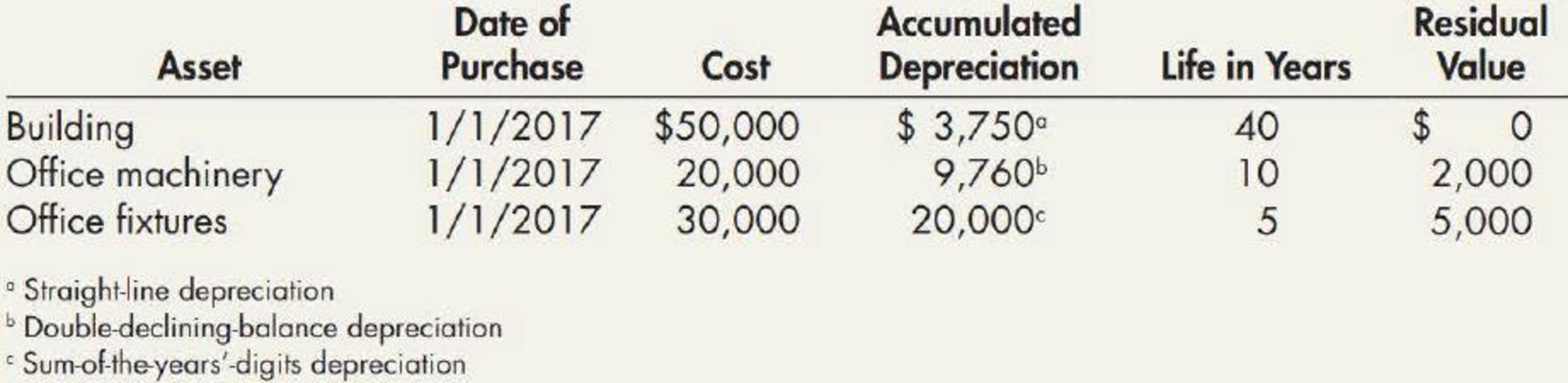

On December 31, 2019, Vail Company owned the following assets:

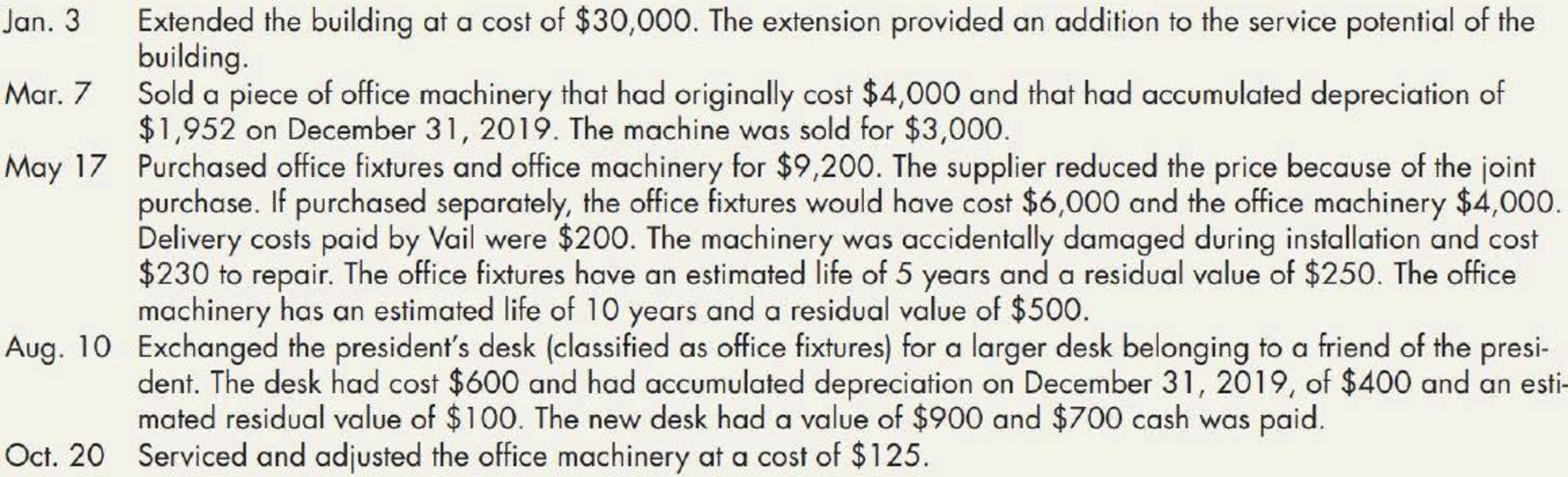

Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions:

Required:

- 1. Check the accuracy of the

accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. - 2. Prepare

journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. - 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance,

post the journal entries from Requirement 2, and compute the ending balance.

1.

Calculate the accumulated depreciation balance at December 31, 2019 for the given assets, and check it’s ‘accuracy.

Explanation of Solution

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset on account of its wear and tear or obsolesces.

Straight-line depreciation method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Sum-of- the-years’ digits method: Sum-of-the years’ digits method determines the depreciation by multiplying the depreciable base and declining fraction.

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life is referred to as double-declining-balance method.

Calculate the accumulated depreciation balance at December 31, 2019 for the given assets, and cross check its’ accuracy as follows:

Building:

Office machinery:

| Year | Beginning book value (A) |

Depreciation rate (2) (B) | Depreciation expense |

Ending book value |

| 2017 | 20,000 | 20% | 4,000 | 16,000 |

| 2018 | 16,000 | 20% | 3,200 | 12,800 |

| 2019 | 12,800 | 20% | 2,560 | 10,240 |

| Total | 9,760 |

Table (1)

Note: Ending book value of the prior year is considered as the beginning book value of current year.

Office fixtures:

| Year | Depreciation base (3) (A) |

Faction (4) (B) | Depreciation expense |

Ending book value |

| 2017 | 25,000 | 8,333 | 21,667 | |

| 2018 | 25,000 | 6,667 | 15,000 | |

| 2019 | 25,000 | 5,000 | 10,000 | |

| Total | 20,000 |

Table (2)

Working note (1):

Calculate the annual depreciation expense of building.

Working note (2):

Compute the straight line rate:

Useful life = 10 years

Working note (3):

Calculate the depreciable base of office fixtures.

Working note (4):

Calculate the denominator of the fraction for sum-of-the-year’s digit.

2.

Prepare necessary journal entries for the given transaction for 2020.

Explanation of Solution

Prepare necessary journal entries for the given transaction for 2020 as follows:

| Date | Account Title & Explanation | Debit ($) |

Credit ($) |

| January 3, 2020 | Building | 30,000 | |

| Cash | 30,000 | ||

| (To record the purchase of building for cash) | |||

| March 8, 2020 | Cash | 3,000 | |

| Accumulate depreciation-Office machinery | 1,952 | ||

| Office machinery | 4,000 | ||

| Gain on disposal of office machinery (5) | 952 | ||

| (To record a piece of office machinery sold during the year) | |||

| May 17, 2020 | Office fixtures (6) | 5,640 | |

| Office machinery (6) | 3,760 | ||

| Repair expense | 230 | ||

| Cash | 9,630 | ||

| (To record office fixtures and machinery purchased during the year) | |||

| August 10, 2020 | Depreciation expense (7) | 67 | |

| Accumulated depreciation-Office fixtures | 67 | ||

| (To record the depreciation expense incurred for office fixtures) | |||

| August 10, 2020 | Office fixtures | 900 | |

| Accumulated depreciation-Office fixtures (7) | 467 | ||

| Cash | 700 | ||

| Office fixtures | 600 | ||

| Gain on disposal of office fixtures (8) | 67 | ||

| (To record the office fixtures exchanged during the year ) | |||

| October 20, 2020 | Repair expense | 125 | |

| Cash | 125 | ||

| (To record the repair expense incurred during the year) | |||

| December 31, 2020 | Depreciation expense – Building (9) | 2,061 | |

| Depreciation expense - Office machinery (14) | 2,390 | ||

| Depreciation expense - Office fixtures (17) | 5,064 | ||

| Accumulated depreciation-Building | 2,061 | ||

| Accumulated depreciation-Office machinery | 2,390 | ||

| Accumulated depreciation-Office fixtures | 5,064 | ||

| (To record the depreciation expense of assets incurred at the end of the accounting year) |

Table (3)

Working note (5):

Calculate the gain on disposal of office machinery.

Working note (6):

Calculate the cost of office fixtures and office machinery.

| Particulars | Appraisal value (A) | Total appraisal value (B) |

Proportion | Total purchase cost (D) |

Cost ($) |

| Office fixtures | $6,000 | $10,000 | 60% |

$9,400 | $5,640 |

| Office machinery | $4,000 | 10,000 | 40% | $9,400 | $3,760 |

| Total | $10,000 | 100% | $9,400 |

Table (4)

Working note (7):

Calculate the depreciation expense of desk.

| Year | Depreciation base |

Faction (4) (B) | Depreciation expense |

| 2017 | 500 | 167 | |

| 2018 | 500 | 133 | |

| 2019 | 500 | 100 | |

| 2020 | 500 | 67 | |

| Total | 467 |

Table (5)

Working note (8):

Calculate the gain on disposal of desk.

Working note (9):

Calculate the depreciation expense of building at the end of the year 2020.

Working note (10):

Calculate the remaining office machinery at 2020.

Working note (11):

Calculate the depreciation expense of office machinery at the end of the year 2020.

