Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 5CP

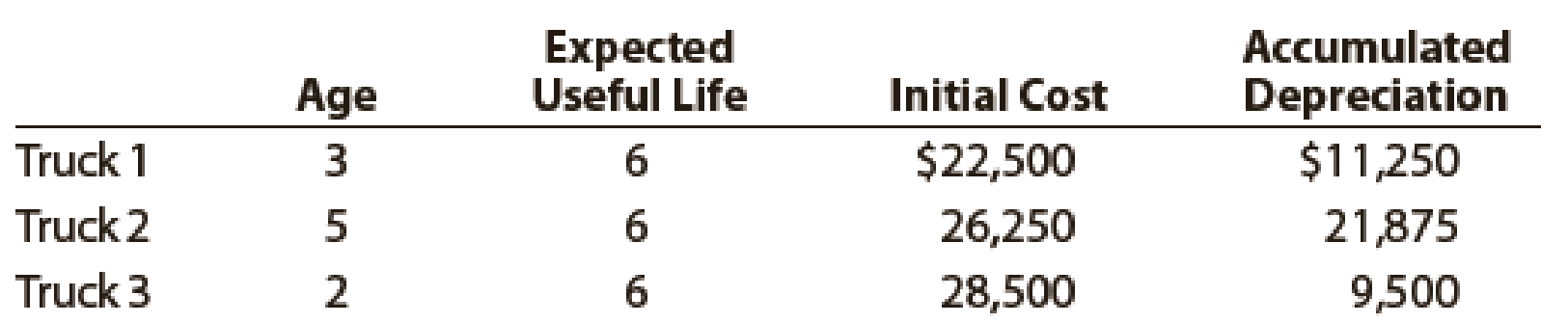

Godwin Co. owns three delivery trucks. Details for each truck at the end of the most recent year follow:

- • At the beginning of the year, a hydraulic lift is added to Truck 1 at a cost of $4,500. The addition of the hydraulic lift will allow the company to deliver much larger objects than could previously be delivered.

- • At the beginning of the year, the engine of Truck 2 is overhauled at a cost of $5,000. The engine overhaul will extend the truck’s useful life by three years.

Write a short memo to Godwin’s chief financial officer explaining the financial statement effects of the expenditures associated with Trucks 1 and 2.

Write a short memo to Godwin’s chief financial officer explaining the financial statement effects of the expenditures associated with Trucks 1 and 2.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts.

Machine A

Machine B

Machine C

Cost of the asset

$

10,800

$

40,000

$

23,800

Installation costs

950

3,900

3,000

Renovation costs prior to use

750

3,500

4,000

Repairs after production began

700

900

2,500

By the end of the first year, each machine had been operating 8,000 hours.

Required:

Compute the cost of each machine.

Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following:

Estimates

Machine

Life

Residual Value

Depreciation Method

A

5

years

$

2,800

Straight-line

B

20,000

hours

2,400

Units-of-production

C

10

years

1,600

Double-declining-balance

During the current year, Central Auto Rentals purchased 60 new automobiles at a cost of $14,880 per car. The cars will be sold to a wholesaler at an estimated $2,000 each as soon as they have been driven 46,000 miles. Central Auto Rentals computes depreciation expense on its automobiles by the units-of-output method, based on mileage.

a. Compute the amount of depreciation to be recognized for each mile that a rental automobile is driven.

b. Assuming that the 60 rental cars are driven a total of 1,650,000 miles during the current year, compute the total amount of depreciation expense that Central Auto Rentals should recognize on this fleet of cars for the year.

a)

transaction

general journal

debit

credit

1

b)

property, plant & equipment

$

During the current year, Central Auto Rentals purchased 60 new automobiles at a cost of $14,880 per car. The cars will be sold to a wholesaler at an estimated $2,000 each as soon as they have been driven 46,000 miles. Central Auto Rentals computes depreciation expense on its automobiles by the units-of-output method, based on mileage.

a. Compute the amount of depreciation to be recognized for each mile that a rental automobile is driven.

b. Assuming that the 60 rental cars are driven a total of 1,650,000 miles during the current year, compute the total amount of depreciation expense that Central Auto Rentals should recognize on this fleet of cars for the year.

Chapter 10 Solutions

Financial Accounting

Ch. 10 - ONeil Office Supplies has a fleet of automobiles...Ch. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Keyser Company purchased a machine that has a...Ch. 10 - Is it necessary for a business to use the same...Ch. 10 - a. Under what conditions is the use of the...Ch. 10 - Prob. 7DQCh. 10 - Immediately after a used truck is acquired, a new...Ch. 10 - Prob. 9DQCh. 10 - Prob. 10DQ

Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - Equipment acquired at the beginning of the year at...Ch. 10 - A truck acquired at a cost of 69,000 has an...Ch. 10 - A tractor acquired at a cost of 420,000 has an...Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - A building acquired at the beginning of the year...Ch. 10 - Equipment with a cost of 180,000 has an estimated...Ch. 10 - A truck with a cost of 82,000 has an estimated...Ch. 10 - On February 14, Garcia Associates Co. paid 2,300...Ch. 10 - On August 7, Green River Inflatables Co. paid...Ch. 10 - Equipment was acquired at the beginning of the...Ch. 10 - Equipment was acquired at the beginning of the...Ch. 10 - Prob. 7PEACh. 10 - Prob. 7PEBCh. 10 - On December 31, it was estimated that goodwill of...Ch. 10 - On December 31, it was estimated that goodwill of...Ch. 10 - Prob. 9PEACh. 10 - Prob. 9PEBCh. 10 - Prob. 1ECh. 10 - Prob. 2ECh. 10 - Prob. 3ECh. 10 - Tri-City Ironworks Co. reported 44,500,000 for...Ch. 10 - Convert each of the following estimates of useful...Ch. 10 - A refrigerator used by a wholesale warehouse has a...Ch. 10 - A diesel-powered tractor with a cost of 90,000 and...Ch. 10 - Prior to adjustment at the end of the year, the...Ch. 10 - A Kubota tractor acquired on January 8 at a cost...Ch. 10 - A storage tank acquired at the beginning of the...Ch. 10 - Equipment acquired at a cost of 105,000 has an...Ch. 10 - A building with a cost of 1,200,000 has an...Ch. 10 - US Freight Lines Co. incurred the following costs...Ch. 10 - Jackie Fox owns and operates Platinum Transport...Ch. 10 - Quality Move Company made the following...Ch. 10 - Willow Creek Company purchased and installed...Ch. 10 - Equipment acquired on January 8 at a cost of...Ch. 10 - Equipment acquired on January 6 at a cost of...Ch. 10 - Prob. 19ECh. 10 - Kleen Company acquired patent rights on January 10...Ch. 10 - Prob. 21ECh. 10 - List the errors you find in the following partial...Ch. 10 - Amazon.com, Inc. is the worlds leading Internet...Ch. 10 - Verizon Communications Inc. is a major...Ch. 10 - FedEx Corporation and United Parcel Service, Inc....Ch. 10 - The following table shows the sales and average...Ch. 10 - Prob. 27ECh. 10 - Prob. 28ECh. 10 - Prob. 29ECh. 10 - On October 1, Bentley Delivery Services acquired a...Ch. 10 - The following payments and receipts are related to...Ch. 10 - Dexter Industries purchased packaging equipment on...Ch. 10 - Perdue Company purchased equipment on April 1 for...Ch. 10 - New lithographic equipment, acquired at a cost of...Ch. 10 - The following transactions and adjusting entries...Ch. 10 - Prob. 6PACh. 10 - Prob. 1PBCh. 10 - Waylander Coatings Company purchased waterproofing...Ch. 10 - Layton Company purchased tool sharpening equipment...Ch. 10 - New tire retreading equipment, acquired at a cost...Ch. 10 - Prob. 5PBCh. 10 - Prob. 6PBCh. 10 - Prob. 1CPCh. 10 - Prob. 2CPCh. 10 - Godwin Co. owns three delivery trucks. Details for...Ch. 10 - The following is an excerpt from a conversation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Communication Godwin Co. owns three delivery trucks. Details for each truck at the end of the most recent year follow: At the beginning of the year, a hydraulic lift is added to Truck 1 at a cost of 4,500. The addition of the hydraulic lift will allow the company to deliver much larger objects than could previously be delivered. At the beginning of the year, the engine of Truck 2 is overhauled at a cost of 5,000. The engine overhaul will extend the trucks useful life by three years. Write a short memo to Godwins chief financial officer explaining the financial statement effects of the expenditures associated with Trucks 1 and 2.arrow_forwardSand River Sales has a fork truck used in its warehouse operations. The truck had an original useful life of five years. However, after depreciating the asset for three years, the company makes a major repair that extends the life by four years. What is the remaining useful life after the major repair?arrow_forwardBaglias Wholesale Trinkets has a 3-D printer used in operations. The original useful life was estimated to be six years. However, after two years of use, the printer was overhauled, and its total useful life was extended to eight years. How many years of depreciation remain after the overhaul in year 2?arrow_forward

- Johnson, Incorporated had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Purchased a copyright for $5,000 cash Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for major repairs If all transactions were recorded properly, what amount did Johnson capitalize for the year, and what amount did Johnson expense for the year?arrow_forwardUtica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forwardJada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for major repairs Depreciation expense recorded for the year is $25,000 If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Jadas balance sheet resulting from this years transactions? What amount did Jada report on the income statement for expenses for the year?arrow_forward

- Johnson, Incorporated, had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for extraordinary repairs Depreciation expense recorded for the year is $15,000. If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Johnsons balance sheet resulting from this years transactions? What amount did Johnson report on the income statement for expenses for the year?arrow_forwardMontezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $4,000. Determine the depreciation expense for the final three years of the assets life, and create the journal entry for year four.arrow_forwardSt. Johns Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMCs Cath Lab. Each technician is paid a salary of 36,000 and is capable of conducting 1,000 procedures per year. The cardiac catheterization equipment is one year old and was purchased for 250,000. It is expected to last five years. The equipments capacity is 25,000 procedures over its life. Depreciation is computed on a straight-line basis, with no salvage value expected. The reading of the catheterization results is conducted by an outside physician whose fee is 120 per test. The technicians report with the outside physicians note of results is sent to the referring physician. In addition to the salaries and equipment, SJMC spends 50,000 for supplies and other costs needed to operate the equipment (assuming 5,000 procedures are conducted). When SJMC purchased the equipment, it fully expected to perform 5,000 procedures per year. In fact, during its first year of operation, 5,000 procedures were run. However, a larger hospital has established a clinic in the city and will siphon off some of SJMCs business. During the coming years, SJMC expects to run only 4,200 cath procedures yearly. SJMC has been charging 850 for the procedureenough to cover the direct costs of the procedure plus an assignment of general overhead (e.g., depreciation on the hospital building, lighting and heating, and janitorial services). At the beginning of the second year, an HMO from a neighboring community approached SJMC and offered to send its clients to SJMC for cardiac catheterization provided that the charge per procedure would be 550. The HMO estimates that it can provide about 500 patients per year. The HMO has indicated that the arrangement is temporaryfor one year only. The HMO expects to have its own testing capabilities within one year. Required: 1. Classify the resources associated with the cardiac catheterization activity into one of the following: (1) committed resources, or (2) flexible resources. 2. Calculate the activity rate for the cardiac catheterization activity. Break the activity rate into fixed and variable components. Now, classify each activity resource as relevant or irrelevant with respect to the following alternatives: (1) accept the HMO offer, or (2) reject the HMO offer. Explain your reasoning. 3. Assume that SJMC will accept the HMO offer if it reduces the hospitals operating costs. Should the HMO offer be accepted? 4. Jerold Bosserman, SJMCs hospital controller, argued against accepting the HMOs offer. Instead, he argued that the hospital should be increasing the charge per procedure rather than accepting business that doesnt even cover full costs. He also was concerned about local physician reaction if word got out that the HMO was receiving procedures for 550. Discuss the merits of Jerolds position. Include in your discussion an assessment of the price increase that would be needed if the objective is to maintain total revenues from cardiac catheterizations experienced in the first year of operation. 5. Chandra Denton, SJMCs administrator, has been informed that one of the Cath Lab technicians is leaving for an opportunity at a larger hospital. She met with the other technicians, and they agreed to increase their hours to pick up the slack so that SJMC wont need to hire another technician. By working a couple hours extra every week, each remaining technician can perform 1,050 procedures per year. They agreed to do this for an increase in salary of 2,000 per year. How does this outcome affect the analysis of the HMO offer? 6. Assuming that SJMC wants to bring in the same revenues earned in the cardiac catheterization activitys first year less the reduction in resource spending attributable to using only four technicians, how much must SJMC charge for a procedure?arrow_forward

- Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forwardMontello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forwardJada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for extraordinary repairs If all transactions were recorded properly, what amount did Jada capitalize for the year, and what amount did Jada expense for the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License