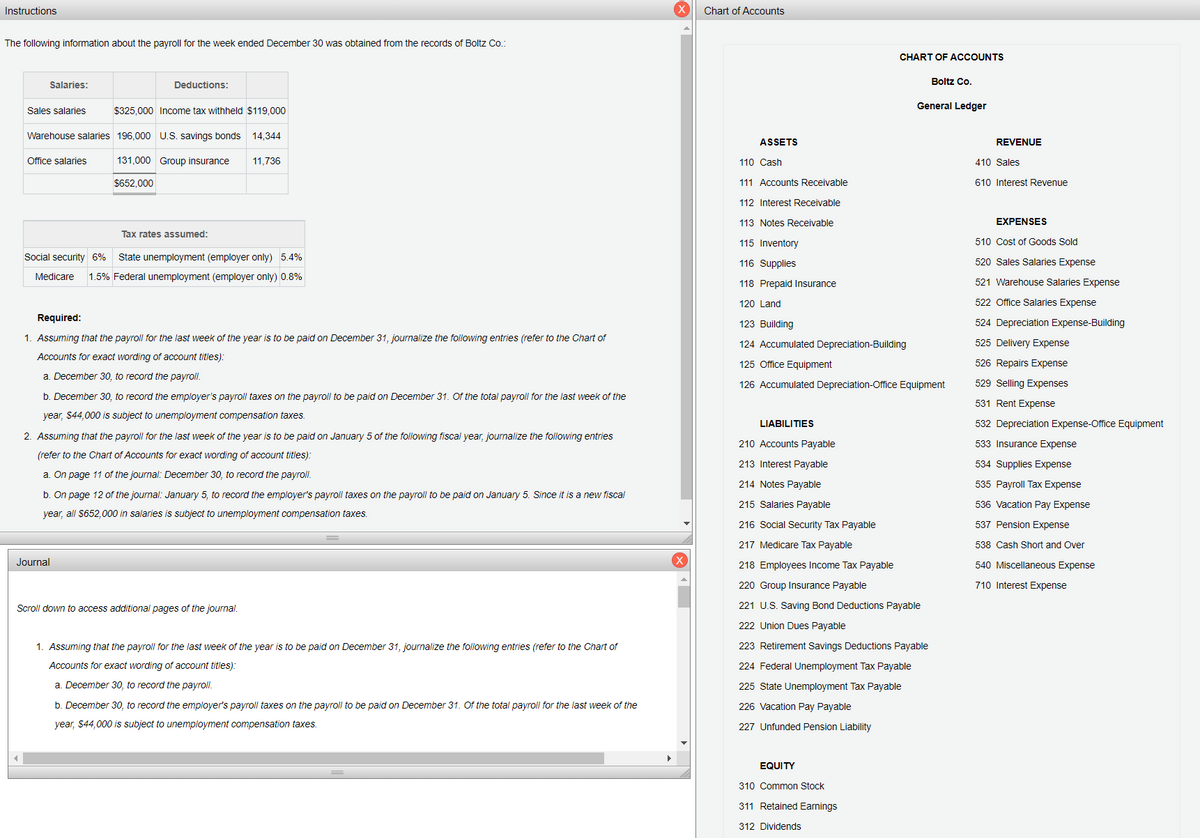

The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.: Required: 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles): a. December 30, to record the payroll. b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes. 2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles): a. On page 11 of the journal: December 30, to record the payroll. b. On page 12 of the journal: January 5, to record the employer's payroll taxes on the payroll to be paid on January 5. Since it is a new fiscal year, all $652,000 in salaries is subject to unemployment compensation taxes. 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles): a. December 30, to record the payroll. b. December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes.

The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.:

Required:

1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles):

a. December 30, to record the payroll.

b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to

2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles):

a. On page 11 of the journal: December 30, to record the payroll.

b. On page 12 of the journal: January 5, to record the employer's payroll taxes on the payroll to be paid on January 5. Since it is a new fiscal year, all $652,000 in salaries is subject to unemployment compensation taxes.

1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles):

a. December 30, to record the payroll.

b. December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 7 images