Working note (12):

Calculate the depreciation expense for remaining office machinery under double declining balance method.

Working note (13):

Calculate depreciation expense of office machinery purchased during 2020 under double declining balance method.

Working note (14):

Calculate total depreciation expense of office machinery at 2020.

Working note (15):

Calculate the depreciation expense of remaining office fixtures under the sum of the year’s digit method.

Working note (16):

Calculate the depreciation expense of new office fixtures under the sum of the year’s digit method.

Working note (17):

Calculate the total depreciation expense for office fixtures.

3.

Prepare T-account for the accumulated depreciation, and calculate the ending balance of accumulated depreciation for the given assets.

Explanation of Solution

Prepare T-account for the accumulated depreciation, and calculate the ending balance of accumulated depreciation as follows:

| Accumulated depreciation - Building | |||

| December 31, 2019 | 3,750 | ||

| December 31, 2019 | $2,061 | ||

| Clos. Bal. | $5,811 | ||

| Accumulated depreciation – Office machinery | |||

| July 3, 2020 | $1,952 | December 31, 2019 | 9,760 |

| December 31, 2019 | $2,390 | ||

| Clos. Bal. | $10,198 | ||

| Accumulated depreciation – Office mixtures | |||

| October 8, 2020 | 467 | December 31, 2019 | $20,000 |

| October 8, 2020 | $67 | ||

| December 31, 2019 | $5,064 | ||

| Clos. Bal. | $24,664 | ||

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting: Reporting And Analysis

- Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset, Dinnell records depreciation expense for one-half year. During 2020, Asset A was sold for 7,000. Required: Prepare the journal entries to record depreciation on each asset for 2017 through 2020 and the sale of Asset A. Round all answers to the nearest dollar.arrow_forwardSoon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.arrow_forwardDuring 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.arrow_forward

- During 2019, White Company determined that machinery previously depreciated over a 7-year life had a total estimated useful life of only 5 years. An accounting change was made in 2019 to reflect the change in estimate. If the change had been made in 2018, accumulated depreciation at December 31, 2018, would have been 1,600,000 instead of 1,200,000. As a result of this change, the 2019 depreciation expense was 100,000 greater than it would have been if no change were made. Ignoring income tax considerations, what is the proper amount of the adjustment to Whites January 1, 2019, balance of retained earnings? a. 0 b. 100,000 c. 280,000 d. 400,000arrow_forwardPrior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the amount of financial depreciation, resulting in a book value of the depreciable assets of 24,500 for financial reporting purposes and of 20,000 for tax purposes at the end of 2019. In addition, Shadrach recognized a 3,500 estimated liability for legal expenses in the financial statements during 2019; it expects to pay this liability (and deduct it for tax purposes) in 2023. The current tax rate is 30%, no change in the tax rate has been enacted, and the company expects to be profitable in future years. What is the amount of the net deferred tax liability at the end of 2019? a. 300 b. 450 c. 1,050 d. 1,350arrow_forwardOn May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.arrow_forward

- Koolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.arrow_forwardRefer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000arrow_forwardAt the end of 2020, while auditing Sandlin Companys books, before the books have been closed, you find the following items: a. A building with a 30-year life (no residual value, depreciated using the straight-line method) was purchased on January 1, 2020, by issuing a 90,000 non-interest-bearing, 4-year note. The entry made to record the purchase was a debit to Building and a credit to Notes Payable for 90,000; 12% is a fair rate of interest on the note. b. The inventory at the end of 2020 was found to be overstated by 15,000. At the same time, it was discovered that the inventory at the end of 2019 had been overstated by 35,000. The company uses the perpetual inventory system. c. For the last 3 years, the company has failed to accrue salaries and w-ages. The correct amounts at the end of each year were: 2018, 12,000; 2019, 18,000; and 2020, 10,000. Required: 1. Prepare journal entries to correct the errors. Ignore income taxes. 2. Assume, instead, that the company discovered the errors after it had closed the books. Prepare journal entries to correct the errors. Ignore income taxes.arrow_forward

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.arrow_forwardAt the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the straight-line method beginning in 2019. For tax purposes, the asset is depreciated under MACRS using a 5-year recovery period. Prior to 2019, Conley had no deferred tax liability or asset. The difference between depreciation for financial reporting purposes and income tax purposes is the only temporary difference between pretax financial income and taxable income. The current income tax rate is 30%, and no change in the tax rate has been enacted for future years. In 2019 and 2020, taxable income will be higher or lower than financial income by what amount?arrow_forwardAssume the same information as in RE11-3, except that Albany Corporation purchased the asset on April 1, Year 1. Calculate the depreciation for Year 1 and Year 2 using the double-declining-balance method. Round to the nearest dollar.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning