College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 10, Problem 2PB

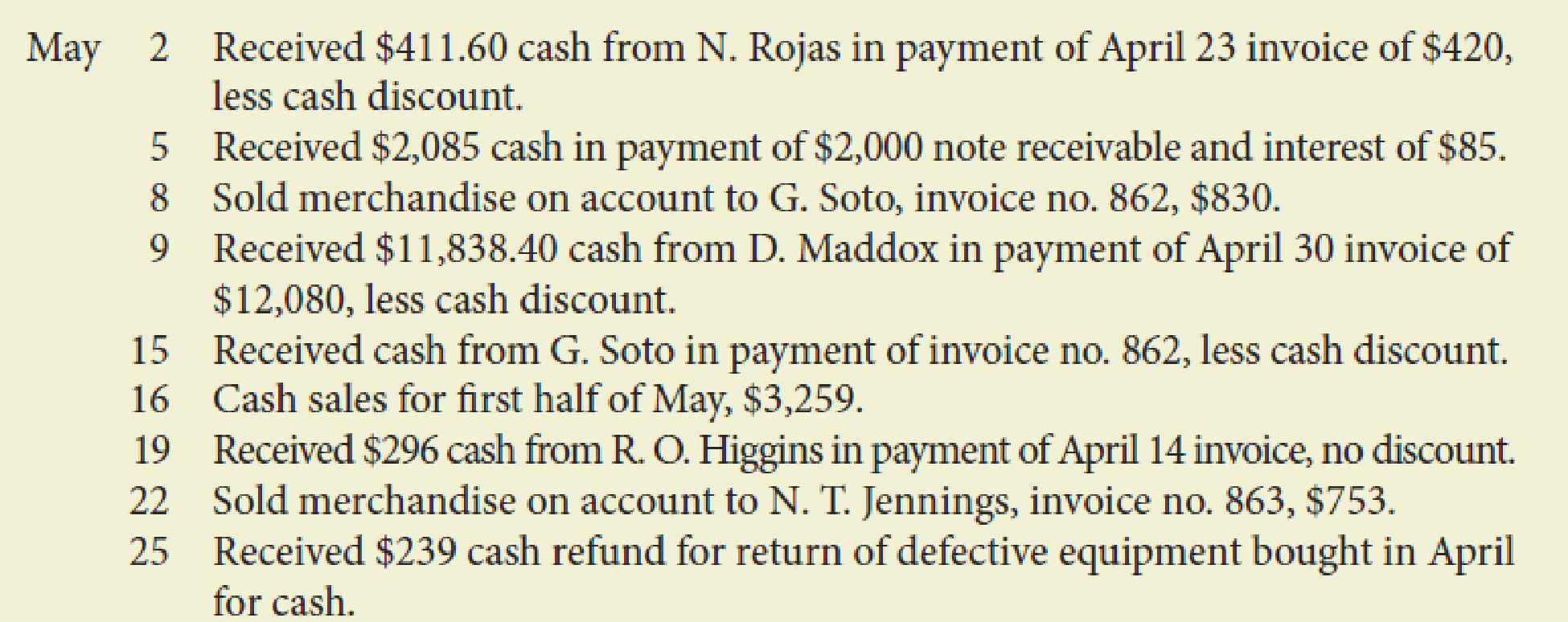

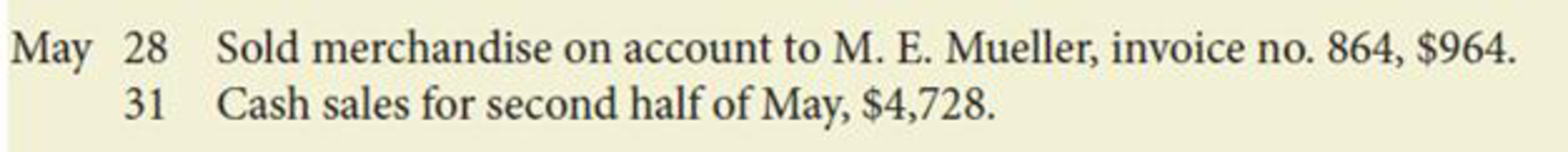

C. R. McIntyre Company sells candy wholesale, primarily to vending machine operators. Terms of sales on account are 2/10, n/30, FOB shipping point. The following transactions involving cash receipts and sales of merchandise took place in May of this year:

Required

- 1. Journalize the transactions for May in the cash receipts journal and the sales journal. Assume the periodic inventory method is used.

- 2. Total and rule the journals.

- 3. Prove the equality of the debit and credit totals.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

College Accounting (Book Only): A Career Approach

Ch. 10 - What do credit terms of 2/10, n/30 mean? 210 days...Ch. 10 - What is the entry to record the cash received on a...Ch. 10 - Prob. 3QYCh. 10 - Which of the following is not an advantage of the...Ch. 10 - Prob. 5QYCh. 10 - What is the normal balance for each of the...Ch. 10 - What does an X under the total of a special...Ch. 10 - Prob. 3DQCh. 10 - In a cash receipts journal, both the Accounts...Ch. 10 - If a cash payments journal is supposed to save...

Ch. 10 - Describe the posting procedure for a cash payments...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - For the following purchases of merchandise,...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Record the following transactions in general...Ch. 10 - Prob. 5ECh. 10 - Record general journal entries to correct the...Ch. 10 - Label the blanks in the column heads as either...Ch. 10 - Describe the transaction recorded.Ch. 10 - Prob. 9ECh. 10 - Indicate the journal in which each of the...Ch. 10 - The following transactions were completed by...Ch. 10 - Preston Company sells candy wholesale, primarily...Ch. 10 - MacDonald Bookshop had the following transactions...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by Yang...Ch. 10 - C. R. McIntyre Company sells candy wholesale,...Ch. 10 - Prob. 3PBCh. 10 - The following transactions were completed by Yang...Ch. 10 - Prob. 5PBCh. 10 - Prob. 1ACh. 10 - You are the manager of the Accounts Receivable...Ch. 10 - Prob. 3ACh. 10 - Suppose we collected cash from a charge customer...Ch. 10 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Preston Company sells candy wholesale, primarily to vending machine operators. Terms of sales on account are 2/10, n/30, FOB shipping point. The following transactions involving cash receipts and sales of merchandise took place in May of this year: Required 1. Journalize the transactions for May in the cash receipts journal and the sales journal. Assume the periodic inventory method is used. 2. Total and rule the journals. 3. Prove the equality of the debit and credit totals.arrow_forwardThe following transactions were completed by Nelsons Boutique, a retailer, during July. Terms on sales on account are 2/10, n/30, FOB shipping point. Required 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payment journal as appropriate. Assume the periodic inventory method is used. 2. Total and rule the journals. 3. Prove the equality of debit and credit totals.arrow_forwardMacDonald Bookshop had the following transactions that occurred during February of this year: Required 1. Journalize the transactions for February in the cash payments journal. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journal. Prove the equality of the debit and credit totals.arrow_forward

- MacDonald Bookshop had the following transactions that occurred during February of this year: Required 1. Journalize the transactions for February in the cash payments journal. Assume the periodic inventory method is used. 2. Total and rule the journal. 3. Prove the equality of the debit and credit totals.arrow_forwardThe following transactions were completed by Nelsons Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4Received cash from M. Alex in payment of August 25 invoice of 275, less cash discount. 7Issued Ck. No. 8175, 915.75, to Top Tools, Inc., for invoice. no. 2256, recorded previously for 925, less cash discount of 9.25. 10Sold merchandise in the amount of 175 on a credit card. Sales tax on this sale is 8%. The credit card fee the bank deducted for this transaction is 5. 11Issued Ck. No. 8176, 653.40, to Snap Tools, Inc. for invoice no. 726, recorded previously on account for 660. A trade discount of 15% was applied at the time of purchase, and Snap Tools, Inc.s credit terms are 1/10, n/45. 15Received 95 cash in payment of August 20 invoice from N. Johnson. No cash discount applied. 19Received 1,165 cash in payment of a 1,100 note receivable and interest of 65. 22Voided Ck. No. 8177 due to error. 26Received and paid telephone bill, 62; Ck. No. 8178, payable to Southern Telephone Company. 30Paid wages recorded previously for the month, 3,266, Ck. No. 8179. Required 1. Journalize the transactions for September in the cash receipts journal, the general journal (for the transaction on Sept. 10th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.arrow_forwardGomez Company sells electrical supplies on a wholesale basis. The balances of the accounts as of April 1 have been recorded in the general ledger in your Working Papers and CengageNow. The following transactions took place during April of this year: Apr. 1 Sold merchandise on account to Myers Company, invoice no. 761, 570.40. 5 Sold merchandise on account to L. R. Foster Company, invoice no. 762, 486.10. 6 Issued credit memo no. 50 to Myers Company for merchandise returned, 40.70. 10 Sold merchandise on account to Diaz Hardware, invoice no. 763, 293.35. 14 Sold merchandise on account to Brooks and Bennett, invoice no. 764, 640.16. 17 Sold merchandise on account to Powell and Reyes, invoice no. 765, 582.12. 21 Issued credit memo no. 51 to Brooks and Bennett for merchandise returned, 68.44. 24 Sold merchandise on account to Ortiz Company, invoice no. 766, 652.87. 26 Sold merchandise on account to Diaz Hardware, invoice no. 767, 832.19. 30 Issued credit memo no. 52 to Diaz Hardware for damage to merchandise, 98.50. Required 1. Record these sales of merchandise on account in the sales journal. If using Working Papers, use page 39. Record the sales returns and allowances in the general journal. If using Working Papers, use page 74. 2. Immediately after recording each transaction, post to the accounts receivable ledger. 3. Post the amounts from the general journal daily. Post the sales journal amount as a total at the end of the month: Accounts Receivable 113, Sales 411, Sales Returns and Allowances 412. 4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable controlling account with the total of the schedule of accounts receivable.arrow_forward

- The following transactions were completed by Nelsons Boutique, a retailer, during July. Terms of sales on account are 2/10, n/30, FOB shipping point. July 3Received cash from J. Smith in payment of June 29 invoice of 350, less cash discount. 6Issued Ck. No. 1718, 742.50, to Designer, Inc., for invoice. no. 2256, recorded previously for 750, less cash discount of 7.50. July 9Sold merchandise in the amount of 250 on a credit card. Sales tax on this sale is 6%. The credit card fee the bank deducted for this transaction is 5. 10Issued Ck. No. 1719, 764.40, to Smart Style, Inc., for invoice no. 1825, recorded previously on account for 780. A trade discount of 25% was applied at the time of purchase, and Smart Style, Inc.s credit terms are 2/10, n/30. 12Received 180 cash in payment of June 20 invoice from R. Matthews. No cash discount applied. 18Received 1,575 cash in payment of a 1,500 note receivable and interest of 75. 21Voided Ck. No. 1720 due to error. 25Received and paid utility bill, 152; Ck. No. 1721, payable to City Utilities Company. 31Paid wages recorded previously for the month, 2,586, Ck. No. 1722. Required 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.arrow_forwardPalisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 20Y6 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on Page 21 of the journal: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. Assume that additional common stock of 10,000 was issued in January 20Y6. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.arrow_forwardToby Company had the following sales transactions for March: Mar. 6Sold merchandise on account to Osbourne, Inc., invoice no. 1128, 563.17. 14Sold merchandise on account to Ortiz Company, invoice no. 1129, 823.50. 20Sold merchandise on account to Bailey Corporation, invoice no. 1130, 2,350.98. 24Sold merchandise on account to Shannon Corporation, invoice no. 1131, 1,547.07. Assume that Toby Company had beginning balances on March 1 of 3,569.80 (Sales 411) and 2,450.39 (Accounts Receivable 113). Record the sales of merchandise on account in the sales journal (page 24) and then post to the general ledger.arrow_forward

- The following transactions relate to Hawkins, Inc., an office store wholesaler, during June of this year. Terms of sale are 2/10, n/30. The company is located in Los Angeles, California. June 1Sold merchandise on account to Hendrix Office Store, invoice no. 1001, 451.20. The cost of the merchandise was 397.06. 3Bought merchandise on account from Krueger, Inc., invoice no. 845A, 485.15; terms 1/10, n/30; dated June 1; FOB San Diego, freight prepaid and added to the invoice, 15 (total 500.15). 10Sold merchandise on account to Ballard Stores, invoice no. 1002, 2,483.65. The cost of the merchandise was 2,235.29. 13Bought merchandise on account from Kennedy, Inc., invoice no. 4833, 2,450.13; terms 2/10, n/30; dated June 11; FOB San Francisco, freight prepaid and added to the invoice, 123 (total 2,573.13). 18Sold merchandise on account to Lawson Office Store, invoice no. 1003, 754.99. The cost of the merchandise was 671.94. 20Issued credit memo no. 33 to Lawson Office Store for merchandise returned, 103.25. The cost of the merchandise was 91.89. 25Bought merchandise on account from Villarreal, Inc., invoice no. 4R32, 1,552.30; terms net 30; dated June 18; FOB Santa Rosa, freight prepaid and added to the invoice, 84 (total 1,636.30). 30Received credit memo no. 44 for merchandise returned to Villarreal, Inc., for 224.50. Required Record the transaction in the general journal using the perpetual inventory system. If using Working Papers, use pages 25 and 26.arrow_forwardShirleys Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Shirleys Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales and purchase of merchandise are as follows: Jan. 3Bought 30 Mango Bath and Shower Gels from Madden, Inc., 660, invoice no. 3487, dated January 1; terms 2/10, n/30; FOB shipping point, freight prepaid and added to the invoice, 125.43 (total 785.43). 4Bought ten Beauty Candle Travel Sets from Calhoun Candles, Inc., 420, invoice no. 4513, dated January 1; terms net 45; FOB destination. 12Sold four Mango Bath and Shower Gels on account to R. Kielman, sales slip no. 1456, 120, plus sales tax of 9.60, total 129.60. 13Received credit memo no. 8715 from Calhoun Candles, Inc., for merchandise returned, 84. 21Bought five Winter Skin Essentials Kits from Whitney and Waters, 197.50, invoice no. A875, dated January 18; terms 2/15, n/45; FOB destination. 25Sold three Winter Skin Essentials on account to A. Benner, sales slip no. 1457, 135.75, plus sales tax of 10.86, total 146.61. 27Issued credit memo no. 33 to A. Benner for merchandise returned, 45.25 plus 3.62 sales tax, total 48.87. Required 1. If using Working Papers, open the following accounts in the accounts receivable ledger and record the balances as of January 1: A. Benner, 45.77; R. Kielman, 175.39. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 2. If using Working Papers, open the following accounts in the accounts payable ledger and record the balances as of January 1: Calhoun Candles, Inc., 355.23; Madden, Inc., 573.15; Whitney and Waters, 50.25. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 3. If using Working Papers, record the January 1 balances in the general ledger as given: Accounts Receivable 113 controlling account, 221.16; Accounts Payable 212 controlling account, 978.63; Sales Tax Payable 214, 128.45. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 4. Record the transactions in the general journal. If using Working Papers, begin on page 25. 5. Post the entries to the general ledger and accounts receivable ledger or accounts payable ledger as appropriate. 6. Prepare a schedule of accounts receivable. 7. Prepare a schedule of accounts payable. 8. Compare the totals of the schedules with the balances of the controlling accounts.arrow_forwardMays Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Mays Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales and purchase of merchandise are as follows: Jan. 2Bought nine Matte Nail Color Kits from Mejia, Inc., 450, invoice no. 4521, dated January 1; terms 2/10, n/30; FOB shipping point, freight prepaid and added to the invoice, 87.50 (total 537.50). 5Bought 30 Perfume Cocktail Rings from Braun, Inc., 1,200, invoice no. 37A, dated January 3; terms 2/10, n/30; FOB destination. 8Sold two Matte Nail Color Kits on account to J. Herbert, sales slip no. 113, 110, plus sales tax of 8.80, total 118.80. 11Received credit memo no. 455 from Braun, Inc., for merchandise returned, 315.25. 18Bought 15 Eye Palettes from Vargas, Inc., 660, invoice no. 910, dated January 14; terms net 30; FOB destination. 23Sold four Eye Palettes on account to T. Cantrell, sales slip no. 114, 200, plus sales tax of 16, total 216. 26Issued credit memo no. 12 to T. Cantrell for merchandise returned, 50 plus 4 sales tax, total 54. Required 1. If using Working Papers, open the following accounts in the accounts receivable ledger and record the balances as of January 1: T. Cantrell, 86.99; J. Hebert, 63.47. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 2. If using Working Papers, open the following accounts in the accounts payable ledger and record the balances as of January 1: Braun, Inc., 513.20; Mejia, Inc., 113.40; Vargas, Inc., 67.15. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 3. If using Working Papers, record the January 1 balances in the general ledger as given: Accounts Receivable 113 controlling account, 150.46; Accounts Payable 212 controlling account, 693.75; Sales Tax Payable 214, 237.89. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 4. Record the transactions in the general journal. If using Working Papers, begin on page 17. 5. Post the entries to the general ledger and accounts receivable ledger or accounts payable ledger as appropriate. 6. Prepare a schedule of accounts receivable. 7. Prepare a schedule of accounts payable. 8. Compare the totals of the schedules with the balances of the controlling accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY