Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 1R

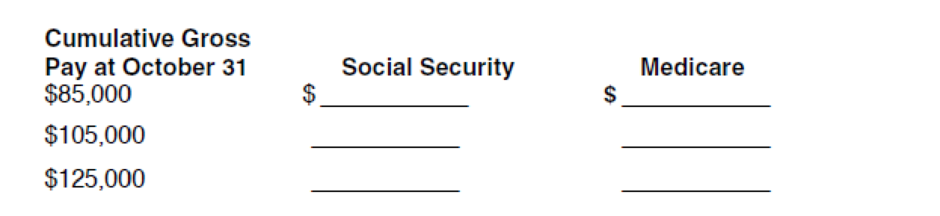

Based on 2011 tax rates provided, use a calculator to compute how much would be withheld from Jones’s November paycheck in the following three cases (round to the nearest penny):

Expert Solution & Answer

To determine

Compute the amount of tax withheld of Employee J for the month of November.

Explanation of Solution

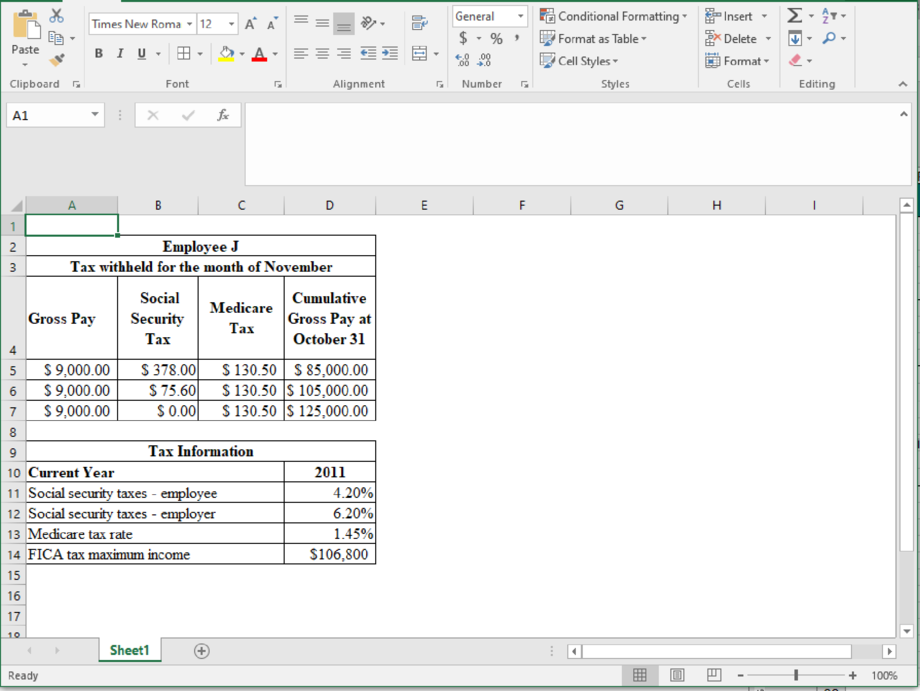

Determine the amount of tax withheld of Employee J for the month of November.

Figure (1)

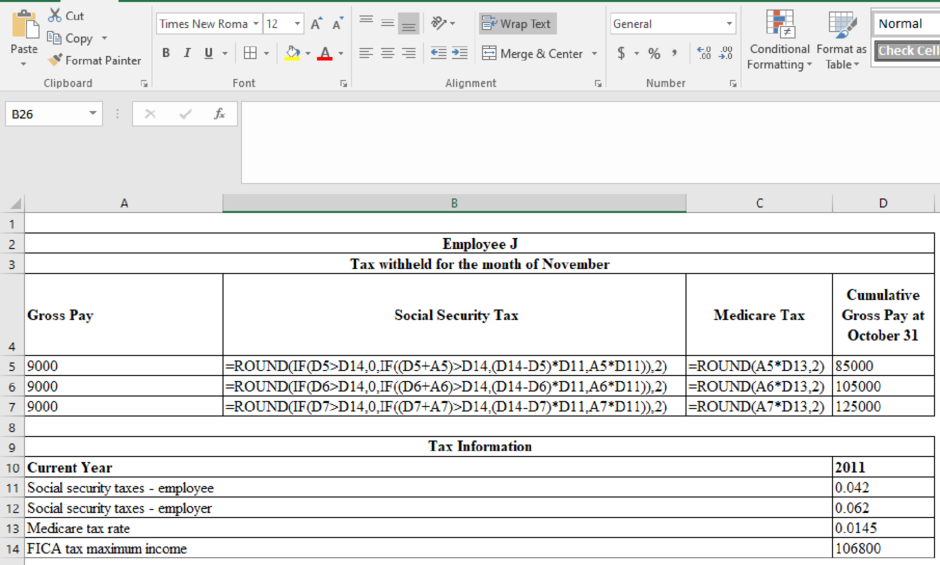

The formulae for the above calculation are as follows:

Figure (2)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

When filing 2015 federal income taxes as a single filer, you paid 10% on the first $9,225 earned, and 15% on moneys earned between $9,226–$37,450. If a person filing their taxes as a single filer earned a total of $36,500 in 2015, What is the effective tax rate on the taxes you calculated in #17? Make sure to include your work along with your answer, and round your answer to the nearest hundredth of a percent if necessary

Based off the following information, what is Reba's federal incomes tax refund for the current year?

Use the 2016 marginal tax rates to compute the tax owed by a head of household with a taxable income of $78,000 and a $6000 tax credit.

Chapter 10 Solutions

Excel Applications for Accounting Principles

Ch. 10 - Based on 2011 tax rates provided, use a calculator...Ch. 10 - You have been asked to record the November payroll...Ch. 10 - To make the worksheet reusable each month, the...Ch. 10 - Prob. 4RCh. 10 - Prob. 5RCh. 10 - In the space provided below, prepare the journal...Ch. 10 - In the space provided below, prepare the journal...Ch. 10 - Prob. 8RCh. 10 - Click the Chart sheet tab. On the screen is a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are filling out your 1040 form for tax season. You find that you paid $3,296.44 in Federal Taxes. Using your taxable income and the tax table, you find you should have paid $3,016 in Federal Taxes. Do you get a refund or do you owe the government money? Why?arrow_forwardHeiman, a VAT registered taxpayer, had the following data in 2022:Deferred input taxes, December 2021, P6,200Sales (net of VAT): January, P620,000 February, P430,000 March, P540,000 Purchases (net of VAT): January, P508,000 February, P432,000 March, P314,500 How much is the VAT payable for the month of March? P26,820 P34,090 P20,860 P26,580 P25,620arrow_forwardUse the following Total Tax / Annual Income relationship to determine which of the following is Beverly's total tax for last year if her income last was $155,000. What total income tax did Beverly pay in income tax. In the image.arrow_forward

- Use the 2016 marginal tax rates to compute the tax owed by the following person. A head of household with a taxable income of $129,000 and an $8000 tax credit The tax owed is $arrow_forwardUse the 2021 tax rates to find Social Security and Medicare deductions for the following problem. Philip earned $1589 last week, and had year-to-date earnings of $108,894 for the year.arrow_forwardUse the information in Table 1-3. If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17%, calculate the amount of tax liability for 2018 for all taxpayers. How does this amount differ from the actual liability? Graded on the following: Calculates tax liability for yearly taxpayers indicating how amounts differ from the actual liability.arrow_forward

- Adelaide is self-employed and must submit estimated quarterly tax payments. Her predicted total tax liability for the current year will be $36,000, and her current withholdings are $18,283. She is advised to determine her quarterly payments by subtracting her current withholdings from her predicted total tax liability and dividing by four. What is a good estimate for Adelaide to use for her quarterly payments?arrow_forwardUsing the graduated tax table, compute the income tax due and/or income tax payable (refundable) of the following given problems. Round off the total income tax due to the nearest whole number. What is the income tax due if the net taxable compensation income is P478,800? In the preceding problem, what if there is tax payments made in the previous quarter in the amount of P47,800, what is the income tax payable (refundable)? What is the income tax due if the net taxable business income is P1,108,600? In the preceding problem, what if there is tax payments made in the previous quarters in the amount of P187,800, what is the income tax payable (refundable)? What is the income tax due if the net taxable business income is P3,158,400? In the preceding problem, what if there is tax payments made in the previous quarters in the amount of P789,780, what is the income tax payable (refundable)?arrow_forwardAccording to the statistic in the case study, what percentage of tax returns are selected for examination each year?arrow_forward

- In 2021, Erica's AGI was $141,000, and the total tax liability was $33,650. This year, Elon’s total tax liability is $35,290. Compute the minimum amount of 2022 tax that Erica had to prepay (withholding and estimated payments) to avoid an underpayment penalty.arrow_forwardUse the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals. If you have a taxable income of $289,980.00, what is your top marginal tax rate? % total tax bill? $ average tax rate? %arrow_forwardWhich of the following is true? The total tax due arising from each quarterly income tax return is only applicable to the taxable income for that quarter. The taxable compensation income of mixed-income earners are reported in each quarterly return. When an eligible taxpayer chooses the 8% optional tax, the P250,000 is deducted from the gross sales/receipts from business and other non-operating income in arriving at the tax base for the 8% rate. When a taxpayer who originally opted to be taxed at 8% breaches the VAT threshold at the middle of the year, he shall be liable to the graduated tax from the time it breaches the threshold. None of the other choices is true.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License