Effect on Ta(1-T) WACC a. The corporate tax rate is lowered. b. The Federal Reserve tightens credit. The firm uses more debt; that is, it increases its debt ratio. C. d. The dividend payout ratio is increased. The firm doubles the amount of capital it raises during the year. f. The firm expands into a risky new area. & The firm merges with another firm whose earnings are countercyclical both to those of the first firm and to the stock market. e. h. The stock market falls drastically, and the firm's stock price falls along with the rest. i Investors become more risk-averse. i The firm is an electric utility with a large investment in nuclear plants. Several states are considering a ban on nuclear power generation. || ||

Effect on Ta(1-T) WACC a. The corporate tax rate is lowered. b. The Federal Reserve tightens credit. The firm uses more debt; that is, it increases its debt ratio. C. d. The dividend payout ratio is increased. The firm doubles the amount of capital it raises during the year. f. The firm expands into a risky new area. & The firm merges with another firm whose earnings are countercyclical both to those of the first firm and to the stock market. e. h. The stock market falls drastically, and the firm's stock price falls along with the rest. i Investors become more risk-averse. i The firm is an electric utility with a large investment in nuclear plants. Several states are considering a ban on nuclear power generation. || ||

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 15P: RETURN ON EQUITY AND QUICK RATIO Lloyd Inc. has sales of 200,000, a net income of 15,000, and the...

Related questions

Question

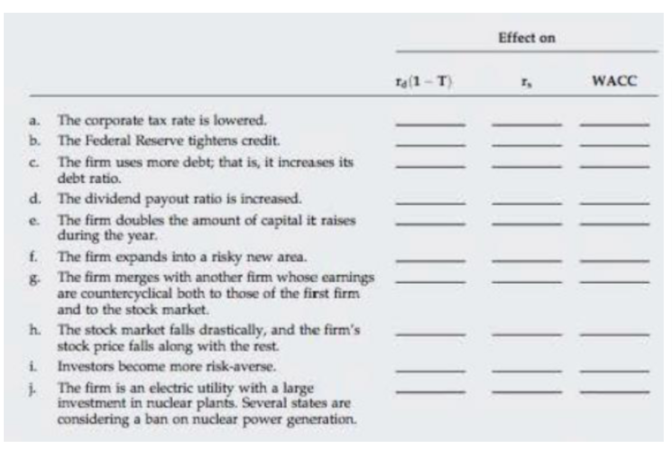

How would each of the following scenarios affect a firm’s cost of debt, rd

( 1 − T); its

cost of equity, rs

; and its WACC? Indicate with a plus (+), a minus (−), or a zero (0)

whether the factor would raise, lower, or have an indeterminate effect on the item in

question. Assume for each answer that other things are held constant, even though in

some instances this would probably not be true. Bo prepared to justify your answer

but recognize that several of the parts have no single correct answer. These questions

are designed to stimulate thought and discussion.

Transcribed Image Text:Effect on

Ta(1-T)

WACC

a. The corporate tax rate is lowered.

b. The Federal Reserve tightens credit.

The firm uses more debt; that is, it increases its

debt ratio.

C.

d. The dividend payout ratio is increased.

The firm doubles the amount of capital it raises

during the year.

f. The firm expands into a risky new area.

& The firm merges with another firm whose earnings

are countercyclical both to those of the first firm

and to the stock market.

e.

h. The stock market falls drastically, and the firm's

stock price falls along with the rest.

i Investors become more risk-averse.

i The firm is an electric utility with a large

investment in nuclear plants. Several states are

considering a ban on nuclear power generation.

||

||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT