7 | 132.50 | 0 | |||

Table (36)

| NAME TS | ||||||

| ADDRESS 3315, L Avenue, City N, State IN 47401-7223 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 12 | J7 | 1,272.00 | 1,272.00 | ||

Table (37)

| NAME NT | ||||||

| ADDRESS 2300, EN Road, City C, State IN 46229-4824 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 58.25 | ||

| 3 | J7 | 72.35 | 130.60 | |||

| 16 | J7 | 58.25 | 72.35 | |||

| 26 | J7 | 72.35 | 0 | |||

Table (38)

| NAME JW | ||||||

| ADDRESS 1813, DP Court, City B, State IN 47401-5124 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 5 | J7 | 46.59 | 46.59 | ||

| 3 | J7 | 10.60 | 35.99 | |||

Table (39)

3.

Prepare the schedule of accounts receivable for W Kennel and P Supply as at September 30, 20--.

Explanation of Solution

Accounts receivable schedule: This is the schedule which is prepared to verify that the total balances of all the customers in the accounts receivable ledger, equals the balance of Accounts Receivable in the general ledger.

Prepare the schedule of accounts receivable for W Kennel and P Supply as at September 30, 20--.

| W Kennel and P Supply | |

| Schedule of Accounts Receivable | |

| September 30, 20-- | |

| AD Camp | $397.50 |

| RA | 106.72 |

| SH | 88.33 |

| TS | 1,272.00 |

| JW | 35.99 |

| Total | $1,900.54 |

Table (40)

Note: Refer to Requirement 2 for the value and computation of customer balances.

Thus, the schedule of accounts receivable of W Kennel and P Supply shows a balance of $1,900.54, as of September 30, 20--.

4.

Ascertain the net sales for W Kennel and P Supply for the month of September.

Explanation of Solution

Net sales: The amount of price of merchandise sold during a certain period is referred to as sales revenue. Net sales is the gross sales, minus sales returns and allowances, and sales discounts.

Formula to compute net sales:

Ascertain the net sales for W Kennel and P Supply for the month of September.

Note: Refer to Requirement 2 for the value and computation of the balances.

Thus, net sales for W Kennel and P Supply for the month of September is $12,744.73.

Want to see more full solutions like this?

Chapter 10 Solutions

College Accounting, Chapters 1-27

- Peter loves dogs and cats. For the past several years, he has owned and operated Homeward Bound, which temporarily houses pets while their owners go on vacation. For the month of June, the company has the following transactions: 1. June 2 Obtain cash by borrowing $21,000 from the bank by signing a note. 2. June 3 Pay rent for the current month, $1,500. 3. June 7 Provide services to customers, $4,700 for cash and $3,000 on account. 4. June 11 Purchase cages and equipment necessary to maintain the animals, $7,900 cash. 5. June 17 Pay employees’ salaries for the first half of the month, $6,000. 6. June 22 Pay dividends to stockholders, $1,425. 7. June 25 Receive cash in advance from a customer who wants to house his two dogs (Chance and Shadow) and cat (Sassy) while he goes on vacation the month of July, $1,850. 8. June 28 Pay utilities for the month, $2,800. 9. June 30 Record salaries earned by employees for the…arrow_forwardPeter loves dogs and cats. For the past several years, he has owned and operated Homeward Bound, which temporarily houses pets while their owners go on vacation. For the month of June, the company has the following transactions:1. June 2 Obtain cash by borrowing $19,000 from the bank by signing a note.2. June 3 Pay rent for the current month, $1,200.3. June 7 Provide services to customers, $5,200 for cash and $3,500 on account.4. June 11 Purchase cages and equipment necessary to maintain the animals, $8,400 cash.5. June 17 Pay employees’ salaries for the first half of the month, $6,500.6. June 22 Pay dividends to stockholders, $1,550.7. June 25 Receive cash in advance from a customer who wants to house his two dogs (Chance and Shadow) and cat (Sassy) while he goes on vacation the month of July, $2,100.8. June 28 Pay utilities for the month, $3,300.9. June 30 Record salaries earned by employees for the second half of the month, $6,500. Payment will be made on July 2.Required:1. Record…arrow_forwardHopper works as an independent contractor (self-employed sole proprietor) for local businesses on weekends, and he often provides services in exchange for property. All of the following happened during 2019: Hopper provided security services in exchange for $1,375 of car repair services, $2,500 of groceries, and cash of $5,250. The cash was mailed to Hopper in the form of a check on December 15, 2019. Hopper, however, was out of town for the entire month of December. When he checked his mail on January 1, 2020, the check was there. Hopper also received a gift card in exchange for services he provided that could only be used for $1,000 work of clothing at a local mall shop. During 2019, Hopper only redeemed $250 worth of clothing at a local mall shop. Hopper has a total of $6,300 worth of legitimate business expenses during 2019, none of which were considered Cost of Goods Sold. Determine Hopper’s gross income for 2019 assuming that he uses the cash basis of accounting.arrow_forward

- Every March, Buddie, who owns and operates a small retail shop, takes a large box of receipts and invoices to her accountant so the accountant can file Buddie's taxes in April. Only then does Buddie know if her business has been profitable. Buddie could benefit from a(n) ________.Select one:a. concurrent control systemb. management information system c. balanced scorecard systemd. inventory control systemarrow_forwardDuring the current year, Paul, the vice president of a bank, made gifts in the following amounts: To Sarah (Paul's personal assistant) at Christmas $36 To Darryl (a key client)—$3 was for gift wrapping 53 To Darryl's wife (a homemaker) on her birthday 20 To Veronica (Paul's boss) at Christmas 30 In addition, on professional assistants' day, Paul takes Sarah to lunch at a cost of $82. Presuming that Paul has adequate substantiation and is not reimbursed, how much can he deduct? Do not round intermediate computations. If required, round your final answer to the nearest cent.arrow_forwardRyan's day care business collected $35,000 in revenues. In addition, customers owed him $3,000 at year-end. During the year, Ryan spent $5,500 for supplies, $1,500 for utilities, $15,000 for rent, and $500 for miscellaneous expenses. One customer gave him use of their vacation home for a week (worth $2,500) in exchange for Ryan allowing their child to attend the day care center free of charge. Ryan accounts for his business activities using the cash method of accounting.arrow_forward

- Bell Florists sells flowers on a retail basis. Most of the sales are for cash; however, a few steady customers have credit accounts. Bells sales staff fills out a sales slip for each sale. There is a state retail sales tax of 5 percent, which is collected by the retailer and submitted to the state. The balances of the accounts as of March 1 have been recorded in the general ledger in your Working Papers or in CengageNow. The following represent Bell Florists charge sales for March: Mar. 4Sold potted plant on account to C. Morales, sales slip no. 242, 27, plus sales tax of 1.35, total 28.35. 6Sold floral arrangement on account to R. Dixon, sales slip no. 267, 54, plus sales tax of 2.70, total 56.70. 12Sold corsage on account to B. Cox, sales slip no. 279, 16, plus sales tax of 0.80, total 16.80. 16Sold wreath on account to All-Star Legion, sales slip no. 296, 104, plus sales tax of 5.20, total 109.20. 18Sold floral arrangements on account to Tucker Funeral Home, sales slip no. 314, 260, plus sales tax of 13, total 273. 21Tucker Funeral Home complained about a wrinkled ribbon on the floral arrangement. Bell Florists allowed a 30 credit plus sales tax of 1.50, credit memo no. 27. 23Sold flower arrangements on account to Price Savings and Loan Association for its fifth anniversary, sales slip no. 337, 180, plus sales tax of 9, total 189. 24Allowed Price Savings and Loan Association credit, 25, plus sales tax of 1.25, because of a few withered blossoms in floral arrangements, credit memo no. 28. Required 1. Record these transactions in the general journal. 2. Post the amounts from the general journal to the general ledger and accounts receivable ledger: Accounts Receivable 113, Sales Tax Payable 214, Sales 411, Sales Returns and Allowances 412. 3. Prepare a schedule of accounts receivable and compare its total with the balance of the Accounts Receivable controlling account.arrow_forwardBlue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardYour Client, Ashley Mason, is an artist who specializes in henna tattoos. Four years ago, she entered into a five-year contract to rent a kiosk inside the local mall to sell henna tattoos to customers. She called the business “Ashley’s Arm Brands” and hired two other local artists to assist in the work. She opened a separate bank account to keep track of the business cash, and she tracked all expenses and income using a detailed spreadsheet. She is not incorporated. In the first year, the business did fairly well, but then revenues and customer interest declined. Another local artist opened a competing henna studio at a nearby location that seemed to get more foot traffic and was able to bring in celebrity artists to complete work. Ashley increased her marketing and advertising, including creating both a webpage and a Facebook page, offered discounts and contests, and created deals with other kiosks to increase business. Ashley works at the mall kiosk almost 40 hours a week. She is…arrow_forward

- Tom loves cooking and after attending culinary school, he decided to start his own eatery in downtown Vancouver in May. Since he did not receive formal business, he has asked you to help him prepare monthly financial statements. He was able to collect all business receipt and financial records. The following are transactions for the month of January 2022, the first month of operations. Jan 1 Tom invested his saving of $350,000 into business bank account at TD Bank and he also borrowed &150,000 as 24 months bank loan. Jan 1 Signed lease contract and secured the locationJan 1 Purchased a one-year insurance policy for $24,000 in cash. Jan 2 Tom purchased kitchen equipment for $150,000 and $1000 kitchen supplies including napkins and clean supplies in cash Jan 1 he hired a soul chef and one receptionist. In contract, he will pay the soul chef $5,000 per month and receptionist $3,000 per month Jan 2 Tom purchased $100,000 furniture in cash Jan 3 Tom hired a renovation company to do…arrow_forwardRex loves to work with his hands and is very good at making small figurines. Three years ago, Rex opened Bronze Age Miniatures (BAM) for business as a sole proprietorship. BAM produces miniature characters ranging from sci-fi characters (his favorite) to historical characters like George Washington (the most popular). Business has been going very well for him, and he has provided the following information relating to his business. A.Rex received approval from the IRS to switch from the cash method of accounting to the accrual method of accounting effective January 1 of this year. At the end of last year, BAM reported accounts receivable that had not been included in income under the accrual method of $14,000 and accounts payable that had not been deducted under the accrual method of $5,000. b.In March, BAM sold 5,000 miniature historical figures to History R Us Incorporated (HRU), a retailer of historical artifacts and figurines, for $75,000. c.HRU was so impressed with the figurines…arrow_forwardKathy Wintz formed a lawn service business as a summer job. To start the corporation on May 1, 2018, she deposited $1,000 in a new bank account in the name of the business. The $1,000 consisted of a $600 loan from Bank One to her company, Wintz Lawn Service, and $400 of her own money. The company issued $400 of common stock to Wintz. Wintz rented lawn equipment, purchased supplies, and hired other students to mow and trim customers’ lawns. At the end of each month, Wintz mailed bills to the customers. On August 31, she was ready to dissolve the corporation and return to college. Because she was so busy, she kept few records other than the checkbook and a list of receivables from customers. At August 31, the business’s checkbook shows a balance of $2,000, and customers still owe $750. During the summer, the business collected $5,500 from customers. The business checkbook lists payments for supplies totaling $400 and it still has gasoline, weed trimmer cord, and other supplies that cost…arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage