Merchandise was purchased on account from Jacob's Distributors on May 17. The purchase price was $1,400, less a 10% trade discount and credit terms of 2/10, n/30. 1. Calculate the net amount to record the invoice, less the 10% trade discount. 2. Calculate the amount to be paid on this invoice within the discount period. 3. Journalize the purchase of the merchandise on May 17 in a general journal. Journalize the payment on May 27 (within the discount period).

Merchandise was purchased on account from Jacob's Distributors on May 17. The purchase price was $1,400, less a 10% trade discount and credit terms of 2/10, n/30. 1. Calculate the net amount to record the invoice, less the 10% trade discount. 2. Calculate the amount to be paid on this invoice within the discount period. 3. Journalize the purchase of the merchandise on May 17 in a general journal. Journalize the payment on May 27 (within the discount period).

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 13Q: If a customer purchased merchandise in the amount of $340, terms 3/10, n/30, returned $70 of the...

Related questions

Question

Trade Discount and Cash Discounts

Merchandise was purchased on account from Jacob's Distributors on May 17. The purchase price was $1,400, less a 10% trade discount and credit terms of 2/10, n/30.

1. Calculate the net amount to record the invoice, less the 10% trade discount.

2. Calculate the amount to be paid on this invoice within the discount period.

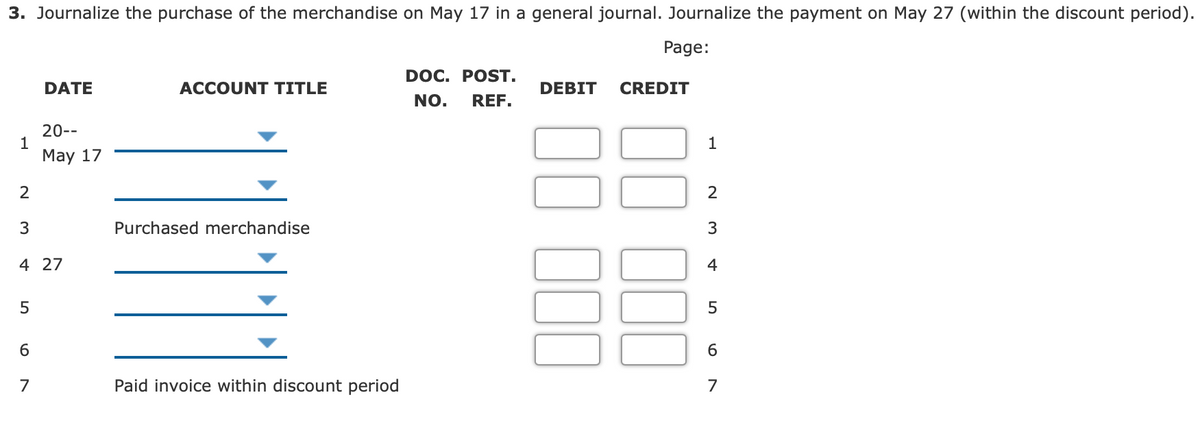

3. Journalize the purchase of the merchandise on May 17 in a general journal. Journalize the payment on May 27 (within the discount period).

Transcribed Image Text:3. Journalize the purchase of the merchandise on May 17 in a general journal. Journalize the payment on May 27 (within the discount period).

Page:

DOC. POST.

DATE

ACCOUNT TITLE

DEBIT

CREDIT

NO.

REF.

20--

1

Маy 17

1

2

3

Purchased merchandise

4 27

4

6

7

Paid invoice within discount period

7

N M

100

100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,