Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 9RE

Dexter Construction Corporation is building a student condominium complex; it started construction on January 1, Year 1. Dexter borrowed $2.5 million on January 1 specifically for the project by issuing a 10%, 5-vear, $2.5 million note, which is payable on December 31 of Year 3. Dexter also had a 12%, 5-year, $3 million note payable and a 10%, 10-year, $1.8 million note payable outstanding all year. Calculate the weighted average interest rate on the non-construction-specific debt for Year 1.

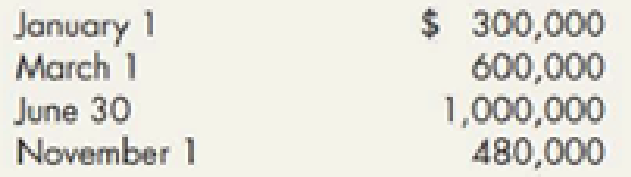

RE10-9 Refer to RE10-8. In Year 1, Dexter incurred costs as follows:

Calculate Dexter’s weighted average accumulated expenditures.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Dexter Construction Corporation is building a student condominium complex; it started construction on January 1, Year 1. Dexter borrowed $1 million specifically for the project by issuing a 10%, 5-year, $1 million note, which is payable on December 31 of Year 3. Dexter also had a 12%, 5-year, $3 million note payable and a 10%, 10-year, $1.8 million note payable outstanding all year.

In Year 1, Dexter incurred costs as follows:

January 1

$300,000

March 1

600,000

June 30

1,000,000

November 1

480,000

Calculate Dexter's capitalized interest on the student condominium complex for Year 1.

Mack Company, HappyDay’s branch, plans to invest $50,000 in land that will produce annual rent revenue equal to 15 percent of the investment, starting on January 1, Year 3. The revenue will be collected in cash at the end of each year, starting December 31, Year 3. Mack can obtain the cash necessary to purchase the land from two sources. Funds can be obtained by issuing $50,000 of 10 percent, five-year bonds at their face amount. Interest due on the bonds is payable on December 31 of each year with the first payment due on December 31, 2021. Alternatively, the $50,000 needed to invest in land can be obtained from equity financing. In this case, the stockholders (holders of the equity) will be paid a $5,000 annual cash dividend. Mack Company is in a 30 percent income tax bracket.

Prepare an income statement and statement of cash flows for Mack Company for Year 3 under the two alternative financing proposals (debt financing and equity financing).

Write a short memorandum explaining why…

Mack Company, HappyDay’s branch, plans to invest $50,000 in land that will produce annual rent revenue equal to 15 percent of the investment, starting on January 1, Year 3. The revenue will be collected in cash at the end of each year, starting December 31, Year 3. Mack can obtain the cash necessary to purchase the land from two sources. Funds can be obtained by issuing $50,000 of 10 percent, five-year bonds at their face amount. Interest due on the bonds is payable on December 31 of each year with the first payment due on December 31, 2021. Alternatively, the $50,000 needed to invest in land can be obtained from equity financing. In this case, the stockholders (holders of the equity) will be paid a $5,000 annual cash dividend. Mack Company is in a 30 percent income tax bracket.

1. Prepare an income statement and statement of cash flows for Mack Company for Year 3 under the two alternative financing proposals (debt financing and equity financing)

Chapter 10 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 10 - Prob. 1GICh. 10 - Prob. 2GICh. 10 - What is the relationship between the book value...Ch. 10 - Prob. 4GICh. 10 - Prob. 5GICh. 10 - Prob. 6GICh. 10 - What are asset retirement obligations? How should...Ch. 10 - Prob. 8GICh. 10 - Prob. 9GICh. 10 - Prob. 10GI

Ch. 10 - At what amount does a company record the cost of a...Ch. 10 - Prob. 12GICh. 10 - Prob. 13GICh. 10 - Prob. 14GICh. 10 - Prob. 15GICh. 10 - Prob. 16GICh. 10 - Prob. 17GICh. 10 - What is the distinction between a capital and an...Ch. 10 - Distinguish between additions and...Ch. 10 - Distinguish between ordinary repairs and...Ch. 10 - Prob. 21GICh. 10 - Hickory Company made a lump-sum purchase of three...Ch. 10 - Prob. 2MCCh. 10 - Electro Corporation bought a new machine and...Ch. 10 - Prob. 4MCCh. 10 - Lyle Inc. purchased certain plant assets under a...Ch. 10 - Ashton Company exchanged a nonmonetary asset with...Ch. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Prob. 10MCCh. 10 - On January 1, Duane Company purchases land at a...Ch. 10 - Prob. 2RECh. 10 - Utica Corporation paid 360,000 to purchase land...Ch. 10 - Prob. 4RECh. 10 - Prob. 5RECh. 10 - Prob. 6RECh. 10 - Nabokov Company exchanges assets with Faulkner...Ch. 10 - Prob. 8RECh. 10 - Dexter Construction Corporation is building a...Ch. 10 - Prob. 10RECh. 10 - Prob. 11RECh. 10 - Ricks Towing Company owns three tow trucks. During...Ch. 10 - Inclusion in Property, Plant, and Equipment...Ch. 10 - Prob. 2ECh. 10 - Acquisition Costs Voiture Company manufactures...Ch. 10 - Determination of Acquisition Cost In January 2019,...Ch. 10 - Asset Retirement Obligation Big Cat Exploration...Ch. 10 - Prob. 6ECh. 10 - Prob. 7ECh. 10 - Prob. 8ECh. 10 - Exchange of Assets Two independent companies,...Ch. 10 - Exchange of Assets Use the same information as in...Ch. 10 - Prob. 11ECh. 10 - Exchange of Assets Goodman Company acquired a...Ch. 10 - Exchange of Assets Use the same information as in...Ch. 10 - Prob. 14ECh. 10 - Self-Construction Harshman Company constructed a...Ch. 10 - Prob. 16ECh. 10 - Prob. 17ECh. 10 - Prob. 18ECh. 10 - Prob. 19ECh. 10 - Expenditures after Acquisition McClain Company...Ch. 10 - Prob. 21ECh. 10 - Prob. 1PCh. 10 - Classification of Costs Associated with Assets The...Ch. 10 - Prob. 3PCh. 10 - Comprehensive At December 31, 2018, certain...Ch. 10 - Assets Acquired by Exchange Bremer Company made...Ch. 10 - Assets Acquired by Exchange Bussell Company...Ch. 10 - Self-Construction Olson Machine Company...Ch. 10 - Prob. 8PCh. 10 - Prob. 9PCh. 10 - Events Subsequent to Acquisition The following...Ch. 10 - Prob. 11PCh. 10 - Prob. 1CCh. 10 - Prob. 2CCh. 10 - Cost Issues Deskin Company purchased a new machine...Ch. 10 - Prob. 4CCh. 10 - Prob. 5CCh. 10 - Prob. 6CCh. 10 - Prob. 7CCh. 10 - Prob. 9CCh. 10 - Prob. 10CCh. 10 - Prob. 11C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pickles R Us is a pickle farm located in the Northeast. The following transactions take place: A. On November 6, Pickles borrows $820,000 from a bank to cover the initial cost of expansion. Terms of the loan are payment due in six months from November 6, and annual interest rate of 3%. B. On December 12, Pickles borrows an additional $200,000 with payment due in three months from December 12, and an annual interest rate of 10%. C. Pickles pays its accounts in full on March 12, for the December 12 loan, and on May 6 for the November 6 loan. Record the journal entries to recognize the initial borrowings, and the two payments for Pickles.arrow_forwardOn January 1, Kilgore Inc. accepts a 20,000 non-interest-bearing, 5-year note from Dieland Company for equipment. Neither the fair value of the note nor the equipment is determinable. Kilgore had originally purchased the equipment for 18,000, and the equipment has a book value of 14,000 on January 1. Kilgore knows Dielands incremental borrowing rate of 9%. Prepare the journal entry for Kilgore to record the sale of the equipment on January 1.arrow_forwardHalep Inc. borrowed $30,000 from Davis Bank and signed a 4-year note payable stating the interest rate was 4% compounded annually. Halep Inc. will make payments of $8,264.70 at the end of each year. Prepare an amortization table showing the principal and interest in each payment.arrow_forward

- McMasters Inc. specializes in BBQ accessories. In order for the company to expand its business, they take out a long-term loan in the amount of $800,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest rate is 9%. Each year on December 31, the company pays down the principal balance by $50,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year. A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest. B. Compute the interest accrued on December 31 of the first year. C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year.arrow_forwardHomeland Plus specializes in home goods and accessories. In order for the company to expand its business, the company takes out a long-term loan in the amount of $650,000. Assume that any loans are created on January 1. The terms of the loan include a periodic payment plan, where interest payments are accumulated each year but are only computed against the outstanding principal balance during that current period. The annual interest rate is 8.5%. Each year on December 31, the company pays down the principal balance by $80,000. This payment is considered part of the outstanding principal balance when computing the interest accumulation that also occurs on December 31 of that year. A. Determine the outstanding principal balance on December 31 of the first year that is computed for interest. B. Compute the interest accrued on December 31 of the first year. C. Make a journal entry to record interest accumulated during the first year, but not paid as of December 31 of that first year.arrow_forwardThe employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments, together with annual rates of return, are as follows: The credit union will have 2 million available for investment during the coming year. State laws are credit union policies impose the following restrictions on the composition of the loans and investments: Risk-free securities may not exceed 30% of the total funds available for investment. Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). Furniture loans plus other secured loans may not exceed the automobile loans. Other secured loans plus signature loans may not exceed the funds invested in risk-free securities. How should the 2 million be allocated to each of the loan/investment alternatives to maximize total annual return? What is the projected total annual return?arrow_forward

- Using the information provided, what transaction represents the best application of the present value of an annuity due of $1? A. Falcon Products leases an office building for 8 years with annual lease payments of $100,000 to be made at the beginning of each year. B. Compass, Inc., signs a note of $32,000, which requires the company to pay back the principal plus interest in four years. C. Bahwat Company plans to deposit a lump sum of $100.000 for the construction of a solar farm In 4 years. D. NYC Industries leases a car for 4 yearly annual lease payments of $12,000, where payments are made at the end of each year.arrow_forwardOn January 1, 2015, SMDC Inc. was granted a non-interest bearing loan from Bangko Sentral ng Pilipinas with a face value of P1,000,000, term of 3 years and implicit rate of 10%. SMDC received the face value of the loan on the condition that the company will continuously operate for the 3-year term of the loan. Required: Based on the result of your audit, determine the following:__________1. Realized income from government grant for the year ended December 31, 2015__________2. Book value of deferred income from government grant as of December 31, 2015arrow_forwardacobs Company borrowed $10,000 on a one-year, 8 percent note payable from the local bank onApril 1. Interest was paid quarterly, and the note was repaid one year from the time the money was borrowed. Calculate the amount of cash payments Jacobs was required to make in each of the two calendar years that were affected by the note payable.arrow_forward

- The government lent $200,000 to Sweet Industries, who signed a 5-year, zero-interest note dated January 1, 2021 to help finance the construction of a building. The market rate of interest is 4% and the effective interest method of amortization is used. The loan will be forgiven if Sweet provides employment for a specified number of individuals for a specified period of time. If these conditions are not met, the amount is due to the government in full in five years. Sweet believes it will be able to meet the conditions.arrow_forwardOn July 31, 2020, Marin Company engaged Minsk Tooling Company to construct a special-purpose piece of factory machinery. Construction begun immediately and was completed on November 1, 2020. To help finance construction, on July 31 Marinissued a $270,000, 3-year, 12% note payable at Netherlands National Bank, on which interest is payable each July 31. $169,000 of the proceeds of the note was paid to Minsk on July 31. The remainder of the proceeds was temporarily invested in short-term marketable securities (trading securities) at 10% until November 1. On November 1, Marin made a final $101,000 payment to Minsk. Other than the note to Netherlands, Marin’s only outstanding liability at December 31, 2020, is a $30,100, 8%, 6-year note payable, dated January 1, 2017, on which interest is payable each December 31. (a) Calculate the interest revenue, weighted-average accumulated expenditures, avoidable interest, and total interest cost to be capitalized during 2020.…arrow_forwardOn July 31, 2020, Marin Company engaged Minsk Tooling Company to construct a special-purpose piece of factory machinery. Construction begun immediately and was completed on November 1, 2020. To help finance construction, on July 31 Marinissued a $270,000, 3-year, 12% note payable at Netherlands National Bank, on which interest is payable each July 31. $169,000 of the proceeds of the note was paid to Minsk on July 31. The remainder of the proceeds was temporarily invested in short-term marketable securities (trading securities) at 10% until November 1. On November 1, Marin made a final $101,000 payment to Minsk. Other than the note to Netherlands, Marin’s only outstanding liability at December 31, 2020, is a $30,100, 8%, 6-year note payable, dated January 1, 2017, on which interest is payable each December 31. (a) Correct answer icon Your answer is correct. Calculate the interest revenue, weighted-average accumulated expenditures, avoidable interest, and total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is a mortgage; Author: Kris Krohn;https://www.youtube.com/watch?v=CFjY-58ooi0;License: Standard YouTube License, CC-BY

Topic 10 Accounting for Liabilities Mortgage Payable; Author: Accounting Thinker;https://www.youtube.com/watch?v=EPJOphrbArM;License: Standard YouTube License, CC-BY