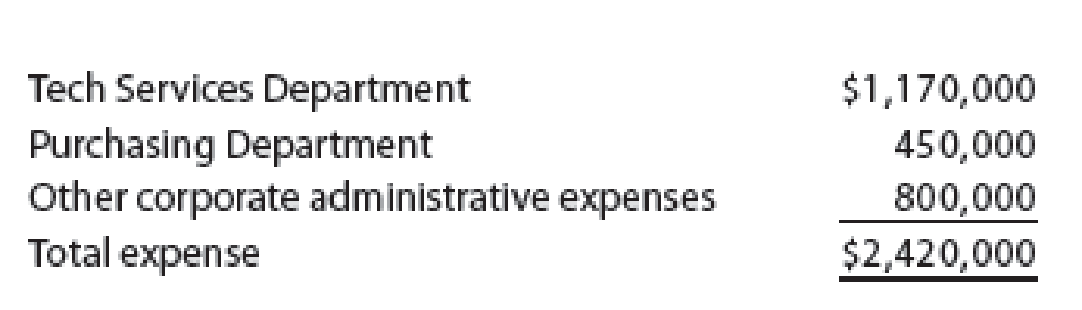

Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows:

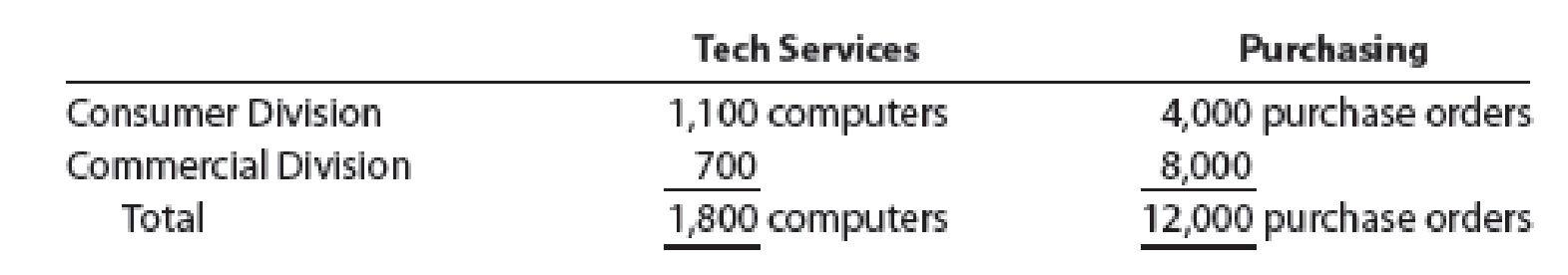

The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows:

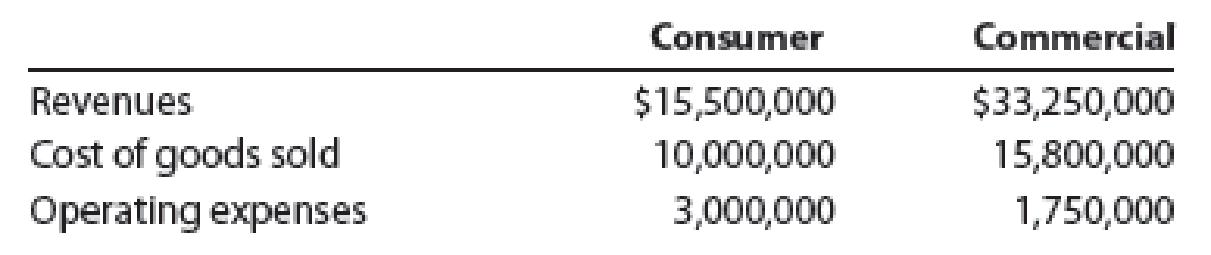

The support department allocations of the Tech Services Department and the Purchasing Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows:

Prepare the divisional income statements for the two divisions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting

- Service department charges In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of 64,560, and the Purchasing Department had expenses of 40,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: A. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. B. Using the cost driver information in (A), determine the annual amount of payroll and purchasing costs allocated to the Residential, Commercial, and Government Contract divisions from payroll and purchasing services. C. Why does the Residential Division have a larger support department allocation than the other two divisions, even though its sales are lower?arrow_forwardColumbia Products Inc. has two divisions, Salem and Seaside. For the month ended March 31, Salem had sales and variable costs of 500,000 and 225,000, respectively, and Seaside had sales and variable costs of 800,000 and 475,000, respectively. Salem had direct fixed production and administrative expenses of 60,000 and 35,000, respectively, and Seaside had direct fixed production and administrative expenses of 80,000 and 45,000, respectively. Fixed costs that were common to both divisions and couldnt be allocated to the divisions in any meaningful way were selling, 33,000, and administration, 27,000. Prepare a segmented income statement by division for March.arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forward

- Profit center responsibility reporting for a service company Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31: The company operates three support departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is a cost driver for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is a cost driver for this work. The following additional information has been gathered: Instructions 1. Prepare quarterly income statements showing operating income for the three divisions. Use three column headings: East, West, and Central. 2. Identify the most successful division according to the profit margin. Round to the nearest whole percent. 3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.arrow_forwardIn divisional income statements prepared for Lemons Company, the Payroll Department costs are allocated to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are allocated on the basis of the number of purchase requisitions. The Payroll Department had costs of $126,550 and the Purchasing Department had costs of $68,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $1,100,000 $1,760,000 $3,520,000 Number of employees: Weekly payroll (52 weeks per year) 410 190 280 Monthly payroll 95 200 110 Number of purchase requisitions per year 5,200 4,600 3,800 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial GovernmentContract Total Number of payroll…arrow_forwardBluStar Company has two service departments, Administration and Accounting, and two operating departments, Domestic and International. Administration costs are allocated on the basis of employees, and Accounting costs are allocated on the basis of number of transactions. A summary of BluStar operations follows. Administration Accounting Domestic International Employees — 25 15 60 Transactions 50,000 — 10,000 40,000 Department direct costs $ 61,000 $ 22,500 $ 155,000 $ 593,000 BluStar estimates that the cost structure in its operations is as follows. Administration Accounting Domestic International Variable costs $ 23,500 $ 5,200 $ 114,500 $ 425,000 Fixed costs 37,500 17,300 40,500 168,000 Total costs $ 61,000 $ 22,500 $ 155,000 $ 593,000 Avoidable fixed costs $ 9,750 $ 4,000 $ 18,000 $ 114,000 Required: a. If BluStar outsources the Administration Department, what is…arrow_forward

- BluStar Company has two service departments, Administration and Accounting, and two operating departments, Domestic and International. Administration costs are allocated on the basis of employees, and Accounting costs are allocated on the basis of number of transactions. A summary of BluStar operations follows. Administration Accounting domestic International Employees – 21 36 43 Transactions 32,000 – 21,000 84,000 Department direct costs 360,000 140,000 $ 935,000 $ 3,730,000 Required: a. Allocate the cost of the service departments to the operating departments using the direct method.b. Allocate the cost of the service departments to the operating departments using the step method. Start with Administration.c. Allocate the cost of the service departments to the operating departments using the reciprocal method.arrow_forwardFlounder Company uses a responsibility reporting system. It has divisions in Denver, Seattle, and San Diego. Each division has three production departments: Cutting, Shaping, and Finishing. The responsibility for each department rests with a manager who reports to the division production manager. Each division manager reports to the vice president of production. There are also vice presidents for marketing and finance. All vice presidents report to the president.In January 2022, controllable actual and budget manufacturing overhead cost data for the departments and divisions were as shown here. Manufacturing Overhead Actual Budget Individual costs—Cutting Department—Seattle Indirect labor $73,100 $69,600 Indirect materials 48,200 45,600 Maintenance 20,900 17,700 Utilities 20,600 16,900 Supervision 22,000 19,600 $184,800 $169,400 Total costs…arrow_forwardBaldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Personnel Legal Eastern Western Employees - 40 120 40 Hours 10,800 - 5,400 1,800 Department direct costs $ 300,000 $ 160,000 $ 1,200,000 $ 790,000 Required: Allocate the cost of the service departments to the operating divisions using the direct method. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. Allocate the cost of the service departments to the operating divisions using the reciprocal method.arrow_forward

- Cost Department Allocations In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $64,560, and the Purchasing Department had expenses of $40,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial Government Contract Sales $2,000,000 $3,250,000 $2,900,000 Number of employees: Weekly payroll (52 weeks per year) 400 250 150 Monthly payroll 80 30 10 Number of purchase requisitions per year 7,500 3,000 2,000 Required: a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential…arrow_forwardCost Department Allocations In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $64,560, and the Purchasing Department had expenses of $40,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial Government ContractSales $2,000,000 $3,250,000 $2,900,000 Number of employees:Weekly payroll (52 weeks per year) 400 250 150 Monthly payroll 80 30 10 Number of purchase requisitions per year 7,500 3,000 2,000 (See image for questions)arrow_forwardCost Department Allocations In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $61,284, and the Purchasing Department had expenses of $26,400 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial Government Contract Sales $ 552,000 $ 731,000 $ 1,679,000 Number of employees: Weekly payroll (52 weeks per year) 245 60 65 Monthly payroll 30 41 28 Number of purchase requisitions per year 2,500 1,800 1,700 Required: a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning